Vertical AI Is No Longer a Thesis — It’s a Map of the Next Decade

We’ve now aggregated and analyzed 140+ Vertical AI startups worth a combined $120B+, and the pattern is unmistakable. The winners are not generic “AI wrappers.” They are domain-specific platforms built inside the workflows of high-value industries, trained on proprietary or operationally unique data, and aligned with budgets that already feel the pressure to modernize.

And the data makes the story even clearer.

What the Vertical AI Landscape Actually Looks Like

1. Defense is the new gravity well

16 companies

$8.6B raised

Flagships like Anduril ($30.5B valuation) redefine the scale of modern defense tech.

2. Healthcare and HR show massive acceleration

17 HealthTech AI companies

$3.3B+ raised

Clinical, diagnostic, and behavioral AI workflows are breaking out of the pilot stage and becoming operational.

3. Supply chain & logistics are being rebuilt from the ground up

9 companies

$3.75B raised

Zipline ($4.2B valuation) represents the AI + autonomy wedge.

Big-Value Vertical AI Companies Define the Map

Company | Sector | Funding | Valuation |

|---|---|---|---|

Anduril | Defense | $3.7B+ | $30.5B |

BetterUp | HR Tech | Unknown | $4.7B |

Outreach | Sales | $490M+ | $4.4B |

Zipline | Supply Chain | $500M+ | $4.2B |

EliseAI | PropTech | $250M | $750M |

These aren’t horizontal “AI for everyone” platforms.

They’re deeply specialized operational systems anchored inside real-world industries.

Top 5 Verticals by Total Capital Raised

Defense: $8.6 Billion

Supply Chain: $3.7 Billion

HealthTech: $3.2 Billion

Software Development: $2.6 Billion

Media & Entertainment: $2.3 Billion

Top 5 Verticals by Number of Companies

HealthTech: 17 Companies

Defense: 16 Companies

Manufacturing: 12 Companies

Supply Chain: 9 Companies

Media & Entertainment: 9 Companies

The firms driving this verticalization trend are highly concentrated, confirming where venture capital is placing its largest bets for specialized AI moats.

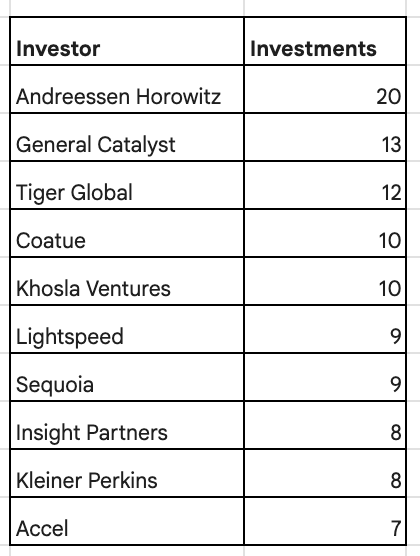

Top 10 Most Active Investors Across 143 Vertical AI Companies

Andreessen Horowitz (a16z): 20 companies

General Catalyst: 13

Tiger Global: 12

Coatue: 10

Khosla Ventures: 10

Sequoia: 9

Lightspeed: 9

Insight Partners: 8

Kleiner Perkins: 8

Accel: 7

This is not a long tail — this is a power law.

A small cluster of top firms is aggressively cornering the Vertical AI market.

Why Vertical AI Is Growing Faster Than Horizontal AI

1. Proprietary operational data

These companies don’t rely on publicly available datasets. They ingest simulation data, regulated workflows, frontline operations, sensor streams, and multimodal telemetry that give them defensible moats.

2. Domain constraints

Regulation, compliance, hardware dependencies, safety requirements — the very reasons incumbents move slowly are the reasons Vertical AI companies compound fast.

3. Real willingness to pay

When AI directly touches revenue, safety, logistics, or cost structure, it stops being a “tool.” It becomes infrastructure.

What This Means for Founders

Your edge is not the model. Your edge is the domain. Founders who build:

workflow-specific tooling

industry integrations

proprietary data loops

operational distribution

…will own the highest-value markets.

What This Means for Investors (including us)

The next generation of $10B–$30B companies will emerge from:

defense

automation

supply chain

healthcare

energy

compliance

and advanced manufacturing

Vertical AI is not a category — it’s the shape of the next enterprise stack.

At Six Point, the dataset reinforces what we already see in our deal flow:

Founders with deep domain expertise and real operational entry points are building the most durable moats in AI.

Check out all the data here!

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.