What is Trace thinking!? TL;DR

Big tech used to acquire VC backed startups for talent, tech and/or revenue but they basically they have all that now themselves

Now Gov’t/regulators around the world are blocking M&A - which makes up 99% of all VC backed exits - so that will substantially lower liquidity and hurt the tech world

Big tech will just wait for startups to go out out business, fail etc and buy everything on the cheap. Or invest in them directly to get around M&A issues to get what they want

No liquidity = less LPs capital/appetite to invest in riskier funds that are also taking longer to get exits

Leading to an overall decline in startups, possibly innovation and disruption etc though big tech seems to be driving most of that right now anyways

But we’re definitely in an Ai bubble; the hype will slow in the next year, so maybe now in the best time to invest to time that nexus point

Google, Microsoft, Apple, Meta, Amazon and Nvidia are becoming increasingly dominant in basically everything. And not like they’ve historically been, but in a new, scarier way… They’re getting leaner (layoffs), more aggressive (investing billions in Ai startups/partnerships) and more competitive (launching so many new products) with each other.

This is BIG TECH like we’ve never see it before with a combined marketcap of almost $14 Trillion - it’s their time to really shine!

Highest % of overall stock concentration in history

Despite the surge of well-funded startups in the AI space, these tech giants maintain a significant edge. Lets delve into how these companies are solidifying their dominance, the challenges startups face in competing with them, and the strategies Big Tech employs to stay ahead.

Financial Muscle and Ability to Invest

The financial power of these tech giants is staggering and some of them can use their cloud computing divisions as “credits” for compute equity because Ai is so intensive. So how much does each have and what do they do with all their billions?

Google, for instance, held over $140 billion in cash by the end of 2023. In the past five years, Google’s AI investments have exceeded $30 billion (Gemini).

Meta, with an annual revenue surpassing $117 billion, reinvests significant portions into AI research, particularly through its Reality Labs division, which sees investments of over $10 billion annually.

Microsoft, with a revenue of $198 billion in 2023, allocates significant funds for AI development, having invested over $60 billion in AI research and cloud AI services.

Apple's cash reserve, over $200 billion, enables substantial R&D spending focused on AI and machine learning. Oddly though they are the most “behind” Ai wise but they always take their time and launch things when they want to.

Nvidia, the smallest revenue wise of $26.9 billion in 2023 though makes up for it with their market cap, has invested over $20 billion in AI research and GPU technology development in recent years. They’re the new player in this crazy world selling the picks and shovels needed to power all of this for now.

Acquisitions are going down…

Data Advantage - Size Does Matter

Data is the lifeblood of AI, and these tech giants have unparalleled access to it. Google processes over 3.5 billion searches per day, providing a vast and unique dataset for training AI models. People oddly enough are making fun of Google for their bad search results recently etc but their firmly still on top.

Meta’s platforms (Facebook, Instagram, WhatsApp) generate immense amounts of user interaction data, continuously enhancing its AI algorithms. They know everything about you - remember Cambridge Analytica?

Apple leverages data from over 1.65 billion active devices to fuel its AI improvements, while Nvidia's GPUs, used globally, provide continuous data and feedback for refinement. Microsoft Azure’s vast platform collects and analyzes data to enhance AI services. The continuous flow of data these companies have access to gives them a significant edge, making it incredibly challenging for startups to compete without similar resources.

Talent and Strategic Acquisitions

So why would they need to acquire smaller startups that dont have their data, scale and resources? Mostly talent/acqui-hires as you can see below with deal count relatively high but the value is at a decade low.

High deal count but low deal value is not good

Top AI talent is drawn to these tech giants, thanks to their reputation and resources and ability to pay up. Google consistently ranks as a top employer for AI professionals. It has bolstered its capabilities through strategic acquisitions, such as DeepMind for $500 million in 2014. Meta’s AI research lab (FAIR) employs leading AI researchers, and strategic acquisitions like Oculus for $2 billion and Kustomer for $1 billion further its technological prowess.

Apple recruits AI experts globally and strengthens its position through acquisitions like Siri (2010), Turi (2016), and Xnor.ai (2020). Nvidia employs top engineers and AI researchers, focusing on GPU optimization for AI applications. Its acquisition of Mellanox Technologies for $6.9 billion has further bolstered its AI capabilities. Microsoft Research employs numerous AI experts across global labs, with strategic acquisitions like Nuance Communications for $19.7 billion enhancing its AI healthcare solutions.

Impact on Startups and the VC Ecosystem

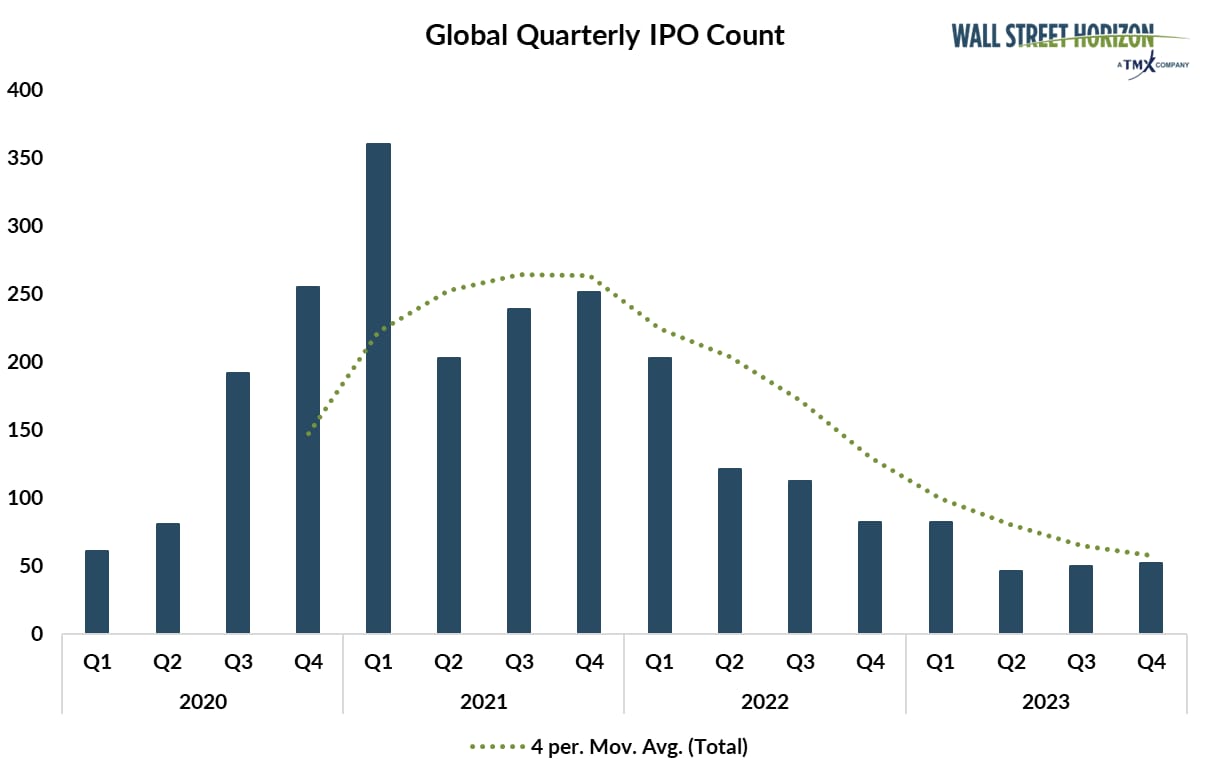

The IPO window is open but there is no breeze…

I wrote a few newsletters ago that while we’re in a tech world Ai bubble with startups raising hundreds of millions, even billions pre product, the dominance of Big Tech companies—Google, Meta, Apple, Nvidia, and Microsoft—remains unchallenged. Their vast resources, data advantages and integrated ecosystems keep them at the forefront of AI development. Startups play a crucial role in driving innovation, but often, the ultimate path to success involves collaboration or acquisition by these tech behemoths. And regulators blocking almost every attempt to acquire VC backed startups will be a double-edged sword.

Issues are brewing in the PE world as well… they need M&A/IPOs too

BIG Tech has found their purpose again and it’s Ai…

This is what actually scares me the most… thanks to Ai big tech is getting back in shape to run a marathon at breakneck speeds. It’s been a long time since all of them competed so intensely against each other to win, in a very public way, with events and media coverage almost daily.

Startups face significant challenges in competing with these giants. The financial muscle of Big Tech allows them to outspend startups in R&D and acquisitions. The data advantage held by these companies means that their AI models can be trained on more comprehensive and varied datasets, leading to superior performance. So most startups will need access to it via partnerships, APIs etc - hopefully go beyond being just a wrapper.

For multi-stage billion dollar funds, it’s their time to shine though - they’ve had so much dry powder waiting to deploy into these capital intensive Ai startups. We are seeing hundreds of millions, even billions being invested some days, definitely every week into some unknown pre product Ai startups founded by ex BIG TECH researchers etc. Some of the early ones are already struggling and up for sale within a year or two but every major VC needs their horse in the race.

😂 MEME of The Week 😂

Always have an ask!

Which big tech company do you like the most?

Hate the most?

Do you think will win/lose this Ai battle?

Need eComm, design, branding or websites build? Check out http://knowstartups.com

Please share this with your friends/network! twitter.com/Trace_Cohen