With Deal Sheet you get curated, actively investable startup opportunities sent once per week.

Deal Sheet offers the best (and actively investable) venture capital investment opportunities directly to your inbox weekly. Deal Sheet subscribers have already received investment opportunities alongside Kleiner Perkins, Naval Ravikant, General Catalyst, Andreessen Horowitz, Khosla Ventures and more!

The Deal Sheet Co-Founders Alex Pattis and Zach Ginsburg are the global VC Syndicate leaders with over 700 investments closed and over $200m invested into startups. Additionally, over the last five years, Alex & Zach have collaborated on deals with over 50 VC leads who have collectively put together well over 1,000 startup investments.

Yes that’s an ad above - the post starts now!

Malcolm in the middle anyone? That’s how I feel right now 😃

There was a debate last week on Twitter (where I spend too much time) about whether VC backed startups should (and could) IPO if they have <$500M in revenue. While the short answer is yes, the longer answer is probably not today right now. The IPO window is 100% open (Reddit, Ibotta etc) but are the 1000 VC backed startup unicorn with enough revenue, growth, margins and public perception? Doesn’t seem like it…

Brad makes really good points and is fundamentally correct that there is discipline and scarcity in going public that shaped Amazon and Facebook (I wont call it Meta) etc but that was 10-30yrs ago. Times have changed and public markets are not forgiving - Facebook dropped almost 50% when they spent $50B on the metaverse + buying Nvidia chips. It bounced back because they print billions in profit and Zuck is the GOAT founder but there is almost no other example of another public company trying to do that.

So if you think that a startup with <$500M rev and a few billion dollar valuation can IPO, raise maybe a few hundred million and miss a few earnings because they want to innovate and public in public, I dont believe you!

What does it take to go public?

2021 was quite a year for initial public offers (IPOs) in the United States, which was largely influenced by the significant rise in the number of special purpose acquisition companies (SPACs) who went public. In 2021, there were 1,035 initial public offerings (IPOs) in the United States. In 2022 and 2023, however, the number of IPOs dropped to 181 and 154 respectively.

Just for fun and sheer size comparison, Google, Amazon, Meta and Tesla, the Magnificent 7 have a $16 trillion combined market value, 34% of the S&P 500 and LARGER than the ENTIRE S&P as recently as February 2016

Microsoft's revenue for the quarter ending March 31, 2024, was reported at $62 billion. So divide that by 90days (1 earnings quarter) and we get $687 million per day which is close to what Reddit which just IPOed generates in 1 full year…

Tomasz did some good research and shows that something happened in 2018 that changed the private/public markets, which I’ll dive into for another newsletter. So with that in mind, lets look at some of their and others humble beginning over the last decade.

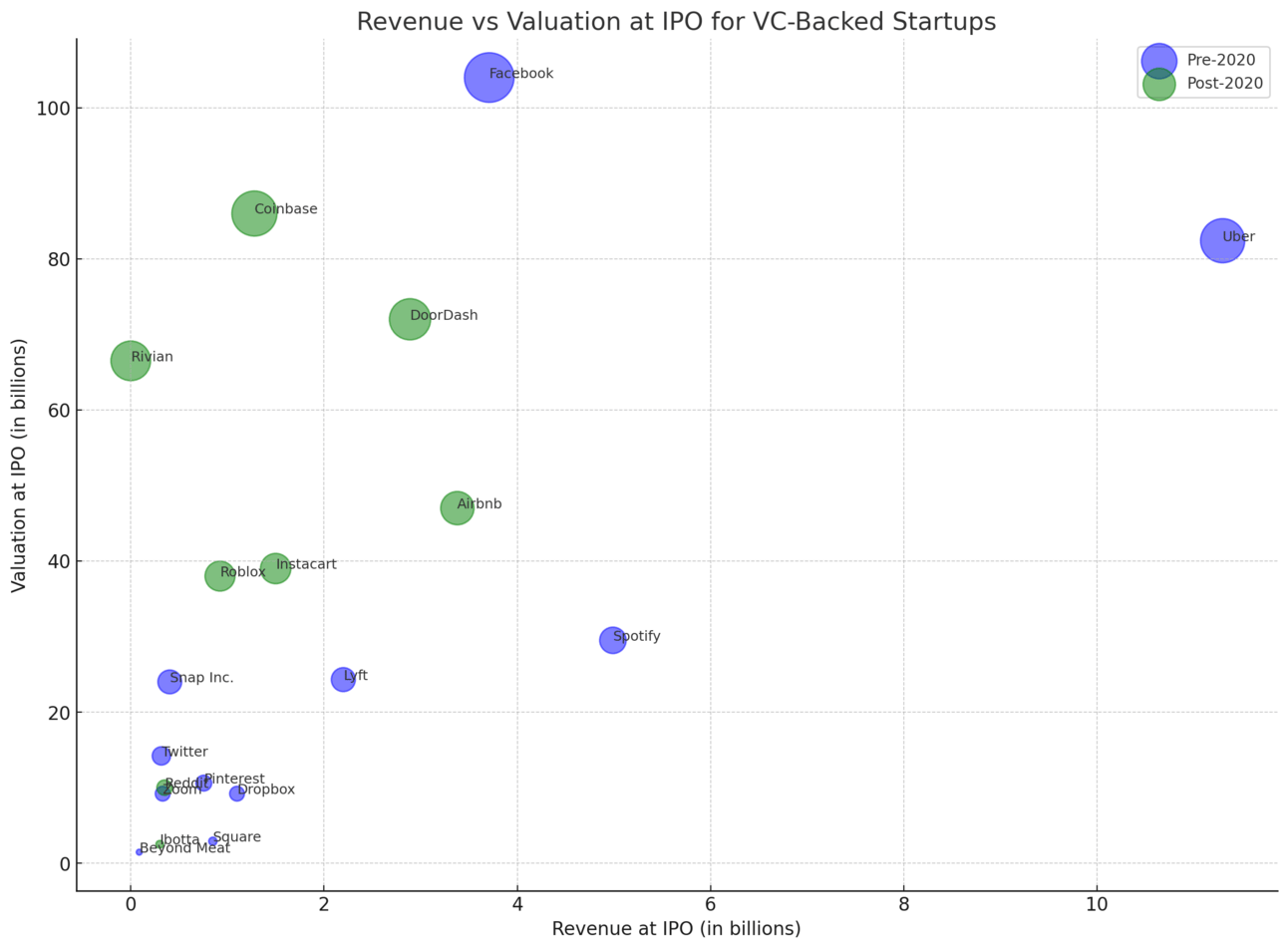

Pre-2020 IPOs

Facebook IPOed in 2012 with $3.7 billion in revenue and a $104 billion valuation.

Twitter went public in 2013 with $317 million in revenue and a $14 billion valuation.

Snap Inc. IPOed in 2017 with $404 million in revenue and a $24 billion valuation.

Square went public in 2015 with $850 million in revenue and a $2.9 billion valuation.

Dropbox IPOed in 2018 with $1.1 billion in revenue and a $9.2 billion valuation.

Spotify went public in 2018 with $5 billion in revenue and a $29.5 billion valuation.

Uber's 2019 IPO saw $11.3 billion in revenue and an $82.4 billion valuation.

Lyft IPOed in 2019 with $2.2 billion in revenue and a $24.3 billion valuation.

Pinterest went public in 2019 with $756 million in revenue and a $10.6 billion valuation.

Zoom IPOed in 2019 with $330.5 million in revenue and a $9.2 billion valuation.

Beyond Meat went public in 2019 with $88 million in revenue and a $1.5 billion valuation.

Pre-2020 Analysis

The total revenue generated by these companies at their IPOs amounted to $34.5 Billion, with a combined valuation of $543 Billion. The average revenue at IPO was approximately $2.9 Billion, and the average valuation was $45.3 billion.

Post-2020 IPOs

Airbnb IPOed in 2020 with $3.4 billion in revenue and a $47 billion valuation.

DoorDash went public in 2020 with $2.9 billion in revenue and a $72 billion valuation.

Coinbase IPOed in 2021 with $1.3 billion in revenue and an $86 billion valuation.

Roblox went public in 2021 with $924 million in revenue and a $38 billion valuation.

Rivian IPOed in 2021 with no revenue and a $67 billion valuation.

Instacart went public in 2021 with $1.5 billion in revenue and a $39 billion valuation.

Reddit IPOed in 2024 with $804 million in revenue and a $6.5 billion valuation.

Ibotta IPOed in 2024 with $320 million in revenue and a $3 billion valuation.

Post-2020 Analysis

The total revenue generated by these companies at their IPOs amounted to $10.6 Billion, with a combined valuation of $361 Billion. The average revenue at IPO was approximately $1.3 Billion, and the average valuation stood at $45 Billion.

BUTTTT it’s so much more than just revenue and valuations… the public markets are an entirely different financial beast. Depending on your industry, customer, market cap and overall perception, certain funds, ETFs, managers etc cant even purchase your shares based on just volume/liquidity alone.

Visualizations for fun!

Pre 2020 was smaller and a little more aligned to revenue multiples

Box Plot of Revenue for VC-Backed IPOs

Revenue was still pretty close pre/post

This box plot shows the distribution of revenue at IPO for pre-2020 and post-2020 VC-backed startups. It highlights the median, quartiles, and potential outliers.

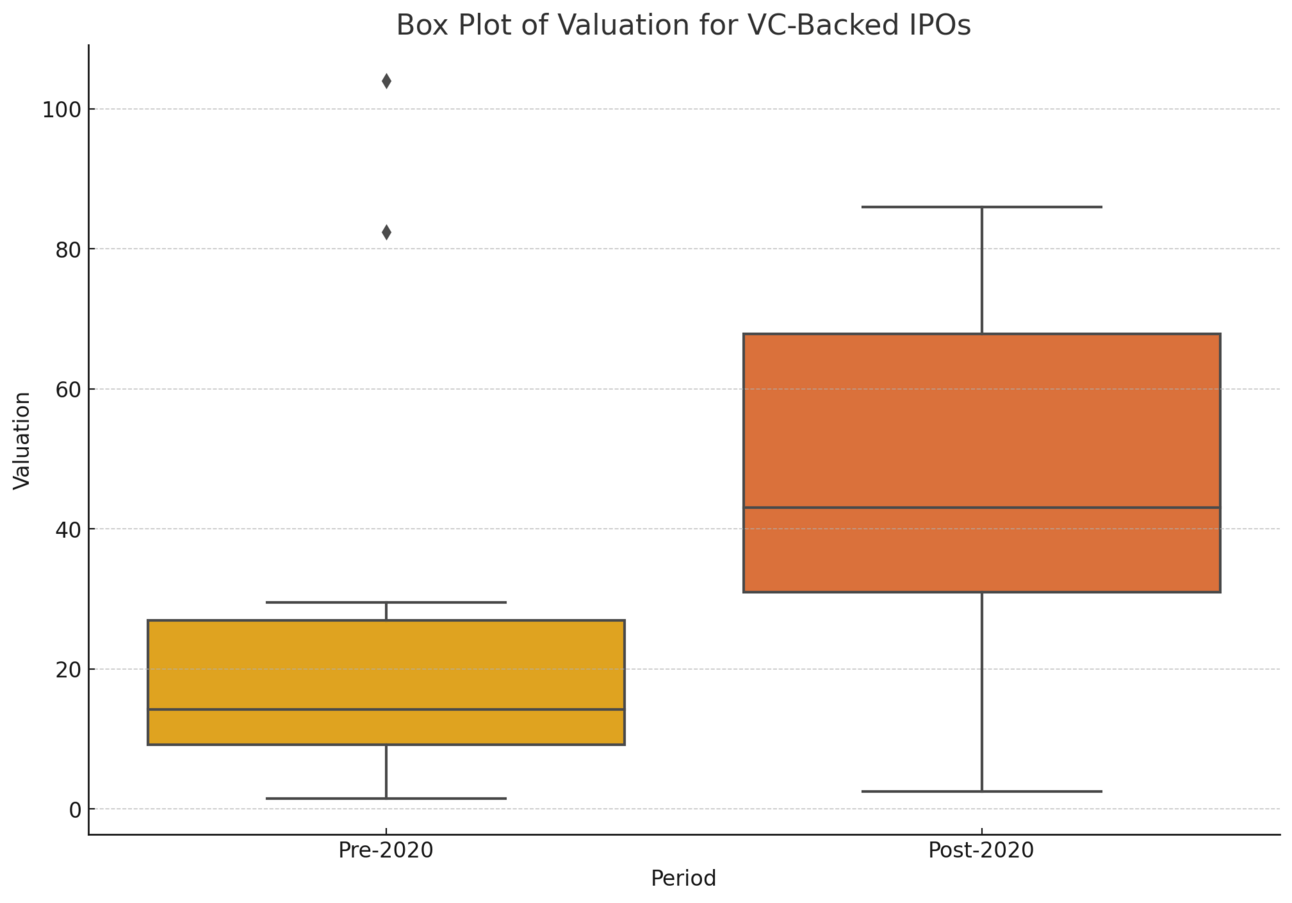

Box Plot of Valuation for VC-Backed IPOs

Valuations might have gotten a little out of hand post 2020…

This box plot shows the distribution of valuations at IPO for pre-2020 and post-2020 VC-backed startups. It provides insights into the spread and central tendency of valuations during the two periods.

So when should you IPO!? Just do it already.

Earlier IPOs were characterized by higher revenues, while the more recent ones reflect the rapid scaling capabilities (growth at all costs) and the substantial market valuations driven by future growth prospects. Smaller IPOs under $500 million unfortunately just wont be as common as they once were. There is too much capital in the markets that needs to be invested privately, the markets need bigger and bigger outcomes/exits and purely the collective investing psyche that bigger is better.

😂 MEME of The Week 😂

Always have an ask!

When will Stripe IPO?

Invested in or sell alcohol online? Use https://www.accelpay.io/

Please share this with your friends/network! twitter.com/Trace_Cohen