Multiple people have told me over the the last year that early stage investing is like stock value investing, which never really made sense to me. Especially after my MBA class on valuing investing (Columbia Business School where it was basically invented) - though fundamentally I agree in principle with the tweet below, it’s more a vernacular issue for me. I’m a word person - ran PR/comms agencies etc - so I would call it more opportunistic investing at the very least. We are all (generally) thesis driven investors, knowing what we want, or intend to, invest in but dont really know it until we see it.

Just to be very clear, Sam is an amazing investor/operator so nothing against him, because fundamentally we play in the same world. It’s just hard to tell myself and others that I do value investing in awesome innovative startups that are pre product and revenue half the time. And across our 60+ investments we average an entry of $7.5M valuation, so the only real value we can access is the team, idea/product and market potential. Is there a huge difference between a $7.5M, $12M and $20M valuation when we expect multi-billion dollar exits… that’s a topic for another post 🙂

What is Value Investing? History lesson time!

Benjamin Graham is The "Father of Value Investing" who developed a systematic approach for analyzing stocks based on their intrinsic value. Graham, along with his colleague David Dodd, emphasized buying securities for less than their true value based on real public data something most startups dont have very early on.

Margin of Safety: One of Graham’s key principles was the "margin of safety." He argued that investors should buy stocks at a significant discount to their intrinsic value (startups dont really have that) to protect against downside risk. This principle became a cornerstone of value investing, focusing on reducing risk by avoiding overpriced or speculative assets (like AI).

There is no margin of safety in what we do and our downside protection is often very limited. Especially with SAFEs.

From Student to Icon: One of Graham’s most famous students, Warren Buffett, took value investing principles to new heights, while studying under Graham at Columbia Business School (I took that class and it was boring).

You think Warren Buffett would invest in startups?

Value vs. Growth: Over the past decade, value investing has faced challenges from growth investors, particularly during low-interest rates when everything was awesome. Growth stocks outperformed traditional value stocks during these periods.

Aka its been a good decade for growth, which the markets demand and expect.

So how can we be value investors when the competition we’re looking to disrupt are not? Not even close.

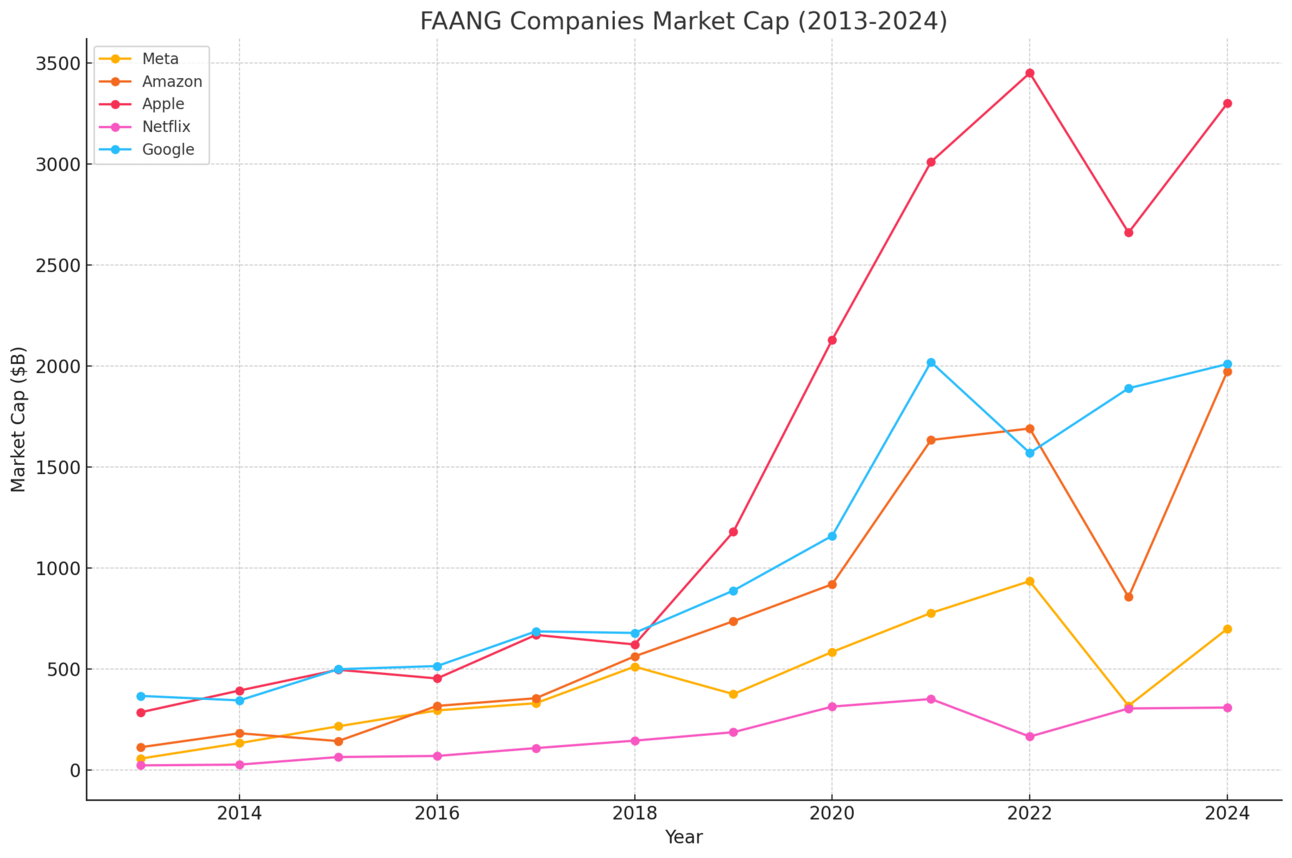

The FAANG Phenomenon: Market Caps, Revenue and multiples

The BIG tech FAANG (Facebook, Amazon, Apple, Netflix, Google), Tesla, and Nvidia etc are truly amazing companies that we hope some of our investments turn into one day. Below is just a quick refresher on what we’re up against and hopefully one day we will beat, at the very least get acquired by (when that’s allowed again).

Market Cap

Apple: From $286 billion in 2013 to $3.5 trillion in 2024.

Amazon: From $113.89 billion in 2013 to $2 trillion in 2024.

Google (Alphabet): From $367.82 billion in 2013 to $2 trillion in 2024.

Meta (Facebook): From $57.67 billion in 2013 to $1.5 trillion in 2024 (after a drop of 50% in 2022-2023 and subsequent recovery).

Netflix: From $24.13 billion in 2013 to $300 billion in 2024.

Revenue

Apple: From $174 billion in 2013 to $385 billion in 2024.

Amazon: From $74.45 billion in 2013 to $604 billion in 2024.

Google (Alphabet): From $56.67 billion in 2013 to $328 billion in 2024.

Meta (Facebook): From $7.86 billion in 2013 to $149 billion in 2024.

Netflix: From $4.37 billion in 2013 to $36 billion in 2024.

Revenue Multiples

Apple: 9x multiple

Amazon: 3.3x multiple

Meta: 10x multiple

Google: 6x multiple

Netflix: 8.3x multiple

Why am I showing you all of this? So we dont lose perspective of the current market, though most companies we invest in wont compete directly with them. But in the last decade here are 10 most acquisitive tech companies and most tech startups exit through acquisition.

Investors are in the business of exits!

Google (Alphabet) - 182 acquisitions

Microsoft - 120 acquisitions

Amazon - 100 acquisitions

Cisco - 81 acquisitions

IBM - 79 acquisitions

Oracle - 75 acquisitions

Salesforce - 60 acquisitions

Apple - 48 acquisitions

Intel - 45 acquisitions

Facebook (Meta) - 40 acquisitions

😂 MEME of The Week 😂

Always have an ask!

What would you call early stage investing?

Who is the best / strongest BIG tech?

Are you a parent / caregiver struggling to change sheets? peelaways.com

FIND ME: 𝕏 @Trace_Cohen / in LinkedIn

The future of presentations, powered by AI

Gamma is a modern alternative to slides, powered by AI. Create beautiful and engaging presentations in minutes. Try it free today.