The very highly anticipated Carta VC Fund Performance: Q1 2024 dropped last week and it seems like a lot of people dont really understand how the VC business model works. So I’m going to break it down by chart and give my thoughts to create some clarity, answers some questions and call out some fear mongers / engagement baiters.

Highlights From The Report

(copy/pasted from link above to make it easier)

Slow capital deployment: Funds in the 2022 vintage have deployed about 43% of their committed capital at the 24 month mark, the lowest share of any analyzed vintage. Prior vintages ranged from 47%-60% after 24 months.

Graduation rates declining: 30.6% of companies that raised a seed round in Q1 2018 made it to Series A within two years. Only 15.4% of Q1 2022 seed startups did so in the same timeframe.

Distributions back to LPs remain elusive: Less than 10% of 2021 funds have had any DPI after 3 years.

Basically it’s not looking good right now which we all know and have been writing about for the last few months. But this is the first time we’ve really seen data like this in a long time - take all this with a grain of salt though as these are only funds that use Carta as their fund admin.

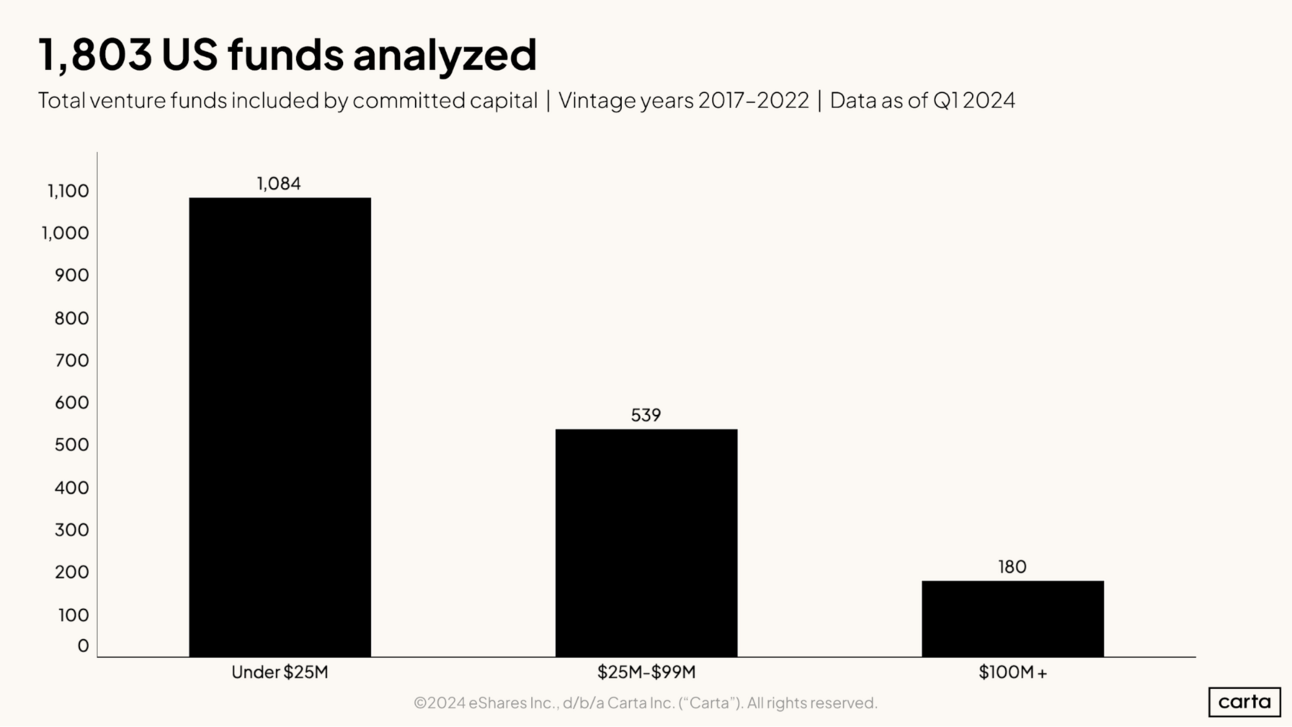

Fund Details & Deployment

This is basically just highlighting where all the data comes from - Carta has a fund management platform, beyond their cap table management that most people know them for. It makes sense that significantly more smaller funds use them, especially I would assume many of them were formed during the 2020-2021 ZIRP era, which will explain some of the data we’re going to breakdown below. I’m also very curious to know how many of the 1803 funds are unique - same firm but funds 1, 2,3 etc.

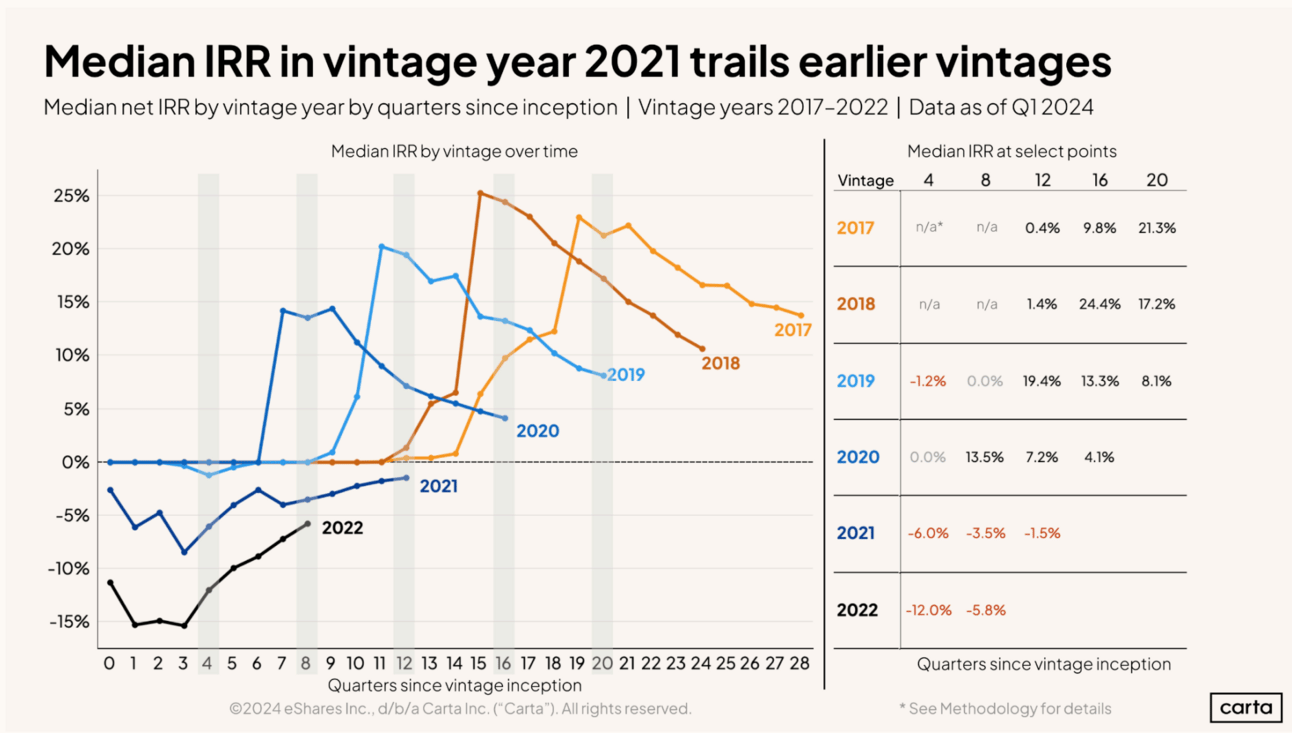

This is called a J-curve which is a typical VC understanding that as you deploy capital, you will have companies go out of business before you have any acquired. Hence you will have losses before any gains as it takes years before small exits could occur and generally 8-12yrs for the big exit, so it’s straight, then it dips, then it hopefully goes way up, which looks like a J.

Years 1-2 you’re investments are flat as they launch, find PMF and generate some revenue. But that doesn’t change the chart above bc this is IRR.

But years 2-4 some of the companies wont work out, cant raise more money and have to shut down. This is when you get negative IRR which is expected and very common as you realize a loss.

Years 4-8 you will definitely have more losses but eventually some gains so it will start to curve up.

Years 8-12 is when it’s expected (hopefully!) you get a big multiple fund return, a 100x+ on your startup investment that shoots up your IRR and returns significant capital (DPI) to your LPs

OK this is definitely one of the most concerning images of the data set. As explained above, you can see some of the J-Curve in action but then sadly it falls off. Why? ZIRP!

Basically 2020-2021 created a lot of liquidity which is why you see them all shoot up. Some investors were able to cash out (M&A, IPO/SPAC and/or secondaries) so they got some IRR but it falls over time because IRR is time based calculation.

The last two years have been really rough for funding but also liquidity - there have been almost no M&A or IPOs so its expected that the IRR will decline as it decays with time.

Ideally we will see a huge spike over the next few years as M&A/IPOs come back and VCs/LPs get so much needed liquidity. Here’s to the W-Curve!

Now this is a very informational chart because it captures TVPI which includes unrealized gains, aka markups on paper as VC investments raise more at higher valuations

TVPI—which stands for total value to paid-in capital. To calculate this multiple, divide the total current value of a fund’s assets and distributions by the amount paid in to date.

For example a fund that started in 2017 lets assume it’s a $20M fund, on average is worth $35.6M on paper unrealized gains (20×1.78)

The major problem/flaw in this is that many of these markups during 2020-2021 were very high but unfortunately most of them will never be worth that much or more. So, many of them are still marked up but if they never had a formal down round, recap etc then they are still valued at their last valuation until a legal event.

This is kind of the ticking time bomb that many of us are worried about as we all know countless highly valued startups with little to no revenue, stalled growth and had significant layoffs.

Giving Money Back to LPs (DPI)

DPI is how a fund is ultimately judged at the end of it’s life - basically what multiple of money did you return to your investors.

“While TVPI incorporates measures of unrealized gains, DPI only uses realized gains”

“Only 9% of funds in vintage year 2021 have returned any capital to LPs at the 3 year mark. In contrast, 25% of the 2017 vintage had distributed at least some capital at the same checkpoint.”

Let start by clarifying that a 2017 VC vintage means they started to deploy in that year but typically a VC invested over 2-4years. So it’s entirely possible that a 2017 fund deployed a check at 2020-2021.

Also many funds recycle - that means if they have an early exit (usually small), they try to invest it in a new startup or current startup. Why? 2% management fees means 20% of the fund goes to fees and expenses, so by investing more, you get closer to deploying 100% (or more) of all the capital you raised.

So for a 2017 fund in 6-7years to return capital to LPs means they had an exit and returned it to their investors. We can safely assume it wasn’t a massive home run but still nice to return like 20-30% to investors for any liquidity these days.

Most massive home runs 100X+ startup returns that can 2x+ (DPI) the fund usually take 8-12yrs these days. Generally a multi billion exit via M&A or IPO to make that happen

Here is the link again to download the report and run through it yourself.

Basically it’s rough out there unless you’re a true deep technical Ai company, growing very fast and/or go viral. Investors are trying to help their investments as much as they can (our jobs depends on it) but really besides the obvious increasing sales, the other side is cost cutting via layoffs and less marketing spend to get as close to break even as possible. That generally means slowing growth but a longer runway to survive to fight another day in better market conditions.

Many are definitely between a rock and a hard place right now, so please reply back if you want to chat personal/professional things - always happy to help!

😂 MEME of The Week 😂

Always have an ask!

How are your investments doing? Obviously confidential 🙂

Talking with a lot of Family Offices about the current funding environment - small/big funds, variance, expectations and more

Send me your best early stage startups to invest in!

Simplify your job search with www.tealhq.com

FIND ME: 𝕏 @Trace_Cohen / in LinkedIn