Become your own CFO

Forecasting your startup growth and runway is your CFO’s job… when you can afford one.

Our 1-week LIVE workshop teaches you to,

Keep track of your runway.

Forecast customer growth

Budgeting rounds of funding

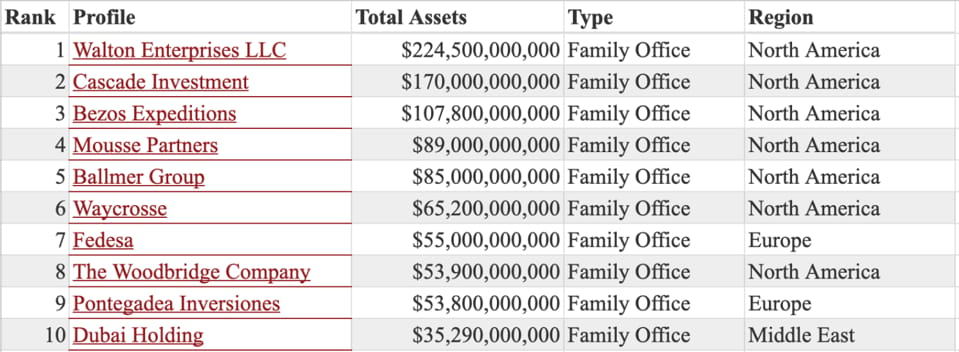

What is a Family Office, who runs them, what do they do, what do they invest in and how do you find them!? All questions I get asked and there is no real answer. Very few, except for the big names like Zuckerberg, Walton, Ellison, Bezos, Gates etc are really visible and easy to find, though hard to get in touch with. Combined they control almost $1T in value - but what about all the others starting at $30M (considered ultra high net-worth) who can still invest and make an impact…

The latest North America Family Office Report 2023 shows a robust environment for family offices that are starting to diversify their assets more. Exact figures are always hard to come by but it’s believed that in North America, family offices are managing an estimated $1.72 trillion in assets, or about $700B outside the top ones list above. So how do you/we work with them? Well it’s sometimes like playing hide and seek or where’s Waldo - not many really want to be found that easily.

All I care about right now is that family offices are starting to become a force in the early stage / emerging manager VC world as they continue to lean in and fill the void of all the tourists that left. Their sometimes considerable resources and strategic benefits can make them strong allies for many emerging managers, beyond their much needed capital as well as compared to traditional LPs. This is especially important right now in light of the fact that major BIG VC firms have secured over 90% of all limited partner capital this year.

The Rise of Family Offices in Venture Capital

Family offices have historically been less interested to make direct investments in tech startups, preferring to act as LPs in established VC funds. Definitely during ZIRP 2020-2021 they dipped their toes like everyone else and hopefully learned a lot but didn’t get too burned. Through now 2yrs later after a drought of capital, we’re starting to see them re-engage; according to the J.P. Morgan 2024 Global Family Office Report, family offices now maintain a 45% allocation to alternative investments, including venture capital, private equity, real estate, and hedge funds. So yes we’re still considered a small piece of the alternative investment pie, even though we get outsized media and attention sometimes for our work.

The Unique Advantages of Family Offices

Patient Capital: Family offices generally have time on their side, allowing startups and emerging managers to grow organically without the pressure of quick exits which we’re seeing a lot these days. This alignment fosters a healthier and more sustainable growth trajectory for everyone involved

Strategic Partnerships: Beyond financial backing, family offices can offer strategic value via extensive networks, industry expertise, and sometimes operational knowledge. For emerging managers, this support is invaluable, providing them with resources and connections that might otherwise be out of reach with traditional LPs

Challenges and Opportunities in the Current Market

Understanding Investment Criteria: Most family offices have diverse investment criteria and most aren’t very familiar with the dynamics of the VC/startup game, making it challenging at times for emerging managers to tailor their pitches

Market Volatility: Recent market conditions, including inflation and higher interest rates, have forced many family offices to reassess their investment strategies. Despite these challenges, the fundamental advantages of patient and strategic capital make family offices attractive partners for emerging managers. Their ability to weather market fluctuations and maintain a long-term focus positions them as stable and reliable investors

Generational Shifts and Professionalization: As family offices become more professionalized and leadership passes to younger generations, there is a growing comfort and interest in technology investments. This generational shift is likely to continue driving family offices towards more innovative and high-growth sectors, aligning perfectly with the goals of emerging managers. The Next Gen (hate that term) for obvious reasons is very interested in the VC/startup world

Some Quick Data and Insights

Investment Growth: Family offices have increased their allocation to alternative investments, including venture capital, from 22% in 2021 to 30% in 2023.

Sector Focus: A significant portion of family office investments is directed towards technology-focused ventures, with 77% of private equity investments funneled into tech-related startups.

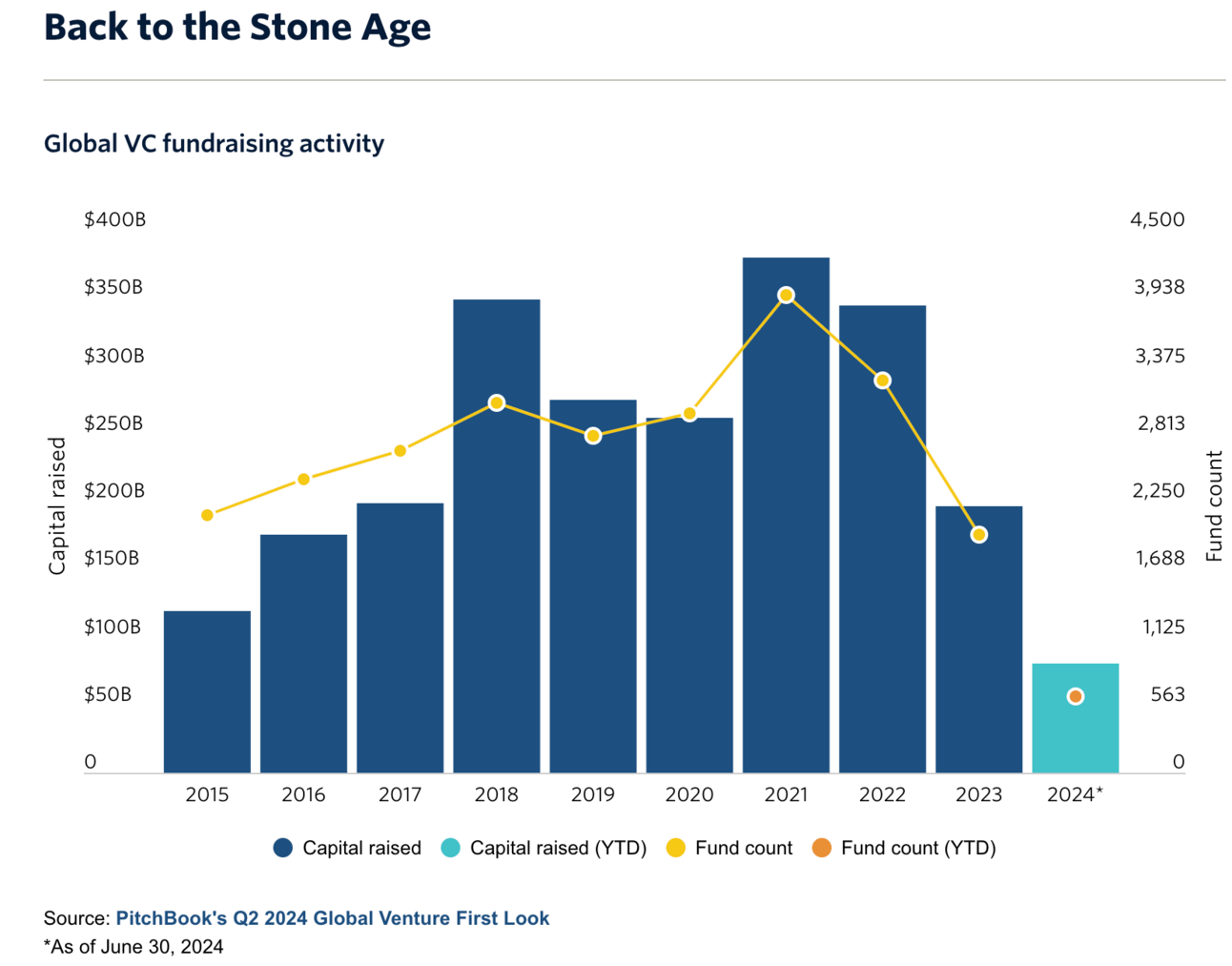

This is very much needed considering we’re basically at all times lows for VC funding and activity…

😂 MEME of The Week 😂

Always have an ask!

Are you raising a fund now? Let me know!

Have you invested in any Emerging Managers you like? What have you learned?

When will the market recover? I think 2025 to 2026 will be so much better - what do you think?

Peel away multi-layer bedsheets!? Yep it’s real https://peelaways.com/

Please share this with your friends/network! twitter.com/Trace_Cohen