We need to seriously jump start the early stage tech world

The tech VC startup world is at a critical juncture as we face a period of economic volatility, tightening capital flows and lack of liquidity. But now that its been a few years with many stocks back at all time highs, though sadly many startups and venture funds have hit the end of their runway, we need to get started again!

The role of limited partners (LPs) supporting emerging managers—particularly those running funds under $100 million, and ideally under $50 million—has never been more urgent. Failure to increase investments in these early catalyst funds could have profound consequences on the startup ecosystem, potentially stunting innovation and delaying economic recovery for years to come.

Everyone needs to remember that we invest in the future - literally if we invest in a pre/seed startup today, I’m trying to predict where the world will be in a year or so when they need to raise again. So please dont confuse a short view with a clear vision.

The aging demographic of Japan

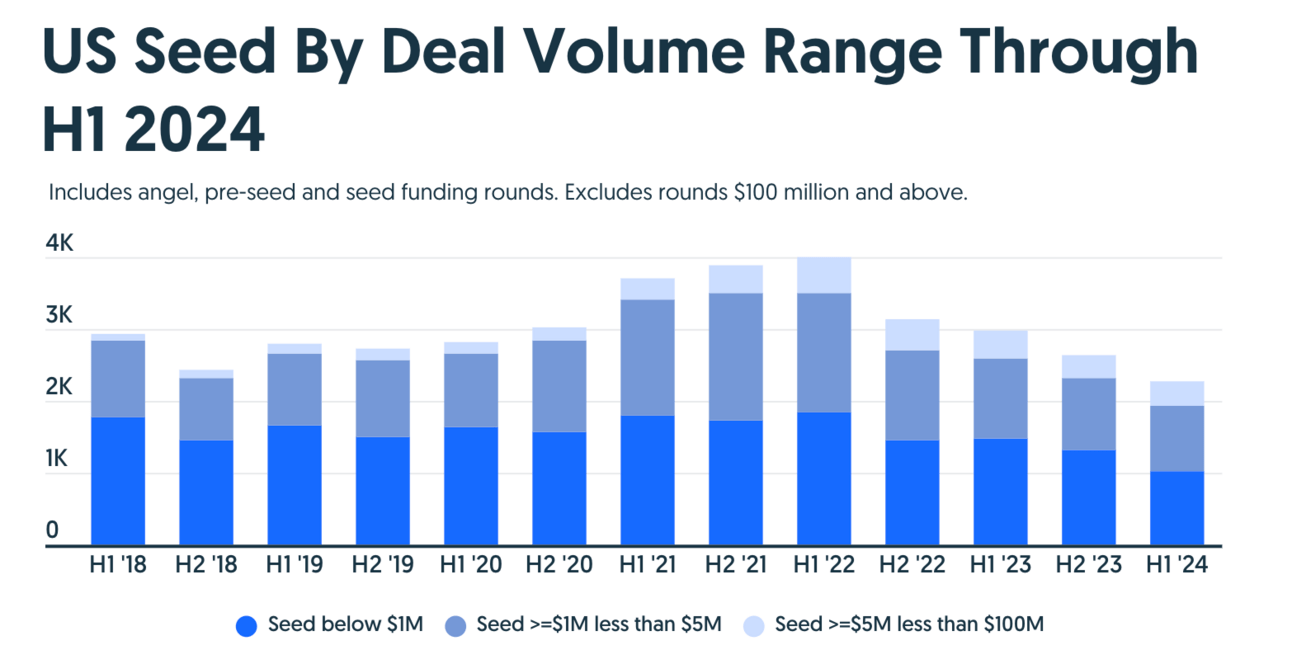

I’m mostly concerned that we’ll face a similar fate that is plaguing the Japanese population as it continues to decline. We need to prime the top of funnel with more startups, which you’ll see below is still going down, and as of now unless we do something, wont increase significantly without intervention. We already have a Series A crunch which I believe will last another year or so but then after that the funnel will dry up if nothing changes and later stage growth etc will have less to choose from. Eventually in 7-10yrs we’ll see a major lull in IPOs and M&A because of the lack of investments now.

The Current Landscape: Emerging Managers and Their Challenges

Emerging managers are the cornerstone of early stage innovation, taking huge risk on relatively unproven ideas and founders. Despite their potential for higher returns, these managers are currently struggling to secure sufficient capital due to LPs’ preference for larger, more established and “safer” funds. As I wrote in a previous newsletter, no one ever got fired for investing in a well established and brand named firm.

I cant really blame them but then again most of those are minimum $50-$100M checks, so EMs are really just too small for them. Imagine though if a few really big LPs that can write $100M checks decided to invest $10M in 10 funds - if 5 to 10 did that, investing $500M-$1B in EMs, they would literally change the entire early stage landscape themselves.

But our world is not about taking the easiest path because then everyone would do it! It’s hard to explain to anyone what it’s like to be a founder of a startup, regardless of the outcome - I joke that I dont wish it even on my enemies (I dont think I have many)

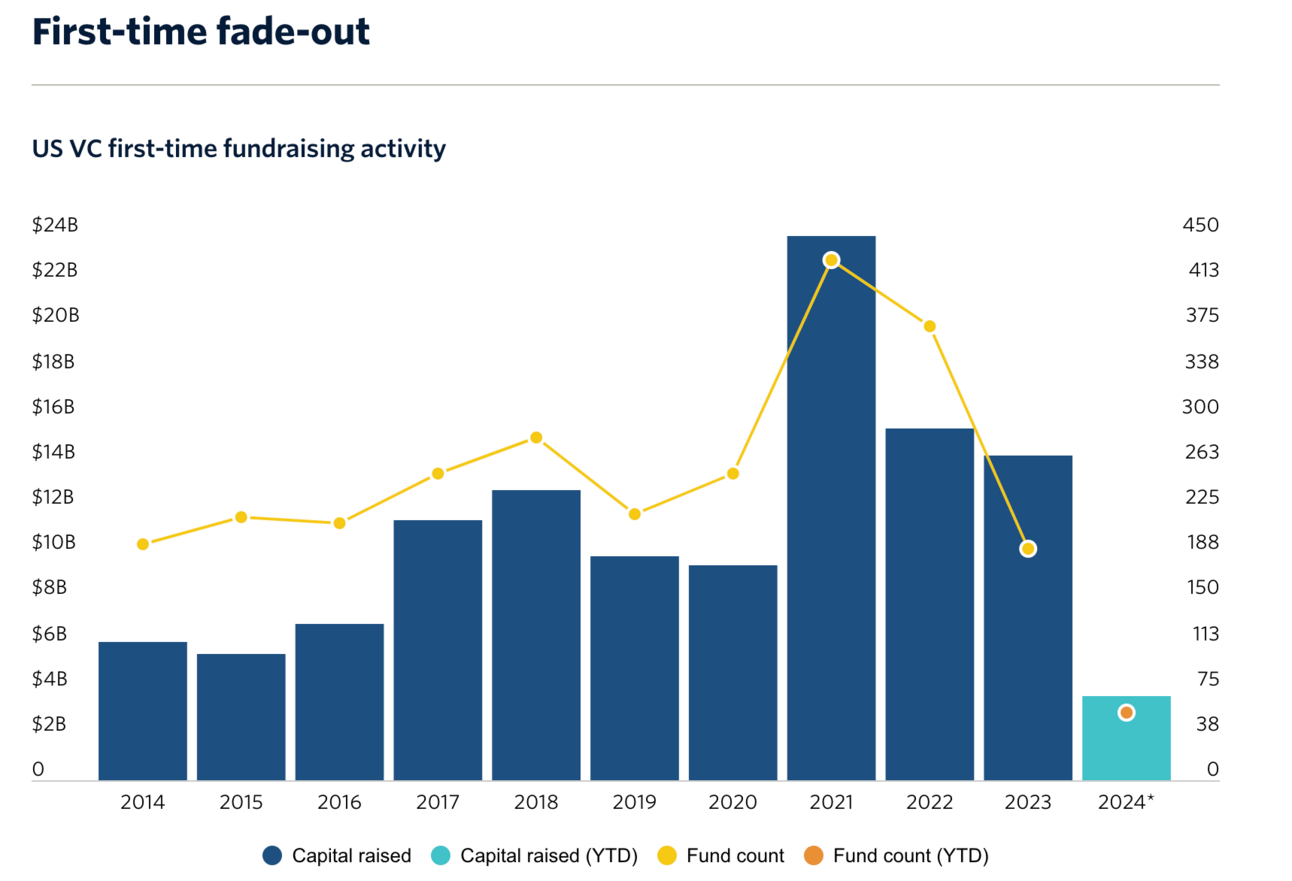

This chart is about first time funds, which obviously peaked in 2021 when everyone thought they could be an investor. While I know numerous funds 1-3 in the market raising that wont show up on these charts yet, I continually hear feedback that it’s rough out there and LPs have lost their appetite after getting burned during ZIRP + the lack of liquidity. But then we all see the billions being raised by the Tier 1 firms, which is a tough pill to swallow for many.

Key Data and Trends From Last Few Years

Decline in Early-Stage Funding: According to PitchBook, early-stage investments have dropped by 20% over the past two years. In Q1 2024, seed and Series A rounds saw a significant decrease in total capital deployed, falling from $7 billion in Q1 2023 to $5.6 billion in Q1 2024.

$5M+ seed rounds are keeping the market afloat

Capital Allocation by Fund Size: Data from Preqin shows that funds with less than $50 million receive only 8% of total venture capital commitments, despite accounting for 30% of the deals. Larger funds, in contrast, receive the majority of commitments, with funds over $500 million capturing 70% of total capital.

Performance of Emerging Managers: A report by the National Venture Capital Association (NVCA) indicates that funds led by emerging managers often deliver superior returns. Over the past decade, emerging funds with less than $100 million have produced an average IRR of 18%, compared to 14% for larger funds.

Cooley’s Q2 2024 report also sheds light on market dynamics that could impact emerging managers:

Valuation Trends: Median pre-money valuations increased for Series Seed which sounds weird but with larger firms mostly leading deals, writing bigger checks, they need to have higher valuations. Conversely, valuations for Series A, B, and C rounds declined, with Series C witnessing the sharpest drop from $175 million to $130 million.

Up Rounds vs. Down Rounds: The percentage of down rounds decreased notably from 33% in Q1 2024 to 22% in Q2 2024, while up rounds rose to 74% of deals—the first time since Q2 2023 that up rounds represented more than 70% of quarterly deals. Showing some positive signs!

Pay-to-Play Provisions: The percentage of deals with a pay-to-play provision increased to 8.7% in Q2 2024, marking the highest since the inception of Cooley’s report in 2014. However, 95% of deals maintained a 1x liquidation preference, and 94% featured nonparticipating preferred stock, indicating favorable terms for companies. This is lame!

😂 MEME of The Week 😂

Always have an ask!

Are you investing in startups or funds right now?

I’m looking to meet with high network, family offices etc to get their perspective on the current climate and what they’re investing in

Send me your best early stage startups to invest in

Have a dog? You need tryfi.com

FIND ME: 𝕏 @Trace_Cohen / in LinkedIn / [email protected]