🇮🇱 Israel's Tech Ecosystem: Sustained Growth Into 2025

Record-breaking venture capital, landmark M&A, and IPO resurgence cement Israel’s position as a global tech powerhouse in 2024, and already in Q1 2025

In a year defined by heightened geopolitical volatility and ongoing macroeconomic challenges, Israel’s high-tech sector showcased exceptional resilience and forward momentum. According to Startup Nation Central, Israeli startups raised $12.2 billion in 2024—a 31% year-over-year increase that firmly reestablished the country’s role as the third-largest global destination for venture capital and technology investment, trailing only behind the United States and China. This resurgence was not simply a rebound; it represented a structural reaffirmation of Israel’s position at the forefront of global innovation.

This upward trajectory was underpinned by a triad of interlinked drivers: (1) a revitalized IPO pipeline as mature startups began preparing for the public markets, (2) a substantial uptick in M&A activity catalyzed by interest from multinational acquirers seeking Israeli IP and engineering talent, and (3) intensified international investor confidence as sovereign wealth funds, institutional investors, and tier-one VCs ramped up allocations.

🚀 Venture Capital & M&A Highlights

$12.2B raised in 2024, representing a 31% increase YoY—one of the strongest years in recent history

75% of total capital inflows came from non-Israeli investors, reflecting deep cross-border engagement

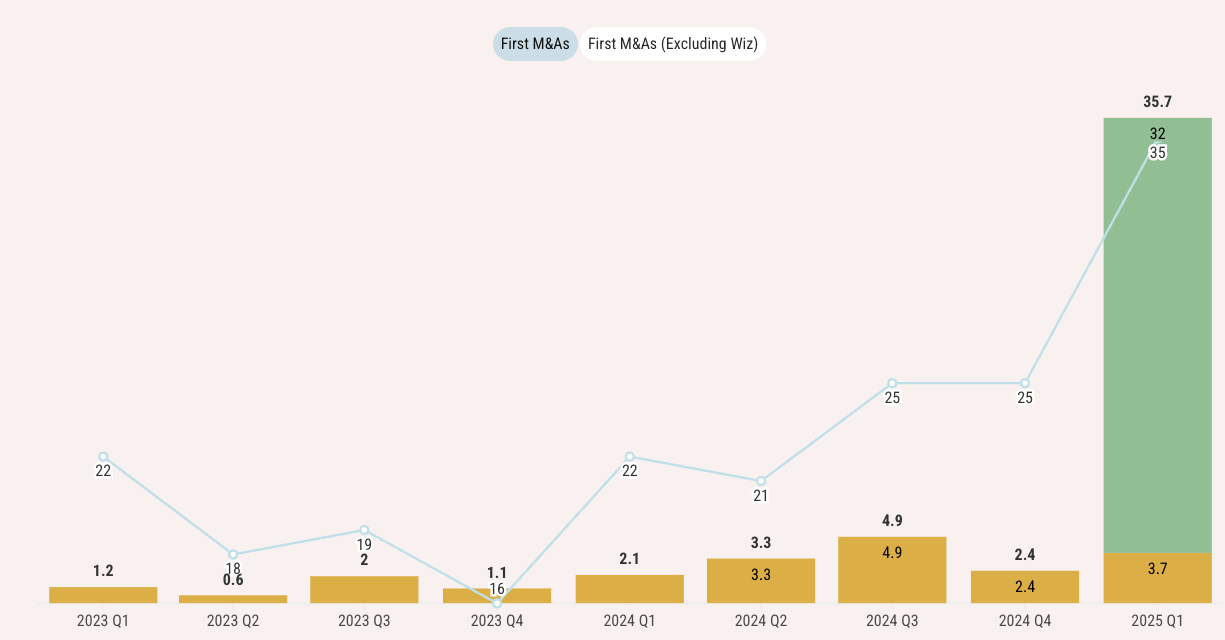

104 M&A transactions executed, totaling $15.8B in disclosed deal value, a 49% increase over 2023, signaling aggressive consolidation and strategic growth

🏆 Big Strategic Moves

Google’s $32B acquisition of Wiz, the largest cybersecurity transaction globally, marked a defining moment for Israeli tech

Next Insurance, a standout in digital insurance for SMEs, was acquired by Munich Re (ERGO) for $2.6B, establishing a strong insurtech beachhead for the acquirer

Mobileye, already a global leader in autonomous vehicle technologies, continued to execute strategic acquisitions focused on enhancing its AI, sensor, and compute stack capabilities

📈 Public Market Momentum

eToro, a leading trading and investment platform, is preparing to go public on NASDAQ in 2025—a move expected to set the tone for fintech IPOs globally

Several unicorns across vertical AI, cybersecurity, and deep tech are laying the groundwork for public listings, supported by a favorable sentiment shift in tech capital markets

🔍 Sector-by-Sector Breakdown

💻 Cybersecurity & AI

Over $3.8B raised in 2024—a 90% increase from 2023—underscoring global demand for secure digital infrastructure

AI21 Labs continued to scale its generative AI platform, establishing itself as a legitimate competitor to OpenAI, Cohere, and Anthropic, with proprietary language models and enterprise use cases

Emerging subfields such as agentic AI, AI security, and domain-specific copilots gained funding traction

🚁 Defense & Dual-Use Tech

$1.2B raised, a 143% year-over-year growth, signaling investor appetite for dual-use technologies with both commercial and strategic military applications

Autonomous systems, cyber-defense platforms, edge intelligence, and drone swarms were among key areas of focus

⚙️ Deep Tech & Semiconductors

Over $3B in total funding across quantum computing, photonics, next-gen chip architectures, and AI accelerators

9 deep tech startups closed rounds of $100M+, indicating that investor risk tolerance for foundational science-based innovation is returning

💳 Fintech & eCommerce

eToro’s IPO is poised to be one of the largest Israeli fintech public listings ever, setting the tone for late-stage valuations

Next Insurance’s exit demonstrated the strength of Israel’s product-market fit in SME-focused financial solutions

Additional momentum was seen in embedded finance, B2B payments, and cross-border commerce infrastructure

🌱 Climate & CleanTech

Over $1.1B invested in 2024 into technologies addressing water scarcity, solar energy storage, alternative proteins, and sustainable agriculture

Many of these startups are now scaling globally through joint ventures with multinational corporates and public-private innovation partnerships

🌍 Why Global Investors Keep Betting on Israel

🎓 Talent Depth

Israel continues to maintain one of the highest global densities of engineers, researchers, and technical founders

Elite military training programs like Unit 8200, Talpiot, and Atuda generate a continuous pipeline of systems thinkers and cyber specialists who transition directly into high-impact startups

🏠 Strategic Acquirer Ecosystem

Acquisitions by Google, Amazon, Microsoft, NVIDIA, Intel, and other global players reinforce the importance of Israeli innovation pipelines to multinational tech strategies

These acquirers often use Israeli subsidiaries and innovation centers as testbeds for next-gen R&D initiatives

📉 Strong Returns & Early Liquidity

$15.8B in M&A exit value in 2024 alone provided robust distributions to early-stage investors

IPO-ready companies across multiple verticals are expected to improve fund DPI and shorten cash return timelines for GPs

🗓️ Looking Ahead: What to Watch in 2025

Investment in generative AI, LLM tooling, and industry-specific copilots will continue to intensify

Defense and dual-use technologies are expected to attract even more capital as security spending rises globally

The eToro IPO, if successful, could open the floodgates for additional late-stage Israeli tech IPOs

Sovereign wealth funds and institutional LPs are increasing Israel allocations, signaling macro conviction in the ecosystem

🇮🇱 The Bottom Line Israel's tech ecosystem remains among the most compelling in the world. It offers unmatched depth in engineering talent, an entrepreneurial culture born from national service and urgency, and a global reputation for capital efficiency and innovation velocity. For VCs, LPs, and acquirers—Israel is not just a growth market, it is a global technology strategy.

Also Startup Brothers is back! My real brother and I talk tech as well 🙂

Stay up-to-date with AI

The Rundown is the most trusted AI newsletter in the world, with 1,000,000+ readers and exclusive interviews with AI leaders like Mark Zuckerberg, Demis Hassibis, Mustafa Suleyman, and more.

Their expert research team spends all day learning what’s new in AI and talking with industry experts, then distills the most important developments into one free email every morning.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.