QQQ is beating most hedge funds

Despite stonk markets reaching all-time highs, the IPO market remains super quiet for startups. Why aren't startups making a dash for public markets? Founders and board members know why…

The startup tech VC world usually lags the public markets by a year or two because of its less liquid and ironically rigid structure. But the below chart must cant last forever and I understand a lull in 2022 but not in 2023 and 2024.

Where Are the Bankers?

The pipeline for IPOs is unusually tiny. In Q3 2024, only 14 companies went public in the U.S., marking one of the lowest points in IPO activity since the 2008 financial crisis. Meanwhile, more than 1,200 private companies globally are valued over $1 billion, but only a fraction—perhaps 100 or so—are truly prepared to IPO, with the financial maturity, sustainable growth, and margins necessary to attract public market investors.

The Unicorn Shuffle: Preparing for Public Scrutiny

Many unicorns are working behind the scenes to improve their financials. According to recent data from PitchBook, the majority of high-growth tech companies are focusing on stabilizing their revenue, optimizing for profitability, and aiming for higher growth rates to meet the public market’s heightened expectations for quality. Duh.

60% are aiming to achieve profitability in the next 18 months, no more “growth at all costs” mentality of previous years.

45% have adjusted growth targets to emphasize margin improvements and operational efficiency rather than revenue growth which will hopefully be enough

This shift reflects changing investor sentiment. While valuations for public tech companies are kind of high right now, investors are increasingly over critical of new entrants.

Secondary Sales Instead of IPOs

Some unicorns, like Stripe, are opting for a different strategy, avoiding the public markets altogether in favor of raising through private secondary offerings. Stripe, in particular, has conducted multiple rounds of secondary sales, allowing employees and early investors liquidity without requiring an IPO. This trend has grown rapidly, with the volume of private secondary transactions in the U.S. increasing by 30% year-over-year as of 2024. The secondary market now provides a critical outlet for capital, especially as the IPO window remains largely closed.

A Broader Impact: Declining Distributions to LPs

This stagnation in public exits has broader repercussions for the venture ecosystem. Limited partners (LPs) who back VC funds are experiencing a downturn in returns. In 2024, the distribution rate, or the rate of cash returns to LPs from VCs, dropped into single digits for the eighth consecutive quarter, hovering at a low 8.5%, according to Cambridge Associates. This rate is drastically below the 10-year average distribution rate of 16.8%, underscoring the extent of the current IPO and exit drought.

This reduced cash flow is making LPs increasingly cautious. Over 80% of new VC capital raised this year has gone to established managers, further consolidating capital and leaving emerging managers in a tougher spot to fundraise. With a record-high inventory of private companies staying off the public markets, the cycle of reinvestment into new ventures has slowed, impacting innovation and the broader startup ecosystem.

What Could Signal an IPO Comeback?

While the outlook for IPOs is uncertain, certain conditions could create a more favorable environment:

Economic Factors: The Federal Reserve’s recent decision to pause rate hikes could eventually lead to better conditions. Historically, lower interest rates have increased IPO activity by making it easier for companies to finance growth post-IPO and reducing investor demands for profitability.

Market Catalysts: A strong, high-profile IPO could restore investor confidence. In past years, a successful public debut by a major player has often paved the way for others. For instance, 2020’s Snowflake IPO, which achieved an over 100% pop on its debut at $100B, spurred a surge of tech IPOs in the following months even if it’s down 50% now

Regulatory Environment: Easing regulatory scrutiny, particularly around tech, could help drive more companies to IPO. In 2023, increased scrutiny delayed or derailed several high-profile IPOs in the tech sector, which continues to discourage new entrants.

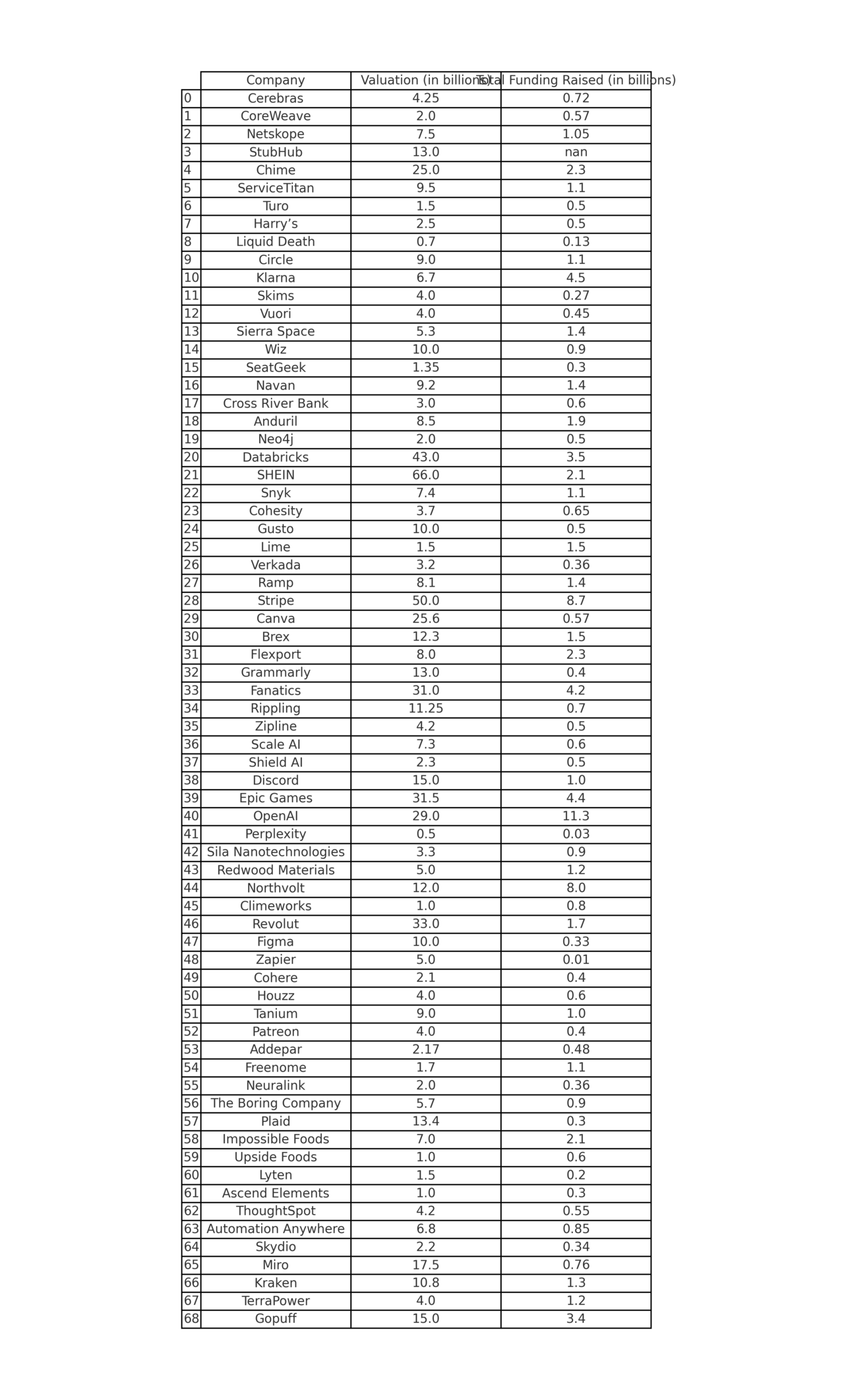

Here is an exhaustive list of numerous startups, their valuations and how much they’ve raised

And yes I did the math for you - that’s $700B in total valuations, which is 5 Ubers or half a Meta, and $100B in locked up VC $ invested in them.

I really believe that Q2 2025 will start an amazing IPO season and 2025 will officially start the roaring 20s again! And once liquidity comes back to the markets, LPs tension will lessen and post lockups, so will VCs, founders and employees.

😂 MEME of The Week 😂

Always have an ask!

What’s your favorite pre-IPO startup from the list?

What startup stock do you want to buy when they IPO?

The future of writing with AI at work www.revi.so

FIND ME: 𝕏 @Trace_Cohen / in LinkedIn

The future of presentations, powered by AI

Gamma’s AI creates beautiful presentations, websites, and more. No design or coding skills required. Try it free today.