My first sponsor thanks to Twitter!

The Founders Club is a co-ed peer community for earlier stage entrepreneurs, founders and business owners. Think of this as your social group of founders who know what you are going through and want to support you along the way! Small monthly groups, awesome retreats, book club, speakers, real networking. The wait-list just dropped and had 150+ signups already.

If interested, feel free to sign up as they are about to launch: https://www.thefoundersclub.io/

Right now is one of the weirdest times in the tech VC world since 2008 when I started my first company in college. We're still recovering from the 2021 ZIRP times of free money and ridiculous valuations based on very little traction, and yet tens of billions of dollars are being invested into this mythical AI things that feels very much like what we just said we wouldn't do again… But we always need an industry focus every cycle because VCs have to invest.

What is AI?

99.99999% of investors can’t tell you. Most people just use it for content creation (just a little here), nothing too sophisticated; another decent amount use it to code better/faster with co-pilots, and the last small group doesn't really know what to use it for yet.

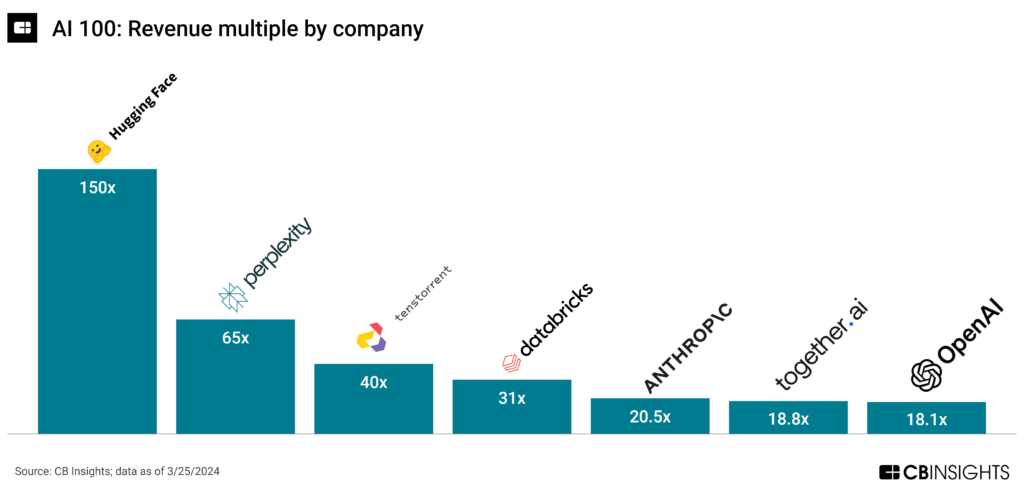

And it's that last part which is driving everyone a little crazy right now in a good way, trying to find the next big thing as you can see in the above image. Which explains why we have so many raising so much money because we have so many VCs that need at least one horse in the race. Why? Their LPs (people who invest in VCs) expect it and invested in them because of their access, which leads to better deal flow, which leads to the smartest people working on the best ideas AND that will take their money over a rival VCs.

$14B has already been raised in just Q1 of 2024 so far.

Welcome to the game.

Every VC below needs at least one, some dozens, major Ai investment:

Sequoia Capital

Andreessen Horowitz

Accel Partners

Benchmark

Greylock Partners

Bessemer Venture Partners

Kleiner Perkins

Founders Fund

Index Ventures

Lightspeed Venture Partners

New Enterprise Associates (NEA)

Insight Partners

Battery Ventures

General Catalyst

Union Square Ventures

Tiger Global Management

Coatue Management

Balderton Capital

Ribbit Capital

IVP (Institutional Venture Partners)

Thrive Capital

Sequoia Capital China

Redpoint Ventures

TCV (Technology Crossover Ventures)

SoftBank Vision Fund

GGV Capital

First Round Capital

Spark Capital

DFJ Venture Capital

Sapphire Ventures

The Basics of Venture Capital Which Seem Obvious But Are Often Ignored

The VC industry thrives on high-risk, high-reward investments, where the potential for disruptive innovation offers substantial returns. Every fund will make 10-20 significant investments, and that's it - that's what you have to wait at least 10 yrs to see if you were right or just collected some management fees.

The goal is not just to recover the initial investment but to earn significantly more, often aiming for a return of 10x the investment at minimum. Anything less is not VC backable.

Let's consider a hypothetical scenario where each of 50 AI startups receives an investment ranging from $50 million to $1 billion.

Minimum Investment Scenario: If each startup receives $50 million, the collective investment totals $2.5 billion.

Maximum Investment Scenario: At the upper end, with each startup receiving $1 billion, the total investment soars to $50 billion.

Venture capitalists exit their investments through a sale of the company via M&A (99%) or an IPO (1%), and they target at least a 20x return to cover not only their successful investments but also to offset losses from other investments didn’t return anything.

Calculating Exit Values: To achieve a 10x return, the total market exit value must be substantially higher, especially when considering that VCs typically own about 10% of each company they invest in.

Minimum Required Exit Value: For the $2.5 billion investment, the required exit value would be $250 billion.

Maximum Required Exit Value: For the $50 billion investment, a staggering $5 trillion exit value would be required.

While these numbers seem crazy, we've already exceeded the upper limit 3x in the last 3 years alone and are probably close to it already in Q1 2024. But the truly hard and unfortunate aspect is that 90%+ of that money invested will not return a penny. Some will see it as a waste, which some definitely got thrown at bad ideas, FOMO, etc., but that 10% that will return tens of billions to a lucky few founders, employees, VC, LPs, etc., is the hope that drives our industry forwards.

Top AI-Funded Startups with Significant Investments

Here’s an expanded list of top AI-funded startups that have raised significant funding, showcasing the breadth and depth of venture capital investment in this high-potential sector:

OpenAI - $10 billion from Microsoft.

Anthropic - Over $7 billion in total funding, with significant investments from Google and Amazon.

Inflection AI - $1.3 billion from investors including Microsoft and Nvidia.

Cohere - $270 million Series C led by Inovia Capital.

Databricks - $685 million from investors including T. Rowe Price Associates and Nvidia.

Tempus - $1.3 billion in debt financing from investors like Franklin Templeton Investments and Google.

Waymo (Alphabet Inc.) - Over $3 billion in total funding for its autonomous driving technology.

Nuro - Over $1 billion in funding for its autonomous delivery vehicles.

Graphcore - Over $300 million in funding for its AI processors.

Argo AI - Over $2.75 billion in funding from Ford and Volkswagen for autonomous vehicles.

Zoox (Amazon) - Acquired by Amazon, previously raised over $1 billion for autonomous vehicles.

Aurora - Over $1 billion in funding for self-driving car technologies.

SenseTime - Over $2.6 billion in total funding for facial recognition and other AI technologies.

Megvii - Over $1 billion in funding for facial recognition and AI services.

Zymergen - Over $1 billion in funding before pivoting to a new business model.

Ginkgo Bioworks - Over $1.6 billion in funding for synthetic biology.

CloudMinds - Over $300 million in funding for cloud-based AI services.

Horizon Robotics - Over $1.2 billion in funding for AI chips for autonomous vehicles.

This diverse list of companies, from autonomous vehicle startups to AI-driven biotechnology firms, illustrates the vast potential and wide-ranging applications of AI. These startups are not just reshaping their respective industries; they're at the forefront of the next wave of technological evolution, backed by significant venture capital commitment.

So next time you see another amazing and hyped AI startup raising hundreds of millions, billions of dollars, with no product just remember while it might seem crazy, and it is, that’s just how the game works right now. And know that some of this technology will change the lives of millions/billions of people, even if it doesn’t return capital to investors.

Meme of the week / your moment of Zen

Always have an ask!

What Ai do you use most often?

What Ai startups have you invested in?

What Ai startup do you think is overhyped and wont work out?

What do you want me to cover next?

Go buy some kreaturesofhabit.com

Please share this with your friends/network! twitter.com/Trace_Cohen