Happy holidays and new year! Definitely ending it with a big bang of news which means 2026 is going to be amazing for tech, startups, VC and Ai 😃

Thank you for being a loyal reader on my almost two year journey writing every week.

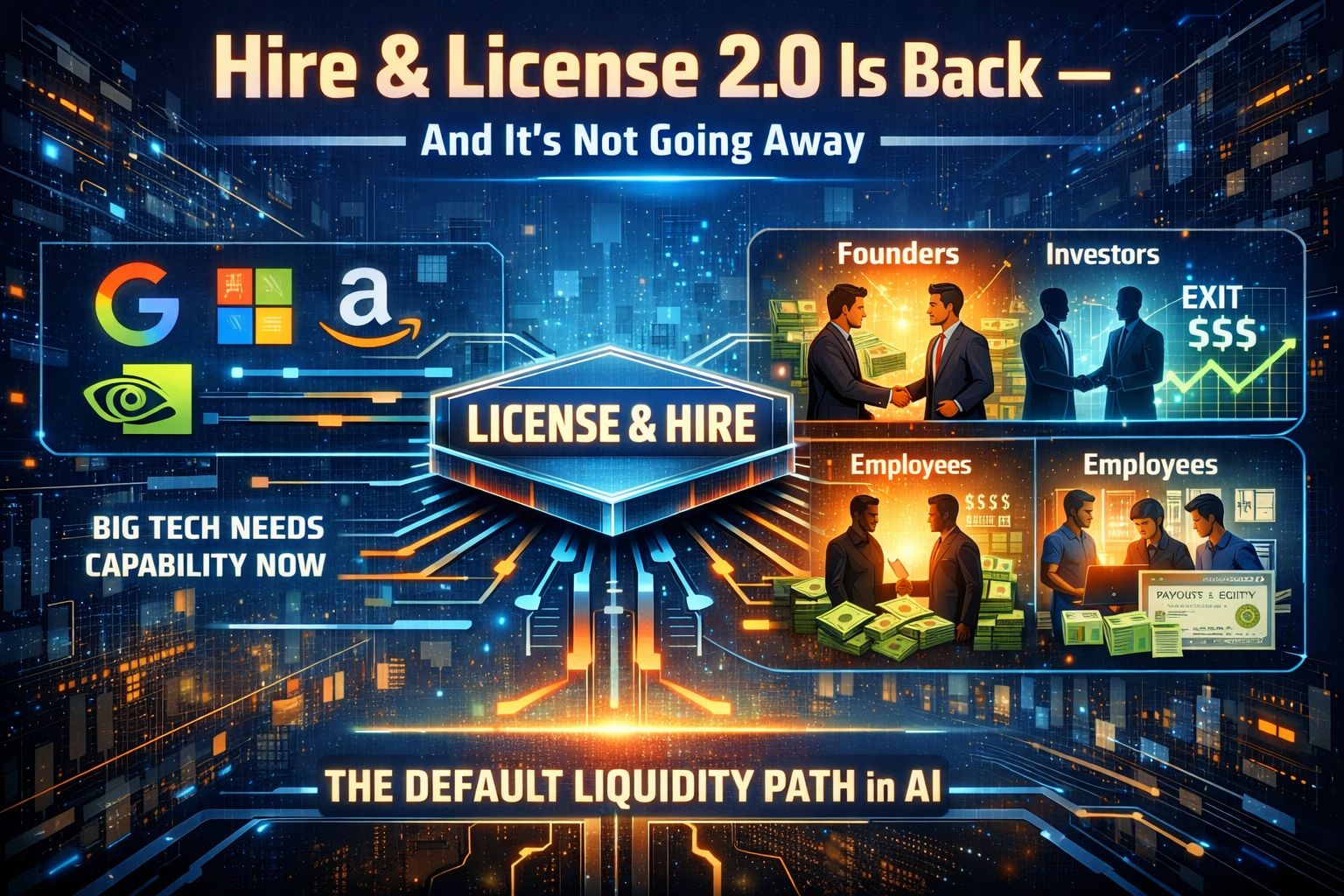

When NVIDIA needed immediate access to next-generation AI inference capability, it did not wait for a traditional acquisition to clear regulatory review. Instead, it structured a “license-and-hire” arrangement with Groq for $20B, securing the technology and the 90% of the team behind it now, not a year from now.

Just as importantly, everyone got paid.

Founders achieved meaningful liquidity.

Investors exited or materially de-risked.

Employees were compensated on vested equity and structured into cash, stock, and retention packages for unvested shares.

The team transitioned with continuity and upside intact.

That outcome was not incidental. It was the point.

This transaction illustrates a broader structural shift taking place across the AI ecosystem: Hire & License 2.0 has become the fastest, safest, and most repeatable way for Big Tech to acquire critical capability while still creating real liquidity for all stakeholders.

Time Is the Scarce Resource

In prior technology cycles, acquisition timelines measured in twelve to eighteen months were inconvenient but manageable. Competitive advantages persisted long enough for legal and regulatory processes to run their course.

AI has fundamentally changed that dynamic.

In frontier AI markets:

Model architectures converge quickly

Techniques diffuse across the ecosystem

Execution velocity matters more than ownership

Competitive advantage decays in quarters, not years

In this environment, waiting a year to close a deal is not merely inefficient. It is often strategically fatal.

That reality explains why the largest technology companies have independently converged on the same solution.

Hire & License 2.0 in Practice

Across the industry, the pattern is now unmistakable.

Google licensed CharacterAI for approximately $2.7B, bringing over the founders and core team without pursuing a full acquisition

Google repeated the playbook with Windsurf, licensing the technology for $2.4B and hiring the CEO and senior engineering team, while the remaining business was later acquired separately

Microsoft paid roughly $650M to license Inflection AI’s technology and hired the majority of the research and engineering organization

Amazon struck a deal with Adept AI for intellectual property and key hires, prioritizing speed over ownership, with terms undisclosed

Meta invested approximately $14.5B for a 49% stake in Scale AI, bringing the CEO into Meta while avoiding a full takeover

Different structures.

Different companies.

The same underlying logic.

Why This Model Works: Everyone Gets Paid

A defining feature of Hire & License 2.0 is that it creates actual liquidity, not theoretical upside.

In these deals:

Founders receive meaningful payouts

Investors exit or partially de-risk at substantial valuations

Employees are paid on vested equity and compensated for unvested shares through cash, stock, or structured retention packages

Teams transition with continuity, upside, and incentives aligned

This is not accidental. It is essential.

These transactions must be repeatable. They only remain viable if participants leave whole and willing to build again. Liquidity is not a side effect of Hire & License 2.0. It is the enabling condition.

Not Anti-Regulation — Pre-Regulation

It is tempting to frame Hire & License 2.0 as regulatory arbitrage. History suggests a more accurate interpretation.

Every major industrial shift followed the same sequence:

Railroads expanded before safety standards

Factories scaled before labor law

Financial markets grew before disclosure regimes

Mechanisms emerge first to solve immediate economic needs.

Guardrails follow once the system stabilizes.

AI is early in that cycle.

Hire & License 2.0 is a bridge between innovation cycles measured in months and governance systems measured in years. Over time, regulation will adapt. Disclosure norms will improve. Employee protections will formalize.

Innovation does not pause while that happens.

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.