A startup abruptly shut down last week leaving it’s users stranded without warnings after raising raising $100M. This is a rare circumstance so it blew up the tech world echo chamber, aka Twitter the last few days as everyone weighed in with good and bad takes, based on very little actual behind the scenes. So a normal day.

Bench which was accounting Saas - I never used it - but the former founder finally came out because they definitely know about whatever was going on behind the scenes. Long story short (hate this phrase lol), the co-founder Ian below helped close their $60M Series C in 2021 (ZIRP!) then the VC investor board removed him (founders gave up board control). Statistically thats a a bad idea and basically never works - only really Uber - but hey it was 2021 so it doesn’t really matter.

1. Early-Stage Startups Shouldn’t Be Profitable (Yet)

“Uber reported its first annual net profit of $1.88 billion in 2023, following cumulative operating losses totaling approximately $31.5 billion from 2014 through 2022”

The expectation that early-stage startups should prioritize profitability is a dangerous myth. The reality is that most startups operate at a loss during their formative years because their primary focus is on growth, not margins. According to data from CB Insights, over 70% of startups fail due to premature scaling—trying to grow too fast without sufficient investment in product-market fit and infrastructure.

Spotify has revolutionized the music industry, becoming the world's largest music streaming platform with over 550 million monthly active users as of 2023. Yet, the company has consistently reported operating losses since its inception. Personally I’m an Apple Music user.

2. Lessons from Bench: A Sign of the Times

Bench raised $100M, including carrying debt which is a whole separate issue and failing to scale revenue at the pace required to raise additional capital. This is a cautionary tale for many startups caught in the aftermath of the 2021 funding boom.

The 2021 Funding Frenzy: According to Crunchbase, global venture funding reached an all-time high of $681 billion in 2021. Many startups raised at inflated valuations, creating unsustainable expectations for future growth. Still lots of cleaning up in progress.

Post-2021 Fallout: By 2023, funding levels dropped by nearly 50%, leaving hundreds of startups without follow-on funding. Many of these companies are now struggling to reconcile their burn rates with lower-than-expected growth.

3. The Rare Success of Replacing Founders

The idea that VCs can step in, replace a founder, and turn a company around is more myth than reality. Uber’s story, where Travis Kalanick was replaced by Dara Khosrowshahi, is one of the few modern examples where this strategy worked.

Uber’s Transformation: When Kalanick “stepped down” in 2017, Uber faced regulatory scrutiny, lawsuits, and a toxic workplace culture. Khosrowshahi helped stabilize the company, leading it to a successful IPO in 2019.

Failure Rates of Founder Replacements: A 2020 study by Harvard Business Review found that replacing a founder increases the likelihood of startup failure unless the incoming leadership brings a clear turnaround plan and strong operational expertise.

Takeaway: Founder-led companies succeed because of vision and execution. Replacing founders should be a last resort, not a go-to strategy.

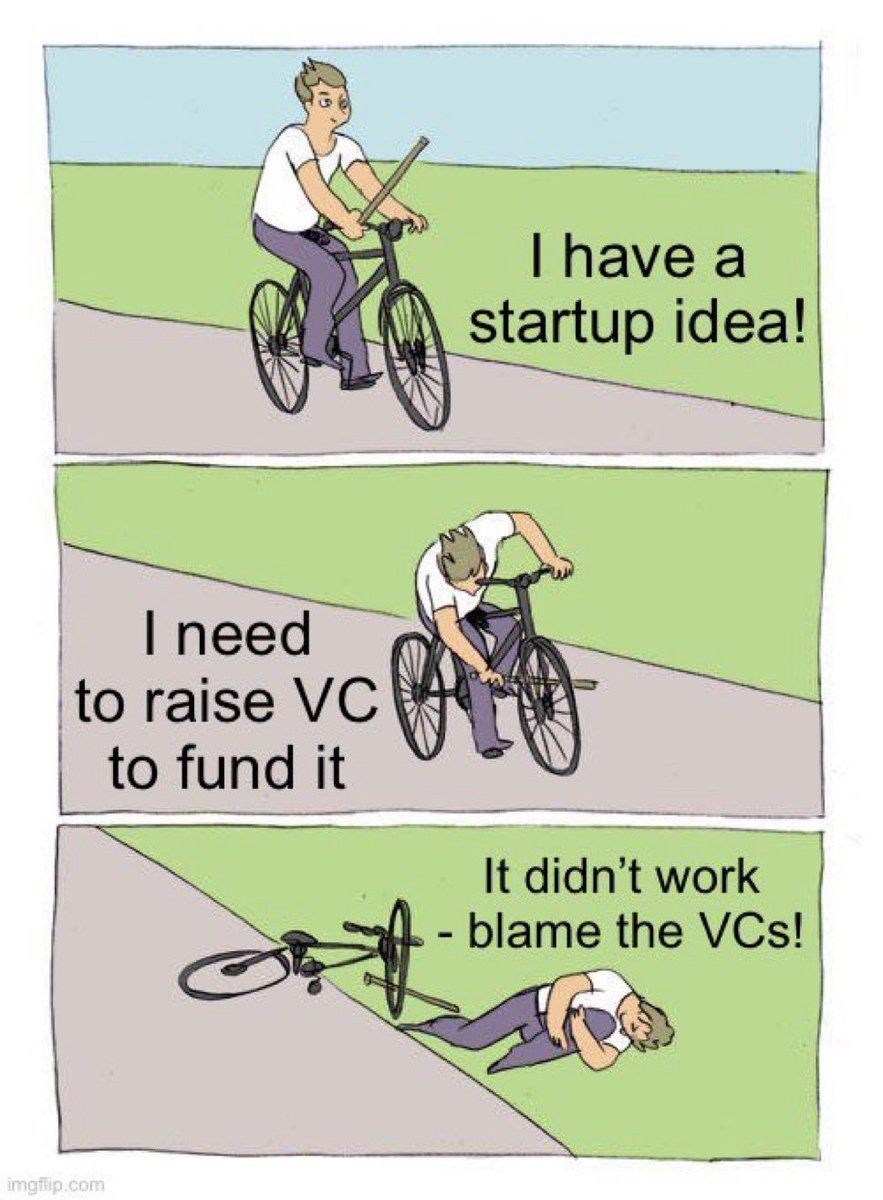

4. Misguided Narratives in the Ecosystem

The Anti-VC Crowd

In recent years, a wave of bootstrapper purists and thought leaders have proclaimed that taking VC funding is inherently bad. While bootstrapping works for some, dismissing VC as "evil" ignores the transformative impact it can have when used strategically.

Bootstrapping vs. VC: Companies like Mailchimp thrived without VC funding, but for high-growth industries like AI or biotech, VC funding is often necessary to achieve scale.

VC’s Positive Impact: According to the National Venture Capital Association, VC-backed companies represent over 43% of all IPOs since 1974, demonstrating their critical role in fueling innovation.

Tier 1 or Bust

Another damaging myth is that only Tier 1 VCs are worth working with. This perspective dismisses the value of Tier 2 and Tier 3 firms, which often bring specialized expertise and hands-on support.

Data on Returns: Cambridge Associates' 2023 report shows that some Tier 2 and Tier 3 firms outperform Tier 1 funds on a returns-per-investment basis, especially in niche sectors.

Examples of Success: Firms outside the "Tier 1 bubble," like Floodgate and Initialized Capital, have been instrumental in early-stage success stories such as Lyft and Coinbase.

5. Founders Need to Take Responsibility

Startups are inherently difficult, and while external factors like funding markets or investor dynamics play a role, founders ultimately steer the ship. Signing term sheets, ceding board power, and making operational decisions are within the founder’s control.

Why This Matters: A PitchBook analysis found that nearly 60% of startup failures could be traced to internal issues like founder misalignment, poor financial planning, or product-market fit problems.

A Case in Accountability: Founders who take ownership of their mistakes—like Stewart Butterfield at Slack (after the failure of Glitch)—are better positioned to learn and pivot toward success.