There’s been a chart floating around the last week showing VC distributions have finally been higher than capital calls, which shocked a lot of us. My philosophy has always been trust but verify so I had to dive in to the data, though I’m still not exactly sure of the source / how it’s actually calculated… so this is mostly conjecture like everything else on the internet.

See the blue that’s bigger than the orange in 2024?

“As of Q3 2024, $53 billion, or 81% of capital raised so far this year, was secured by established GPs, pointing to the highest level of concentration within this cohort in a decade. Through Q3 2024, $46 billion, or 70% of capital raised so far this year, belonged to funds that are $500 million or larger.”

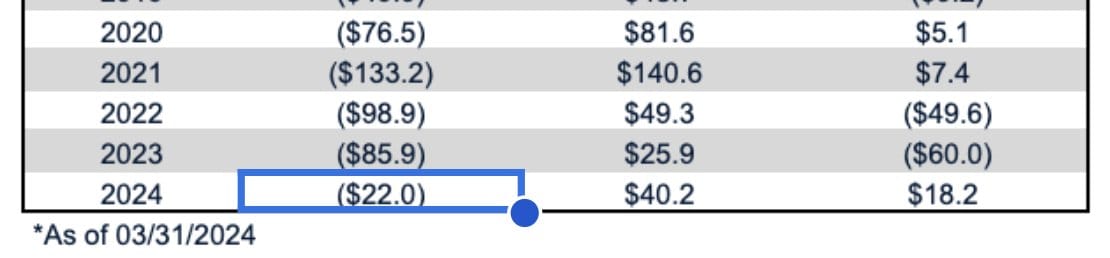

This is the data for the chart above

To be clear this data is as of 3/31/2024 so really Q1 data because it lags which is fine. My concern is that it’s kind of misleading as much as I would love for it to be really really true - I dont like false positives that cause people to do things based on bad data. The exits below are from Q3 so 6months later, which unfortunately I still dont know how it’s made up.

I’m a data nerd so you can read it all here if you want https://nvca.org/document/q3-2024-pitchbook-nvca-venture-monitor/

Above are the exits as of Q3 which is easier to record because it’s generally announced and public data. I still have no idea what the source data is - private VC backed, secondaries, continuation funds, PE/buyouts/take privates etc. Sadly software (whatever is in it) is down 10% YoY and only makes up 28%, while pharma/bio is up over 100% and for the first time in a decade over 47% of all acquisitions/IPOs.

The hardest part of all this is trying to decipher how you determine distributions (who publicly announces that?) and capital calls (also who announces that?) are off by 6 months, which makes sense because ones lagging depending on the data source. Some deals are stock/cash and when do you account for it. There has to be a method to the madness which I’m still trying to find…

So Far The Mag 7 are 4 for 4

Google not only just crushed earnings but is actually accelerating again! Tesla was the first, Meta and Microsoft all with beats doing just fine. Apple and Amazon report after hours today.

The best public tech companies will continue to greatly benefit from the proliferation of Ai. Unfortunately most other companies will take more years to strategize (too many meetings and power points) to implement basic Ai that will eventually increase their revenue. This will continue to create an even wider gap between big tech+ and everyone else.

Liquidity Will Come Back - Get Ready

It’s rough out there for emerging managers and none Ai startups. Like BIG Tech, BIG VC is still crushing it right now - money is going to growth and what they know. But that has to slow down eventually and everyone will remember that the alpha is once again at the early stage startups in the long run.

While I dont fully believe in overall trickle down economics, I do believe in it when it comes to the tech world - once it starts to rain, it pours. Why? I believe in behavioral economics very much and capitalism = once M&A, IPOs etc return, everyone will want a piece because of FOMO and seeking alpha.

I truly believe by end of Q1, early Q2 2025 the IPO Window which is definitely open, will get a big breeze that will make headlines and start to get everyone excited again.

😂 MEME of The Week 😂

Always have an ask!

Whats your favorite big tech company?

When do you think IPOs and M&A will come back?

Simplify your job search https://www.tealhq.com/

FIND ME: 𝕏 @Trace_Cohen / in LinkedIn

“Like Morning Brew (but for venture capital)”

Join 15,000+ VCs and investors getting smarter on venture capital by reading this free daily newsletter.

Start getting the headlines that matter, lists of companies breaking out, and other resources and playbooks you won’t find anywhere else.

Become a smarter investor in < 5 min a day.