The early-stage venture market is in flux—but not in the way you think.

If you're reading the headlines, you'd assume capital is scarce. But zoom in, and it's more complicated. Seed-stage valuations are at all-time highs. Series A is a chokepoint. And emerging managers? They're not gone—they're everywhere, grinding to close capital in a market that’s playing favorites.

This isn’t just a dip. It’s a market bifurcation. And it’s reshaping the future of startups and venture capital.

🌱 Seed Valuations Hit Record Highs

According to Carta, the median seed-stage valuation hit $15.8M in Q1 2025—the highest ever recorded.

That’s nearly 2x from the $8M median valuation just five years ago.

But before we celebrate too much, it’s worth noting: deal volume is down significantly. Only 389 priced seed rounds were recorded this past quarter, the lowest in recent years.

What's happening?

✅ The best founders are still getting funded—and often at premium valuations.

💡 AI startups, in particular, are driving much of this growth.

🧠 Investors are laser-focused on conviction: strong founder-market fit, traction, and early signs of breakout potential.

TL;DR: If you’re top 1%, you’re getting paid. Everyone else? It’s crickets.

🛑 Series A Is the New Valley of Death

While seed is holding strong, Series A is where deals go to die.

Only 343 Series A rounds closed in Q1 2025—down nearly 60% from the 2021 peak (845 rounds). Even though valuations are rebounding (back up to $56.5M median post-money), the volume drop speaks volumes.

Why?

📉 Larger funds are retrenching, protecting their portfolios and avoiding new leads unless metrics are undeniable.

🧪 Startups are now expected to show late-stage traction just to qualify for a Series A.

🚀 The AI hype is driving a few outlier rounds, but the median founder is being left out.

So what do we see? More “seed extensions,” more bridge rounds, and more startups stuck waiting.

🧭 Emerging Managers Haven’t Disappeared—They’re Just Stuck Mid-Climb

Let’s clear something up: emerging managers are NOT gone. In fact, there are more of us than ever. But we’re facing a reality where only a small percentage are able to close their funds.

PitchBook data shows:

In 2021: 441 first-time funds launched with $24B raised.

In Q1 2025: only 15 first-time funds raised $1B total.

That's not a disappearance—it’s a funding logjam.

Why it matters:

🧠 Emerging managers are the startup scouts of venture—backing founders others overlook.

🛠️ They hustle, build, and go earlier than anyone else.

💥 They were behind first checks into many of the biggest names in tech.

So what’s changed?

LPs are consolidating. They’re chasing perceived “safety” in big brands. That creates a vacuum—and emerging managers are the only ones filling it.

Now is not the time to pull back on emerging managers. It’s time to double down.

🤖 The AI Round Vacuum Is Real

Let’s not forget the elephant in the room—AI is sucking up all the oxygen.

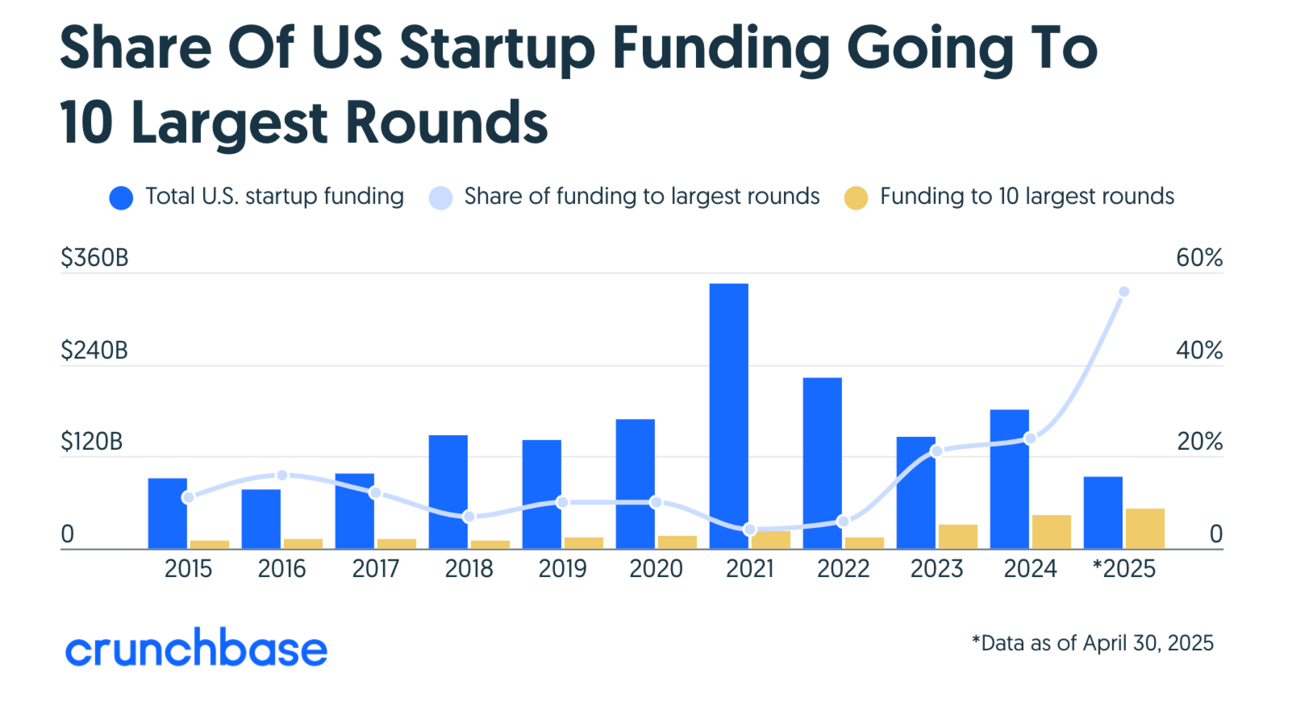

Crunchbase reports that in just the past few quarters:

OpenAI, Anthropic, xAI, Mistral, Perplexity, and CoreWeave have raised multi-billion dollar rounds.

These deals are coming from a handful of mega-funds and strategics.

This barbell market—tiny checks for early-stage, massive checks for elite AI—leaves everyone else in limbo.

It’s clear: unless you’re in the hype cycle or on a rocket ship, you're likely stuck somewhere in the middle.

💡 What This Means for Founders

Founders need to be more strategic than ever.

Here’s the playbook:

Raise smart, not just fast. You may not get a second chance.

Avoid the Series A trap. Raise enough at seed to reach real traction.

Show signal early. Investors want to see revenue, partnerships, or engagement spikes—anything that says you're a breakout.

Even great teams aren’t guaranteed a next round. You’ll need metrics, story, and defensibility baked in from day one.

💸 What This Means for LPs

If you’re an LP or allocator reading this—listen closely:

✅ The vintage is clean.

✅ Competition is low.

✅ The best managers are still writing first checks into tomorrow’s biggest companies.

But they’re being overlooked.

This is exactly when the best funds get built. Not during the hype. Not in the frenzy. Now.

Backing emerging managers today is like backing seed-stage startups—risky, early, and filled with potential.

🧠 Final Thought: Conviction > Consensus

The venture market isn’t collapsing—it’s consolidating.

Capital is still flowing. But it’s flowing toward the top 1% of founders and a tiny fraction of firms. That’s not healthy. That’s a monoculture.

The best investors and LPs won’t follow the crowd—they’ll back the overlooked.

Because the best outcomes come from people who built before the spotlight was on them.

Let the others chase consensus. We’ll stay focused on conviction.

Find out why 1M+ professionals read Superhuman AI daily.

In 2 years you will be working for AI

Or an AI will be working for you

Here's how you can future-proof yourself:

Join the Superhuman AI newsletter – read by 1M+ people at top companies

Master AI tools, tutorials, and news in just 3 minutes a day

Become 10X more productive using AI

Join 1,000,000+ pros at companies like Google, Meta, and Amazon that are using AI to get ahead.