One of the most compelling analyses I've come across recently is by Benedikt Langer, who thoughtfully outlines the decision-making process that led a family office to pivot away from direct startup investments and toward a focused Limited Partner (LP) strategy in venture capital funds. This wasn’t a quick or casual change, it was the result of deep introspection and years of market engagement.

The key insight is both simple and powerful: to consistently access the best early-stage venture deals, you must treat it as a full-time profession. Pre-seed and seed investing require more than just capital; they require deep networks, constant deal flow, sharp judgment, and the ability to act quickly. This isn't something that can be done effectively part-time or passively, it demands the same rigor and discipline as any operating business.

This conclusion aligns with my own experience after meeting thousands of founders, and working closely with hundreds of venture funds and family offices. The best early-stage deals don’t circulate widely, they are won through trust, speed, and domain expertise. If you’re not living and breathing this space, you’re simply not going to see the right opportunities.

Why Family Offices Shouldn't Rely on Direct Investments Alone

Despite the appeal of directly backing startups, most family offices are not structured to win at early-stage venture on their own. After a comprehensive search, I still have not found a single example of a startup that was only funded by a family office, without any professional venture firm involved, that went on to raise tens or hundreds of millions and became a meaningful success story.

The reality is this: startups need professional investors to get to the next level. These investors bring more than capital, they bring governance, signaling, networks, follow-on capital access, and market credibility. Without that, even the most promising startup backed by a family office is unlikely to scale.

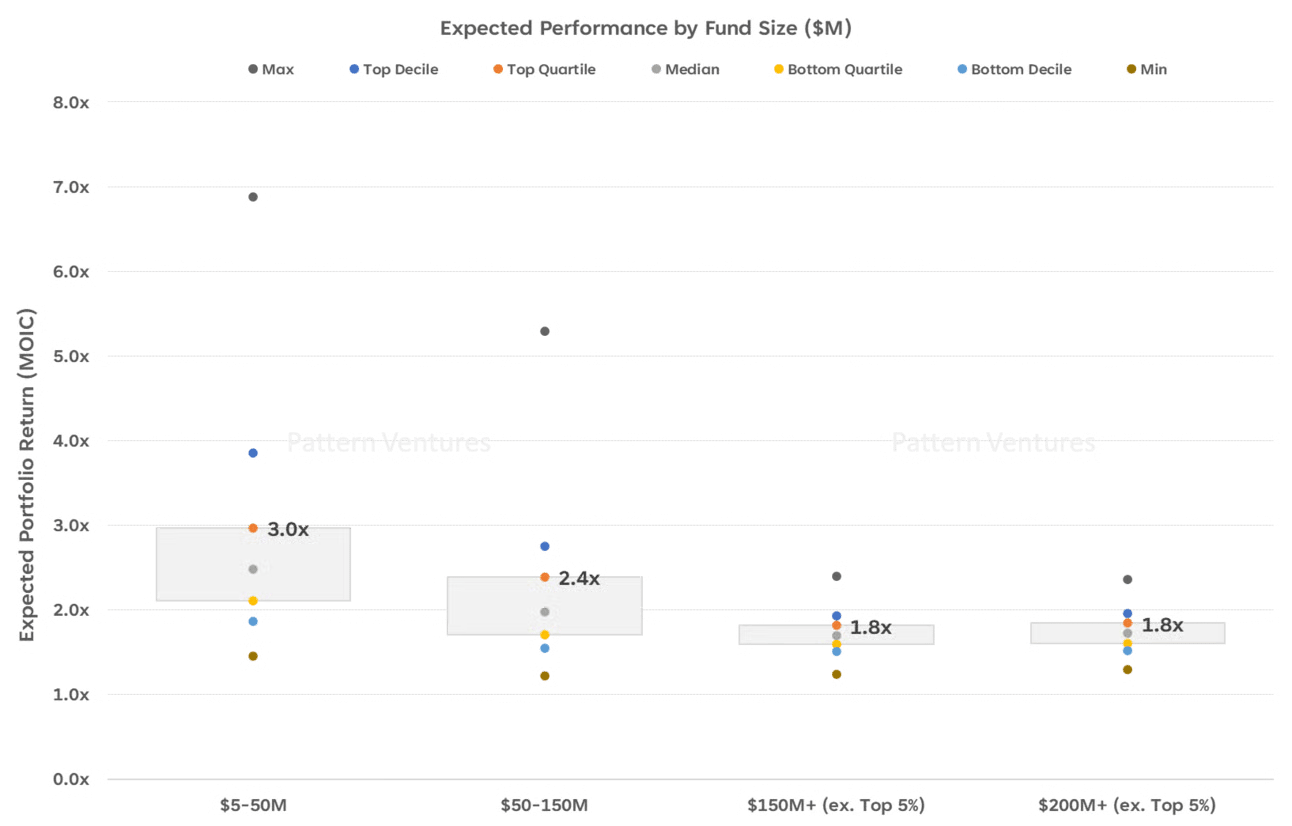

The best path for family offices is to first invest in funds managed by full-time professionals, and then selectively follow on into later rounds of those portfolio companies if they develop conviction. That way, the family office gains access to curated deal flow and leverages the diligence, access, and insight of fund managers.

Carta & AngelList Data: Quantifying the Bifurcation

This bifurcation is no longer theoretical, it’s now clearly visible in the data. Consider the recent AngelList chart on pre-seed post-money valuations:

It illustrates a widening gap between the top quartile and the rest of the market. The top 10% of startups, frequently backed by large multi-stage firms, are closing pre-seed rounds with valuations usually exceeding $25 million. These rounds often come with oversized checks of $5M–$20M and are filled quickly with very little public visibility. These are not traditional pre-seed rounds, they are highly strategic, often built around repeat founders or AI-native companies before any revenue or product exists.

Meanwhile, the bottom 75% of startups are facing a very different reality. Valuations are flat or declining, and capital is harder to come by. The gap is structural, not just cyclical.

Carta’s Q1 2025 report reinforces this:

New early-stage fund creation has dropped significantly.

Seed and Series A deal volume continues to decline.

Median valuations are up, but primarily for top-tier companies.

The number of down rounds is growing across the rest of the market.

Secondaries are up, signaling increased demand for liquidity.

This suggests that large funds are increasingly paying higher prices to "buy access" to breakout companies early, sometimes as a form of option value on future participation.

The Strategic Role of Family Offices in a Bifurcated Market

The result is a two-tiered venture capital ecosystem:

Top-tier deals: Absorbing significant capital from big funds at high valuations.

Everyone else: Operating with discipline, smaller checks, and valuation sanity, often backed by emerging managers and angels.

Large multi-stage funds are delivering beta, broad exposure across predictable categories. Meanwhile, alpha is hiding in the edges, where small funds identify and nurture high-potential companies before they hit anyone’s radar.

Family offices are uniquely positioned to capitalize on this. Unlike institutions, they:

Aren’t bound by bureaucratic cycles.

Can build trust-based relationships with niche managers.

Can move quickly and follow conviction.

Can invest earlier, and then double down later.

In many ways, the best family offices mirror the best emerging managers, independent, contrarian, and focused on long-term returns over short-term optics.

Let Professionals Do What They Do Best

Benedikt’s conclusion is both practical and prescriptive: if you’re not dedicating your full attention to early-stage investing, then the best move is to partner with those who are. Don’t try to replicate the work of a full-time GP unless you’re prepared to compete at that level.

For family offices that want to access the next generation of breakout companies, now is the moment to lean into emerging managers. The institutional herd is retreating to safety, but that’s exactly where alpha dies.

The next decade of outperformance will be built in the early stages, and it will be led by the GPs and LPs willing to take bold, well-informed bets today.