The venture capital industry is undergoing a structural transformation. Rather than a simple “re-bundling,” what we’re seeing is a bifurcation: a split between lean, nimble teams operating like startups and ever-scaling institutional mega-funds. This divergence reflects both the evolution of the market and a growing recognition that no single model can dominate the increasingly complex venture landscape.

At the same time, one thing remains unchanged: the business model. Venture capital is still largely built on the 2-and-20 framework—2% management fees and 20% carried interest. Smaller funds may charge slightly higher fees to make up for their limited scale, while mega-funds can command as much as 3.5% and 35% thanks to their track record, brand, and access to deals.

There’s no harm—or shame—in it. Anyone who can successfully raise and deploy capital in this space deserves congratulations because the work is incredibly hard. Building a venture fund, regardless of size, requires a combination of vision, relentless execution, and unwavering conviction. This is nothing compared to startup founders, whom also face incredibility difficulies in different ways.

A lot of this was precipitated by Kyle Harrison’s post below, which I recommend you read. We also jammed on a fun podcast too that will be published soon too.

Four Types of Venture Funds

Today, venture capital can largely be divided into four categories, each with distinct characteristics:

SPVs and Scout Funds (<$20M): These are hyper-focused vehicles, often designed to capture single deals or micro-portfolios, providing access to high-risk, high-reward opportunities.

True Seed Funds ($20M–$100M): Lean, thesis-driven funds built to move quickly and make high-conviction bets at the earliest stages. These funds thrive on speed and specialization.

The Messy Middle ($100M–$500M): Funds in this range often struggle with identity—too large to be nimble but too small to compete with mega-funds. Many face challenges scaling without losing focus.

Mega-Funds ($500M+): Institutional giants that dominate the industry, leveraging deep resources, broad networks, and trust to deploy capital at scale, often focusing on growth-stage investments or multi-stage portfolios.

This categorization highlights the dynamics of the bifurcation: smaller, agile funds that move fast and focus deeply versus larger funds that operate at scale. The middle ground remains the most challenging, often lacking the agility of smaller funds or the influence of mega-funds.

The Nimbleness Advantage

The rise of smaller teams isn’t just about size—it’s about how they operate. These funds act more like startups than traditional venture firms, leveraging their agility to:

Move Quickly: Smaller teams can execute faster, cutting through bureaucratic layers to close deals ahead of larger players.

Specialize Deeply: With focused theses, these funds can outmaneuver mega-funds in emerging markets like Vertical AI, deep tech, and frontier technologies.

Adapt Strategically: Unencumbered by large LP bases or rigid mandates, nimble funds can pivot to align with shifting market dynamics.

Meanwhile, mega-funds often resemble corporations, with extensive operational layers, slower decision-making processes, and a broad focus that can dilute their ability to capture niche opportunities. This isn’t entirely a bad thing though - process, knowledge and functional large teams are also why some have lasted so long as well. There sometimes is strength in size.

ZIRP and the Unbundling Era

The Zero Interest Rate Policy (ZIRP) era (2020–2022) catalyzed the “unbundling” of venture capital, as abundant capital flowed freely into the market. Social media amplified the visibility of emerging managers, creating an influx of smaller funds eager to deploy capital into buzzy sectors.

While this period saw the proliferation of innovative fund models, it also highlighted the limitations of scale:

Many new LPs allocated to new managers or smaller teams, chasing “access” into the unknown

Much of the capital flowed into overhyped sectors or startups with inflated valuations, resulting in widespread write-downs.

I’ve shared this before but this is the world we live in now

The fallout from this era has driven LPs to reassess their strategies, with many retreating to what feels “safe”—mega-funds or spinouts from proven managers. But this flight to safety risks overlooking the value that smaller funds with real experience that have been around and/or in the tech world for longer.

The Bifurcation: Giants vs. Startups

As venture capital bifurcates, two dominant models are emerging:

Mega-Funds and Institutional Giants:

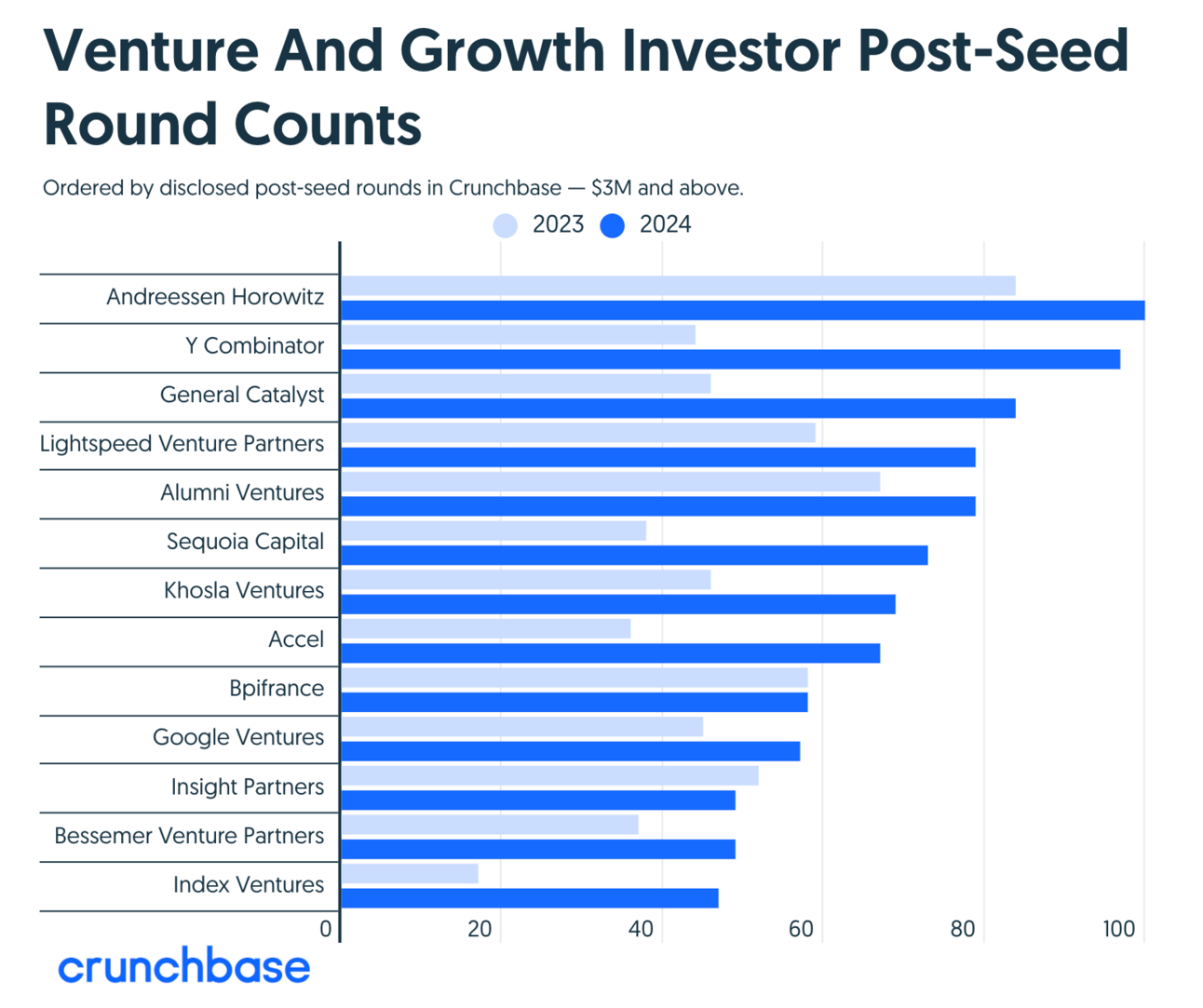

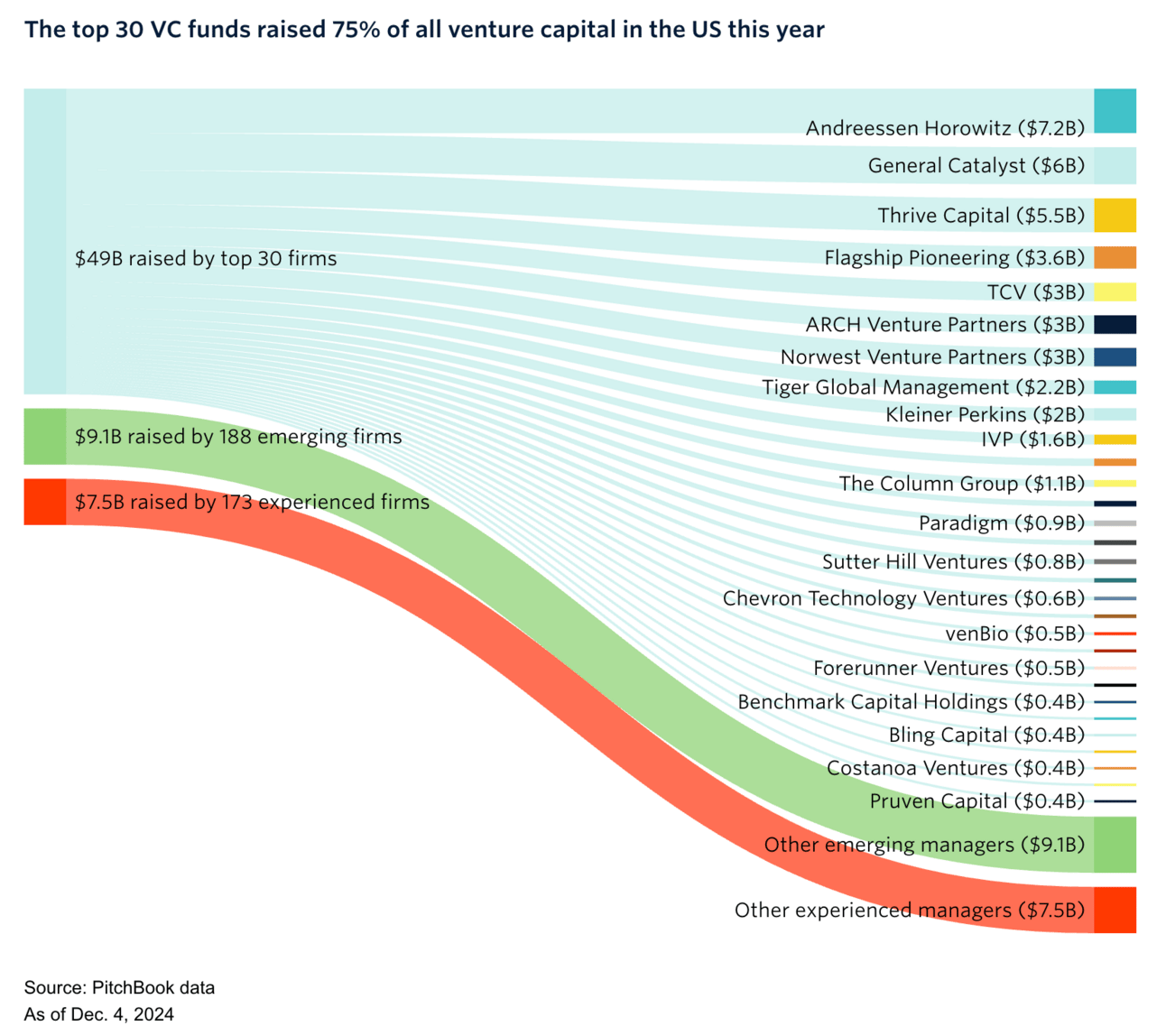

Large funds dominate capital flows, with the top 10 VC firms raising 55% of all venture capital in 2023.

These funds operate at scale, leveraging extensive networks and resources to secure their place in competitive deals.

They cater to LPs seeking predictability and stability, often trading alpha for beta.

Smaller, Agile Teams:

These funds, often $20M–$100M in size, are built for speed, focus, and deep specialization.

They excel in emerging markets, where their lean structure allows them to identify and act on opportunities faster than larger competitors.

By focusing on high-conviction bets and building strong relationships with founders, they deliver value that larger funds can’t replicate.

While both models serve different purposes, the nimble approach is increasingly proving its value in sectors that reward focus and execution speed, such as automation, defense, and early-stage AI.

What About the Business Model?

Despite the market’s evolution, the fundamental economics of venture capital remain the same. The industry still runs on the 2-and-20 model, with variations depending on fund size:

Smaller Funds: True seed funds may charge slightly higher fees (e.g., 2.5% and 25%) to compensate for their limited scale, as their management fees are inherently small.

Mega-Funds: The largest firms often command premium terms (e.g., 3.5% and 35%), leveraging their brand, access, and track record to justify higher fees.

Regardless of size, it’s an incredible feat to pull this off successfully. Building a venture fund—whether it’s $20M or $2B—is incredibly hard work. The ability to manage LP relationships, deliver returns, and support founders requires not just skill but an extraordinary level of dedication. But you’re either in the AUM or carry game at the end of the day.

Final Thoughts: Specialization is Strength

The bifurcation of venture capital is not a step backward—it’s an evolution. Smaller, nimble teams are proving their value by operating with the speed and focus of startups, while mega-funds provide stability and scale for institutional capital who can’t write smaller checks.

This divergence reflects the industry’s growing maturity, offering LPs and founders more tailored options. As the market continues to evolve, the most successful players will be those who embrace their unique advantages—whether they operate with the scale of a corporate or the agility of a startup.

One thing remains constant: venture capital is, and always will be, a long game. Success comes from patience, discipline, and delivering value—not just for LPs but for the founders building the future.

FIND ME: 𝕏 @Trace_Cohen / in LinkedIn

Get your news where Silicon Valley gets its news 📰

The best investors need the information that matters, fast.

That’s why a lot of them (including investors from a16z, Bessemer, Founders Fund, and Sequoia) trust this free newsletter.

It’s a five minute-read every morning, and it gives readers the information they need ASAP so they can spend less time scrolling and more time doing.