Tech companies have been at the forefront of economic growth, innovation, and market transformation over the past few decades. However, even the most successful tech giants face growth limits due to various internal and external factors. By analyzing the growth data of the top 20 tech companies over the last five years, we can gain valuable insights into these limits and the reasons behind the fluctuations in their growth rates.

And I’m sorry, I’m not sorry but I’m using a lot of graphs below to show in different ways just how big some of these companies are, the growth they’re still able to maintain relatively, while trying to understand how they can try to continue it indefinitely for now.

So why am I brining this up? Well it was a rough week for some Saas companies - some we know what they do like Salesforce and others like UiPath and MongoDB that 99% of people (including myself), dont really know what they actually do… which these days might be a problem.

Is this an over reaction based on algorithms and missing by <1% on made up analyst estimates + a softened forward looking guidance? Yes. But it’s also watching companies like Salesforce at a $38 Billion dollar run rate continuing to grow at a massive scale, which has to come from someone else’s budget… And they’re not even the closest to biggest out there, to be worried and/or concerned about as a canary in the coal mine.

Recent Growth Trends: A Data-Driven Perspective

I examined the growth rates of the top 20 BIG Tech companies from 2019 to 2023. The data reveals several interesting trends - note that in 2020+2021 Covid pulled years of sales growth ahead, exacerbated numerous systemic issues and most companies are still trying to recover from it.

Also I had to remove NVIDIA from the data as it skewed it / made the graphs harder to read because of it’s recent insane growth.

Median and Quartiles:

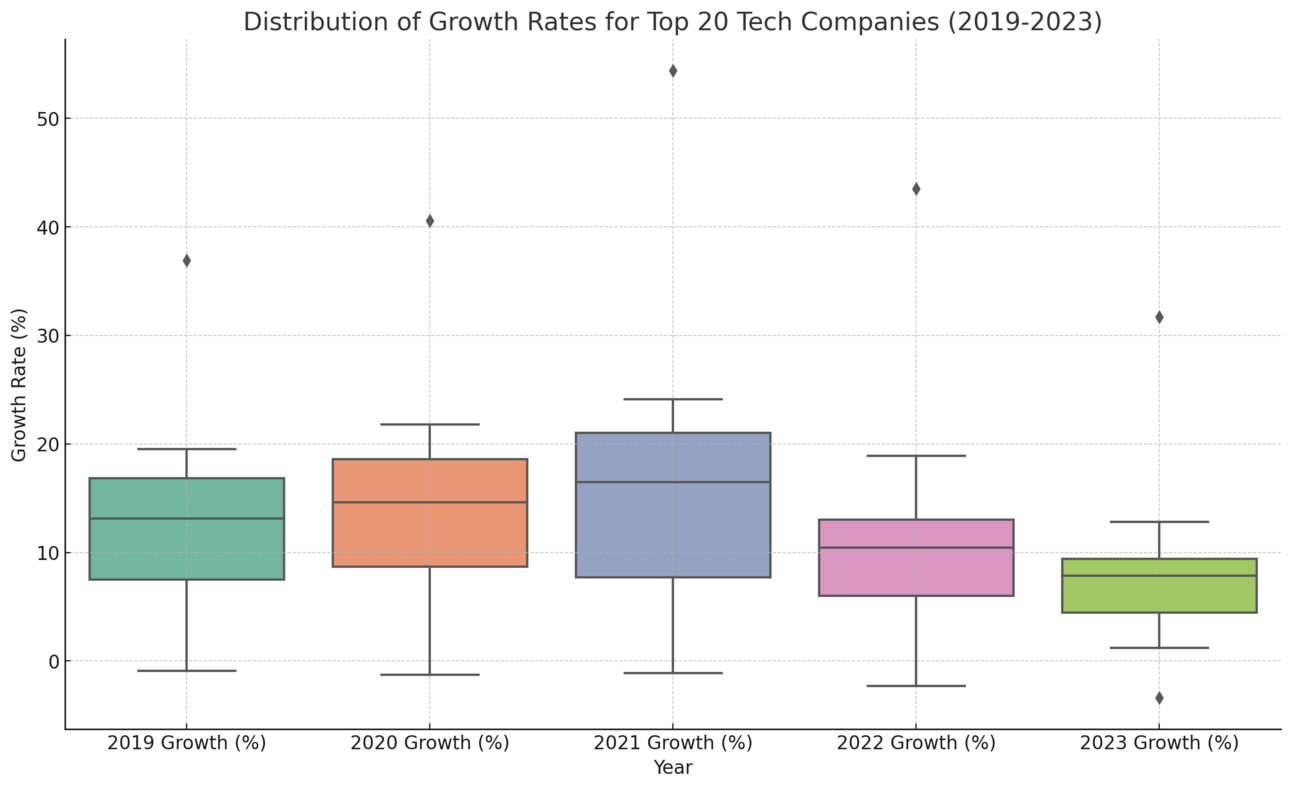

The box plot below shows the median growth rate (the line within each box) and the interquartile range (the box itself), which captures the middle 50% of the data.

The median growth rates are relatively consistent over the years, but the spread of the data varies, indicating differing performance levels among the companies.

Yearly Trends:

2021 shows a wider range and higher outliers, reflecting a year of significant growth for several companies, likely driven by the accelerated digital transformation during the pandemic.

The trend narrows in 2022 and 2023, suggesting a normalization of growth rates post-pandemic.

As you see in the above box plot, growth in 2019-2020 was relatively steady but then in 2021 it got wider with huge growth and outliers that were benefited from Covid. But then growth slowed, even decelerated 2022-2023 which was kind of expected, stocks still diped because of it as it takes years to rightsize as we’re seeing now with BIG Tech back to almost all-time highs.

Factors Influencing Growth Limits

As I’ve mentioned before, there are several key factors influence the growth limits of these tech companies. Mostly right now each other - with the latest trends in Ai, they’re all spending countless billions to be at the forefront that may eventually drive future revenue, beyond the publicity news headlines, and for the first time in a while getting really competitive between each other.

Market Saturation:

As markets mature, the growth potential naturally declines. For example, Apple and Microsoft face challenges in sustaining high growth rates as their primary markets become saturated.

Innovation and Product Lifecycle:

Companies like NVIDIA have maintained high growth through relentless innovation in AI and graphics processing.

In contrast, companies that struggle to innovate or adapt, such as Intel, face declining growth.

Timing and Market Trends:

The timing of market trends and technological advancements can also impact growth. Companies that align their strategies with emerging trends, like TSMC with semiconductor manufacturing, tend to outperform those that miss these trends.

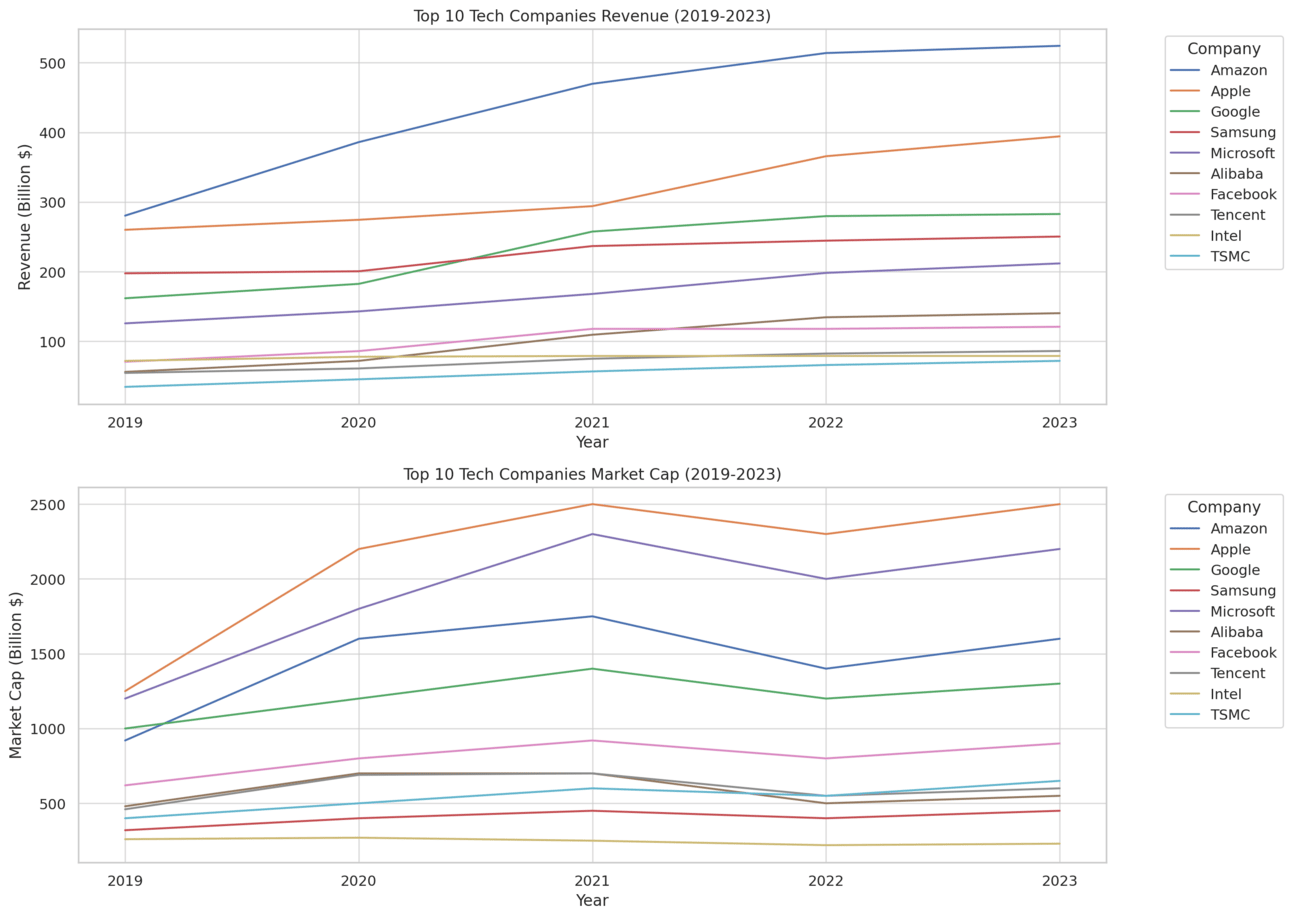

And just because you generate the most revenue, doesn’t mean you command the highest market cap. Amazon generated almost $200B more revenue than Apple in 2023 but Apple still has $1T more in market cap.

So what’s next? The growth is still in the private markets

The growth trajectories of major tech companies reveal that while they have achieved remarkable success, they also face inherent potential limits. Factors such as market saturation, innovation cycles, regulatory challenges, economic conditions, and market timing play significant roles in shaping their growth.

So of the 1000+ private startups worth $1B+ as an example, maybe 100 of them are growing faster enough (30%+) that could possible consider IPOing in the next few years. Some of them, possibly an expanded pool, that are growing but not as fast, would be great candidates for M&A if BIG Tech is ever allowed to acquire anything again.

Companies that have managed to sustain high growth rates have done so through continuous innovation, strategic diversification, and timely market adaptation. On the other hand, those struggling with declining growth often face challenges in these areas. And with so many funds trying to raise right now and significantly more demand > supply for LPs/capital, we might miss out on some amazing opportunities to fund early stage growth companies.

I wrote about this previously that there really are countless emerging managers and even bigger funds in the market right now trying to raise. But with the lack of liquidity from previous investment/commitments, slowing growth and a non existent M&A and IPO market, many LPs are not investing or are making safer bets. A very contentious election year doesn’t bode well for any of this, so we’re really looking to get through this by early to mid 2025.

😂 MEME of The Week 😂

Always have an ask!

What stock do you think will first grow to 30%+ again?

Improve your resume / help get a job using https://www.tealhq.com/

Follow me on twitter.com/Trace_Cohen

BIG leagues now with my first ad below - lets go!

Your team's secret sauce to success is here. From concept to completion with monday.com helps you manage, automate, and streamline your projects effortlessly. It’s time to transform your work life.