Rumor has it Coreweave (Ai servers) will IPO this year for $30-50B, Klarna for $15-$20B and Chime for $15B+. You cant really IPO for any less… we need to rebrand and rename IPOs as they aint what they used to be and wont be for years to come.

The Rise and Stumble of Unicorns

Over the past decade, the tech startup VC world has been enamored by the rise of "unicorns"—privately held companies valued at over $1 billion. By September 2024, we counted 1,467 unicorns worldwide, collectively worth over $1 trillion. These startups once symbolized triumph, but many have lost their luster sadly and well never should have been valued so highly (ZIRP). The IPO market, a revered a rare exit for many, has shriveled: U.S. IPOs nosedived from 397 in 2021 to 99 in 2022—a 75% drop—crawling back to 108 in 2023 and 150 in 2024, still a shadow of past highs.

Mergers and acquisitions (M&A) have also faltered, with global tech M&A deals plunging from 1,353 in 2021 to 616 in 2023—a 54% decline—before ticking up to 700 in 2024. This has spawned "zombie-corns," trapped in a limbo of lofty valuations with no exit in sight, leaving investors and founders in a bind. Yet, amid this stagnation, the artificial intelligence (AI) sector is surging, with a few powerhouses redefining growth and value creation.

Most after 2021 are VC backed tech startups

AI Titans Are The New Cool Thing

Enter the AI titans: OpenAI, Anthropic, and xAI. These companies aren’t just riding the innovation wave—they’re steering it, with valuations hitting stratospheric levels. As of early 2025, they’re nearing a combined $400+ billion. OpenAI, behind ChatGPT, reached $300B+ billion in October 2024, projecting $3.7 billion in 2024 revenue and a staggering $11.6 billion in 2025, driven by its language model breakthroughs. Anthropic, a rising star, is in talks for a $60 billion valuation, with $800 million annualized revenue in September 2024, eyeing $1 billion by year-end and $34.5 billion by 2027. xAI (Grok), Elon Musk’s brainchild, is negotiating a $75 billion valuation in February 2025, up from $40 billion, with modest tens of millions in revenue but vast potential via X platform ties.

These figures herald AI as an economic juggernaut, with the market poised to grow at a 30-40% annual rate, potentially reaching trillions by 2030. Yet, M&A in AI lags, dropping from 137 deals worth $24 billion in 2021 to 104 deals at $4.9 billion in 2023, despite a value bump in 2024.

This is also all happening while Stargate with OpenAI and SoftBank are starting a $500 billion AI data center company. ‘The Stargate Project’ is starting its buildout in Texas, with participation from Oracle, MGX, Microsoft, Nvidia, and Arm… Very little details so far.

Getting to $100M is the new benchmark

The IPO and M&A Drought: A Closer Look

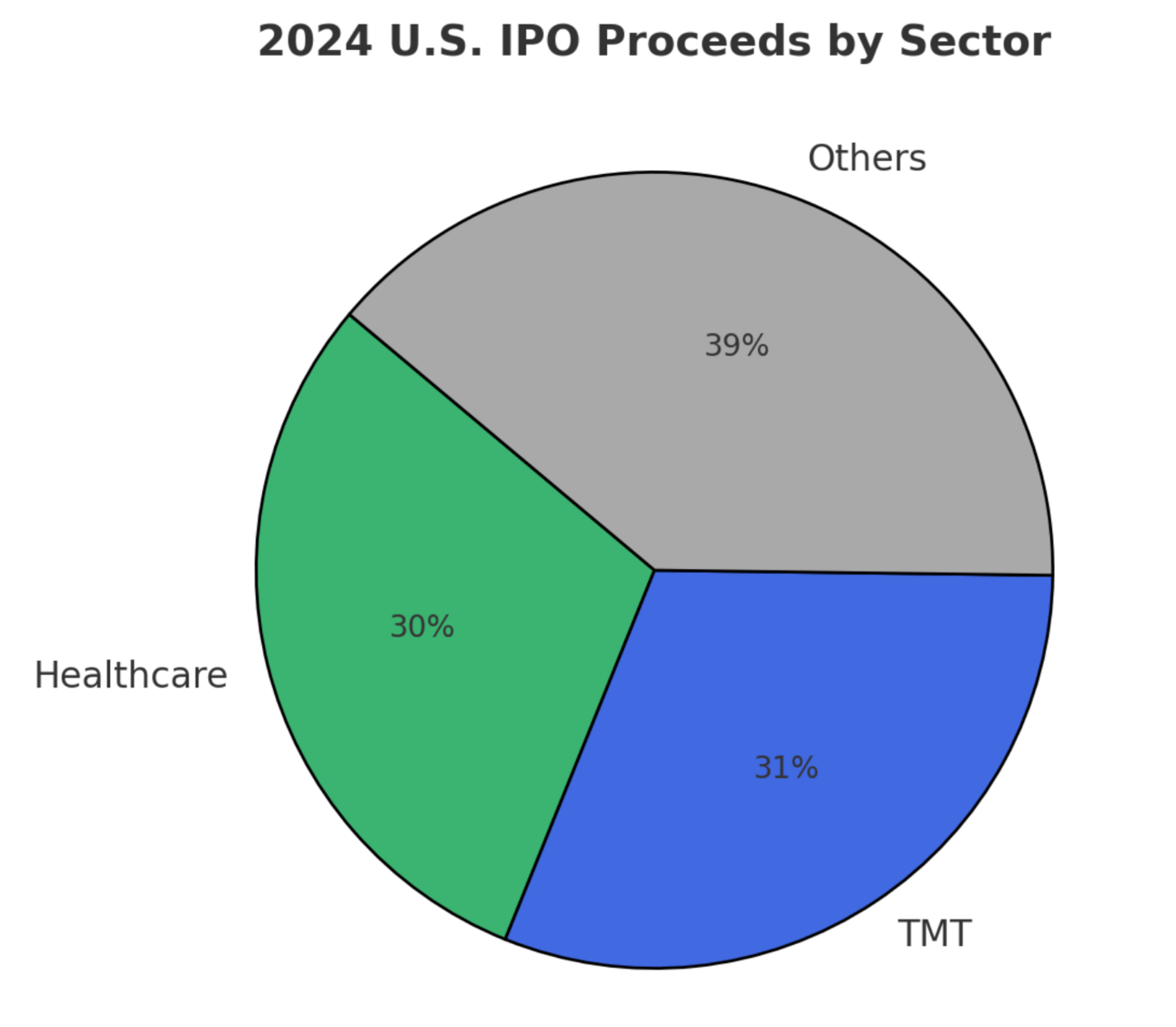

The past few years have been punishing for startup exits. IPOs crashed post-2021: U.S. proceeds fell from $142 billion (397 IPOs) in 2021 to $12 billion (99 IPOs) in 2022—a 92% drop—edging up to $19 billion (108 IPOs) in 2023 and $28 billion (150 IPOs) in 2024, per EY and PitchBook. Tech IPOs shrank to 10-15 annually in 2023-2024 from over 100 in 2021, per Morgan Stanley.

M&A has been equally grim: global deal value slid from $5.9 trillion in 2021 to $3.4 trillion in 2024—an 8% rise from 2023’s $3.1 trillion but far from peak—while deal counts dropped 16% from 2021-2023. AI M&A fell from 137 deals ($24B) in 2021 to 104 ($4.9B) in 2023, per IMAA, hampered by valuation gaps and regulation. Private capital has filled the void, with $50 billion into AI startups in 2023 alone, per Crunchbase, letting firms delay exits as investors hoard cash—pharma’s $171 billion reserves, per AlphaSense, exemplify this trend.

The IPO Dilemma for AI Giants

These towering valuations pose exit riddles for AI titans. M&A is nigh impossible—few can afford or clear regulatory hurdles to buy such giants. IPOs beckon, but the market’s unforgiving: 2024’s 150 IPOs (up 80% from 2023 but almost no tech startups) demand $500 million in revenue and 30%+ growth. OpenAI and Anthropic currently have this astronomical growth, but most unicorns sadly dont. With so few IPOs—down 62% from 2021’s peak—and startups now commanding astronomical private valuations (think $157 billion for OpenAI alone), future IPOs must be colossal to justify the hype.

These won’t be modest debuts but mega-IPOs with valuations dwarfing past norms, reflecting years of private capital bloating balance sheets. Private funding’s $50 billion AI infusion in 2023 means IPOs aren’t for cash but for liquidity—freeing early backers and employees—plus branding and stock-based deals. Rare 2024 tech IPOs like Astera Labs and Tempus AI, both AI-powered, soared, hinting at investor appetite for these titanic offerings, yet the game remains high-stakes: only the fittest thrive.

What’s Next for AI and the Market?

The next few years will reveal if IPOs broaden or stay elite. The last cycle spawned unicorns with no exit; this one forges fewer, fiercer players delaying public bows. With IPOs so scarce and private valuations ballooning—1,467 unicorns at $1 trillion-plus by 2024—future IPOs will need to be massive, multi-billion-dollar spectacles to match the stakes. OpenAI’s potential $157 billion debut would eclipse 2021’s biggest IPOs, like Rivian’s $12 billion raise, by an order of magnitude. M&A might rise—EY predicts a 10% U.S. deal volume jump in 2025 with lower rates—but AI firms, too big for most buyers, lean toward these mega-IPOs. If OpenAI, Anthropic, and xAI keep their pace, their $300 billion could near $1 trillion by decade’s end, per market forecasts. Beyond AI, energy transition (renewables M&A up 20% in 2024) and healthcare (pharma’s AI-driven deals spiking) signal wider recovery, per PwC. Private equity’s 34% deal value leap in 2024, per Morrison Foerster, hints at a 2025 surge. This shift—from unicorn herds to AI juggernauts—recasts startup success in a ruthless, selective world of towering valuations.

Key Takeaways

AI Titans’ Rise: OpenAI ($300B), Anthropic ($60B), and xAI ($75B) near $400B, with OpenAI’s revenue jumping to $11.6B in 2025.

IPO Collapse: U.S. IPOs fell from 397 ($142B) in 2021 to 99 ($12B) in 2022; 2024’s 150 ($28B) shows tepid recovery.

M&A Slump: Tech M&A dropped 54% from 2021-2023; AI deals slid from 137 ($24B) in 2021 to 104 ($4.9B) in 2023.

Mega-IPOs Ahead: Scarce IPOs and high private valuations mean future debuts must be massive, $50-$500B events.

Future Outlook: AI’s 30-40% growth could push titans to $1T, with selective mega-IPOs and M&A rising in 2025.

FIND ME: 𝕏 @Trace_Cohen / in LinkedIn

Maximize Sales Pipeline Coverage with AI Agent Frank

Lower costs by letting Agent Frank take care of prospecting, crafting messages and booking meetings while your team can focus on closing deals!

Agent Frank can operate 24/7 and is fully customizable to best suit your company’s needs. By adding AI Agents to your team you can replace dozens of tools and scale your outreach without scaling your human team. Book a demo now to get a complete walkthrough: