It’s time to build!

I’ve spent the better part of this year digging into the companies and infrastructure that make AI possible, not the apps, not the hype, but the physical backbone that’s being built across the U.S. right now.

Because while the headlines focus on OpenAI, ChatGPT, or NVIDIA’s market cap, the real story lies underground — in the copper, lithium, power grids, nuclear plants, liquid-cooling towers, and data-center campuses that together form a trillion-dollar industrial ecosystem.

This is what separates hype from substance. The public markets and private markets are moving in lockstep here: as venture capital funds startups developing AI applications, institutional investors and corporations are pouring trillions into the infrastructure that keeps it all running.

Let’s break it down; the layers of America’s AI economy, the scale of each one, and the companies driving it.

1. Networking & Compute Infrastructure (~$500B Market)

This is the apex of the AI economy — the hardware that turns electricity into intelligence. GPUs, CPUs, servers, and networking gear define the pace of innovation below them.

NVIDIA (NVDA) posted FY2024 revenue of $60.9B, up 126% YoY, with $29.8B in net income and 50%+ operating margins. The company’s valuation crossed $1T, driven by explosive data-center demand that now accounts for over 90% of revenue.

AMD (AMD) generated $22.7B in revenue, setting the stage for its MI300 AI accelerators and EPYC server chips, as its stock doubled through 2024.

Arista Networks (ANET) hit $7B in revenue (+19.5% YoY) and $2.85B in profit (41% margin), leading the shift to 400G/800G networking.

Cisco (CSCO) logged $14.1B in quarterly sales (+11% YoY) as enterprise and hyperscale clients upgrade their backbones.

Intel (INTC), at $54B in annual revenue, continues to retool as a foundry and AI-chip manufacturer.

This layer represents roughly half a trillion dollars in annual market value across public and private firms — and it’s still expanding. Every watt of compute at the top drives megawatts of energy demand, new cooling systems, and grid buildout downstream.

2. Power Generation: Gas, Nuclear, Renewables (~$4T Market)

The U.S. grid wasn’t built for AI-scale power draw. Each hyperscale data center now requires the energy of a mid-sized city. That’s forcing utilities, IPPs, and even AI companies to build or contract new power sources directly.

NextEra Energy (NEE) posted $7.3B in net income, up 76% YoY, leading renewables with wind, solar, and battery projects spanning Florida to the Midwest.

NRG Energy (NRG) earned $1B in profit on $28B in revenue, with diversified gas and renewables assets.

Duke Energy (DUK) operates 50 GW of capacity across coal, gas, and nuclear, generating $2.1B in annual profit.

Exelon (EXC) runs the largest U.S. nuclear fleet, while Dominion Energy (D) invests heavily in hybrid gas-solar portfolios.

This sector alone represents more than $4 trillion in regulated and contracted assets — and it’s where the biggest opportunity lies. The next generation of AI data centers will be built where there’s power, not necessarily where there’s talent.

3. Energy Storage & Battery Systems (~$200B Market)

AI runs 24/7, but renewables don’t. Energy storage is now critical to ensure uptime and stability.

Fluence Energy (FLNC) generated $2.7B in 2024 revenue with a $5B backlog, making it the leading U.S. grid storage provider.

Tesla Energy (TSLA) deployed 31 GWh of storage (+31% YoY), turning its Megapack business into a multi-billion-dollar segment.

Eos Energy (EOSE) and ESS Tech (ESS) are scaling iron and zinc-flow battery systems for longer-duration discharge.

Private leader Form Energy raised $405M to commercialize iron-air batteries with GE Vernova, capable of storing energy for days.

The energy storage market could exceed $200B globally by 2030, as every major hyperscaler and grid operator integrates battery systems for peak shifting and backup.

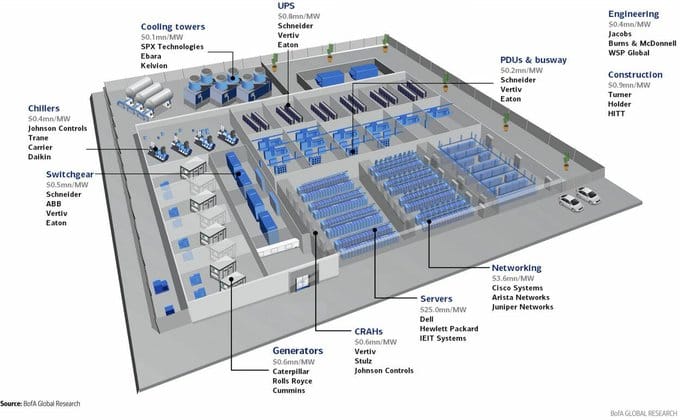

4. Power Distribution & Thermal Management (~$300B Market)

The Circulatory System of AI

Power has to be conditioned, distributed, and cooled before a single line of code can run.

Vertiv (VRT) posted $8B in annual revenue (+17% YoY) and 20% margins, making it one of the fastest-growing infrastructure players.

Eaton (ETN) and Schneider Electric (SU.PA) supply switchgear and UPS systems, each generating $20–25B annually.

Cummins (CMI) earned $735M on $34B in revenue from heavy-duty generator sales.

Generac (GNRC) brought in $215M in profit from distributed backup systems.

HVAC leaders Carrier (CARR) and Trane (TT) dominate the chiller and liquid-cooling segment.

This segment — roughly $300B+ globally — sits at the intersection of power, performance, and physics. As rack densities climb past 80–100 kW, advanced cooling and power conditioning become the most profitable engineering challenges in the sector.

5. Rare Earths & Minerals (~$1T Market)

The Elemental Foundation

AI’s future depends on securing the materials that make everything else possible.

Albemarle (ALB) earned $1.6B in net income on $9.6B in revenue — the world’s largest lithium producer powering batteries across EVs and storage.

Freeport-McMoRan (FCX) reported $1.85B in profit from copper — the conductor of modern civilization and the lifeblood of the grid.

MP Materials (MP) generated $204M in revenue, down YoY as it scales U.S. rare-earth magnet production.

Livent (LTHM) and Lithium Americas (LAC) are expanding domestic lithium mining and processing capacity.

The global mining and materials market for AI-adjacent inputs is estimated at $1 trillion, with strategic importance rising as the U.S. seeks supply-chain independence from China.

6. Construction & Engineering (~$60–80B U.S. Market)

Turning Capex into Capacity

Designing and building hyperscale data centers is one of the fastest-growing categories in construction.

Jacobs (J), WSP Global (WSP.TO), and AECOM (ACM) lead multi-billion-dollar EPC contracts for hyperscalers.

Private firms Turner, Holder, and HITT dominate physical delivery.

The U.S. data-center construction market surpassed $60B in 2024, growing 20% annually with another $200B+ in global pipeline commitments.

These projects have multi-year lead times, contracted payments, and significant recurring maintenance — far removed from speculative tech cycles.

The Macro View: A Real Economy Built on Real Assets

Every layer of this ecosystem is anchored in cash-generating operations, regulated returns, or tangible assets.

These are not fleeting trends — they’re balance sheets, factories, and substations that will exist for decades.

Yes, valuations can fluctuate. Momentum and retail enthusiasm will always drive short-term froth. But the fundamentals are undeniable:

Compute demand continues to outpace chip efficiency.

Power generation and storage are entering long-term reinvestment cycles.

Thermal and electrical systems are becoming critical chokepoints.

Materials and mining are strategic again, not just cyclical.

Construction is fully booked through 2026 and beyond.

This is not a speculative bubble inflated by hype — it’s an industrial buildout funded by cash flow, underwritten by infrastructure-grade economics, and executed by companies that have been through every business cycle imaginable.

Business news doesn’t have to be boring

Morning Brew makes business news way more enjoyable—and way easier to understand. The free newsletter breaks down the latest in business, tech, and finance with smart insights, bold takes, and a tone that actually makes you want to keep reading.

No jargon, no drawn-out analysis, no snooze-fests. Just the stuff you need to know, delivered with a little personality.

Over 4 million people start their day with Morning Brew, and once you try it, you’ll see why.

Plus, it takes just 15 seconds to subscribe—so why not give it a shot?