Future data centers :)

It feels like very day we hear announcement of new $1B, $10B, $100B and now $1T deals and required capital in order to build the Ai foundation we need.

When people look back on this period, it won’t be remembered for chatbots, memes, or flashy demos. It will be remembered for the trillion-dollar gamble that OpenAI and the broader tech sector are making on the future: that artificial intelligence is not just another product cycle, but the foundation of a new industrial era. And like every industrial revolution before it, this one requires massive infrastructure, unprecedented financing, and political willpower.

Just as railroads, power grids, and the internet defined their centuries, the next leap will depend on vast networks of data centers, advanced chips, and compute systems scaled to the size of nations. The “agentic world” we envision—where AI systems coordinate tasks, manage industries, and drive scientific breakthroughs—can only exist if we build the physical and financial groundwork today. Without this groundwork, progress risks stalling, and the vision of AI reshaping economies may remain unrealized.

The Present: A $500 Billion First Step

The launchpad is Project Stargate. In 2025, OpenAI, SoftBank, Oracle, and MGX announced plans for five new U.S. supercomputing campuses. With $400 billion already secured and a $500 billion target for the first phase, these facilities are projected to deliver nearly 7 gigawatts of capacity by 2028—the equivalent of seven nuclear plants dedicated entirely to AI workloads.

NVIDIA is contributing up to $100 billion in GPU systems through leasing arrangements, turning what would be capex into opex and reducing hardware risk.

Microsoft is expanding Azure with $20–30 billion in yearly investment, keeping OpenAI closely tied to its cloud infrastructure while growing its enterprise services.

Oracle is building out large-scale data centers, expected to provide over 5.5 GW of compute across multiple U.S. regions.

SoftBank, with sovereign capital from MGX, is assuming much of the financial risk through Stargate, structuring commitments in a way that allows global sovereign funds to participate.

CoreWeave and Google Cloud provide overflow compute capacity, ensuring resilience and flexibility when demand spikes beyond forecasted levels.

This is no longer a single-company project. It is a coordinated effort among financiers, sovereign funds, cloud providers, and chipmakers—all recognizing that without unprecedented infrastructure, AI progress will hit a ceiling. And importantly, it demonstrates that financing innovation is just as critical as technical breakthroughs.

Funding Today’s Infrastructure to Build Tomorrow’s Intelligence

We cannot wait for the agentic future to arrive; the foundations must be laid now. This requires financial models normally reserved for national infrastructure projects, combining public and private capital. The key mechanisms include:

Joint ventures like Stargate, which keep massive capital costs off OpenAI’s balance sheet while pooling resources from multiple partners.

Chip leasing structures, where NVIDIA shoulders initial hardware costs and recoups them over time through service-like contracts.

Sale-leasebacks of data centers, with Oracle and SoftBank building and then leasing capacity back to OpenAI, smoothing financial obligations.

Government incentives such as tax credits, workforce development subsidies, and expedited permitting that reduce effective capital costs and accelerate project timelines.

Debt securitization tied to long-term compute contracts, converting OpenAI’s projected revenues into present-day financing power.

Together, these methods allow a trillion-dollar plan to be distributed across a mosaic of funding sources rather than weighing down one company or balance sheet.

The Midpoint: Scaling Toward $2 Trillion

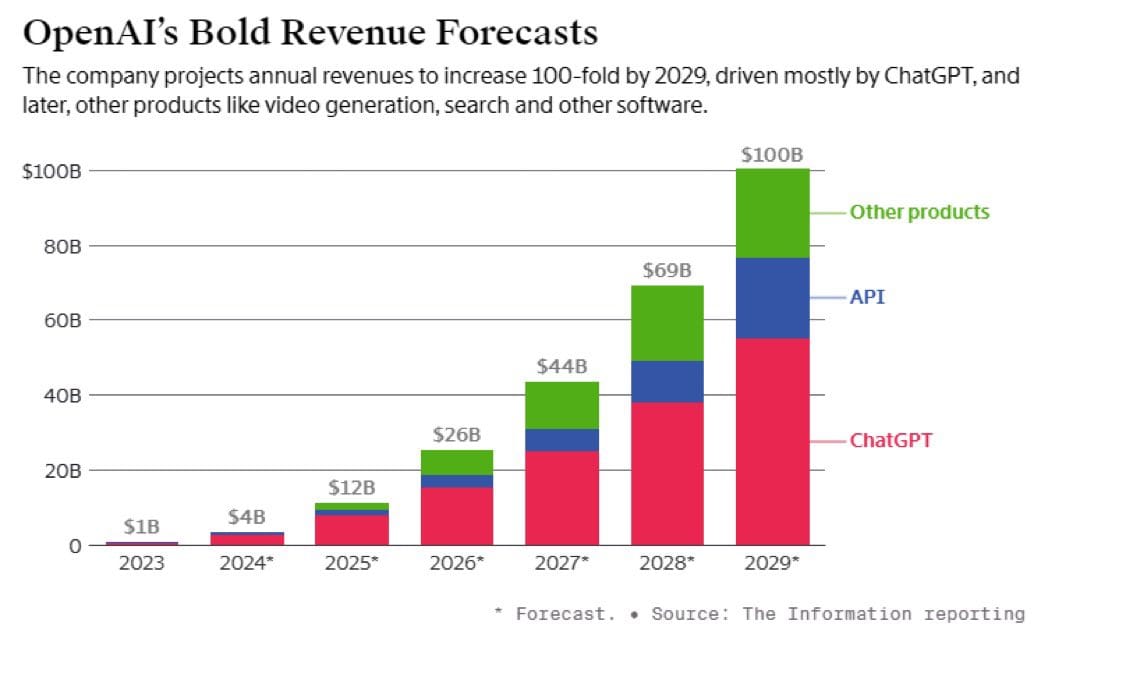

By 2027–2028, total commitments could climb toward $1.5–2 trillion. OpenAI’s revenues are projected at $30–50 billion annually, enough to back hundreds of billions in securitized debt. Meanwhile, SoftBank is expected to launch new Vision Funds focused on AI infrastructure, with backing from sovereign giants like Saudi Arabia’s PIF, Abu Dhabi’s Mubadala, Singapore’s GIC, and Canada’s CPP. Oracle could finance $300 billion or more in new data centers by treating them like real estate assets sold into capital markets.

Revenue securitization turns OpenAI’s long-term contracts into present-day borrowing power, freeing capital without immediate equity dilution.

SoftBank’s Vision Funds III/IV are designed as global infrastructure vehicles channeling $100–150 billion from sovereign LPs into AI projects.

Oracle’s ABS financing packages data centers like REITs, unlocking capital from traditional real estate investors while still tied to AI demand.

NVIDIA’s equity-linked tranches tie hardware deliveries directly to incremental ownership stakes, creating shared risk and upside.

This financial engineering mirrors earlier industrial revolutions: distributing obligations across institutions, tapping debt markets at scale, and monetizing future demand before it fully materializes. Crucially, these mechanisms spread risk while keeping the pace of development relentless.

The Future: A $5 Trillion Global Build-Out

By 2029–2030, this effort becomes fully global. Sovereign wealth funds from the UAE, Saudi Arabia, Norway, and Singapore are expected to contribute roughly half a trillion dollars. The U.S. Treasury may issue AI Infrastructure Bonds, raising $250 billion from institutional investors like BlackRock, Vanguard, and PIMCO under the banner of national security and technological leadership.

Big Tech cash reserves will be critical, with Microsoft, Google, Amazon, Meta, and Oracle expected to invest $30–50 billion annually from operating profits, tying their core businesses even more tightly to AI infrastructure.

Global SPVs (special purpose vehicles) will allow sovereign funds across Europe, Asia, and the Middle East to finance local data hubs, diversifying ownership and geopolitical influence.

Deferred revenue models will allow governments and corporations to prepay for compute blocks, providing OpenAI and its partners with upfront liquidity that can be leveraged for further expansion.

Cross-subsidization will let profits from inference workloads cover the depreciation of mega data centers, keeping costs sustainable as the infrastructure ages.

Government partnerships will become more formalized, with regulatory frameworks created to support long-term compute and energy planning.

By the end of the decade, no single entity will carry the burden. Corporate cash flow may contribute $1.5 trillion, sovereign wealth funds $1 trillion, debt markets and asset managers another $1 trillion, creative structures up to $1 trillion, and government bonds about $500 billion. The financial architecture will be just as innovative as the technological one.

What’s at Stake

This project is not about speeding up chatbot responses. It is about building cognitive energy grids—industrial-scale infrastructure capable of supporting world models, automating industries, and enabling transformative breakthroughs in medicine, defense, energy, and science. Without it, the promise of agentic AI could falter under bottlenecks of cost, compute, and access.

Many critics point to the enormous costs, the lack of immediate revenue, and the limited results so far. These concerns are real, but they also reflect the early stage of an infrastructure build that takes time to mature. Adoption outside of Big Tech has been slow not because of lack of interest, but because most corporations lack the incentives, technical talent, budgets, and risk appetite to drive large-scale deployments on their own. History shows that major technological revolutions rarely deliver instant returns; they require patient investment before economies of scale and productivity gains become visible.

Sam Altman put it directly: “I don’t think we’ve figured out yet the final form of financing for compute. But, like in many other technological revolutions, figuring out the right answer will unlock a huge amount of value delivered to society.”

What do you think?

The Gold standard for AI news

AI keeps coming up at work, but you still don't get it?

That's exactly why 1M+ professionals working at Google, Meta, and OpenAI read Superhuman AI daily.

Here's what you get:

Daily AI news that matters for your career - Filtered from 1000s of sources so you know what affects your industry.

Step-by-step tutorials you can use immediately - Real prompts and workflows that solve actual business problems.

New AI tools tested and reviewed - We try everything to deliver tools that drive real results.

All in just 3 minutes a day