From "one model to rule them all" to specialization

Every major technological wave starts with a platform breakthrough. In 2023–2024, that breakthrough was the rise of foundational models—GPT-4/-o, Claude 3, Gemini 2, Llama 3, and DeepSeek-R1. These models became the base infrastructure for language understanding, visual processing, and code generation, each trained on massive datasets spanning trillions of tokens. Training costs vary widely—from tens of millions of dollars to potentially billions—depending on the organization, with OpenAI reportedly investing heavily, and companies like Google generating over $70 billion in revenue just last quarter.

However, the economics of these systems force companies like OpenAI and Google to chase only the largest markets. Highly specialized industries like synthetic biology, shipping logistics, or elder-care support are too small for them to prioritize. This gap creates the ideal space for Vertical AI startups to emerge—solving highly specific problems with deep industry expertise.

The three layers of the AI stack

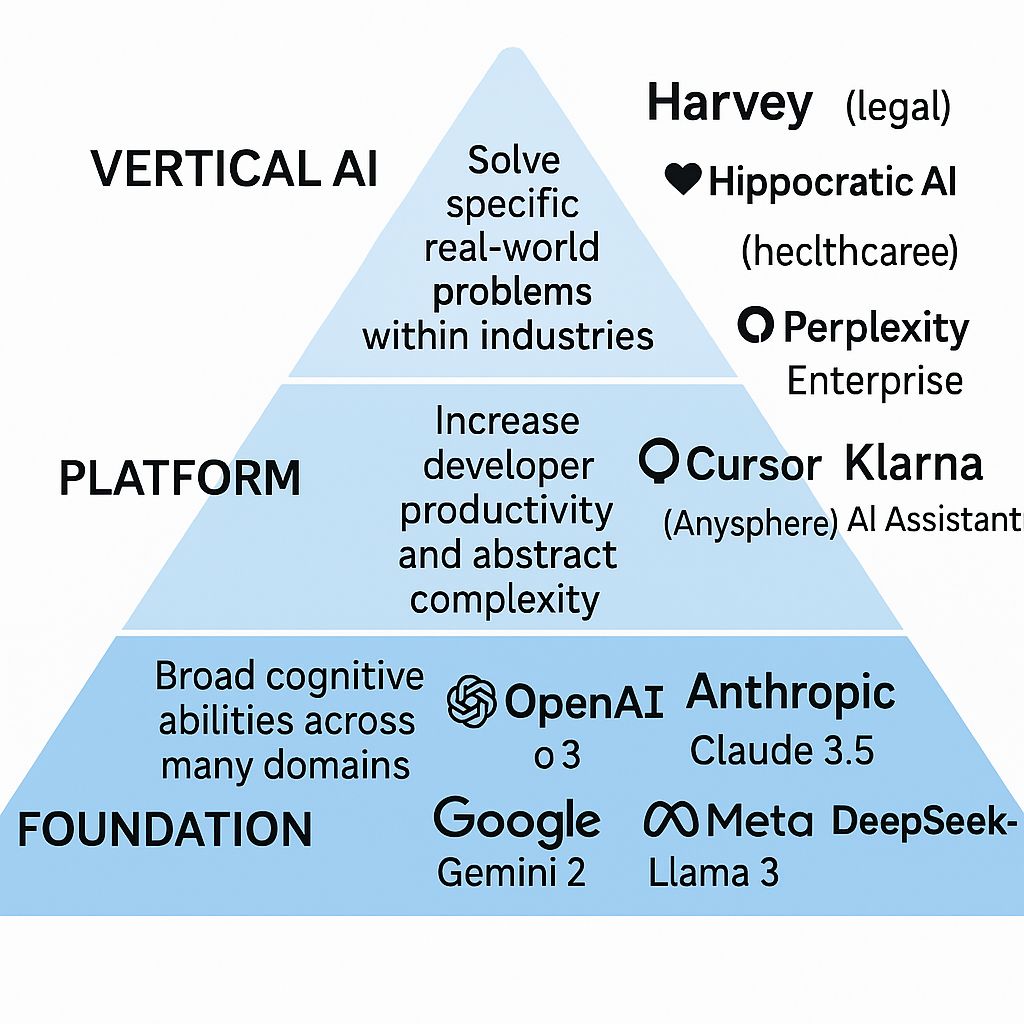

Today’s AI ecosystem is structured into three distinct layers:

Layer | Core Value | Key Players (2025) |

|---|---|---|

Foundational Models | Broad cognitive abilities across many domains | OpenAI o3, Anthropic Claude 3.5, Google Gemini 2, Meta Llama 3, DeepSeek-R1 |

Enablement Platforms | Increase developer productivity and abstract complexity | Cursor (Anysphere), Windsurf (formerly Codeium), GitHub Copilot, Replit Ghostwriter |

Vertical Applications | Solve specific real-world problems within industries | Harvey (legal), Hippocratic AI (healthcare), Perplexity Enterprise, Klarna AI Assistant |

Foundational models provide raw intelligence at the base. Enablement platforms empower users to work with that intelligence productively. Vertical AI companies sit at the top, embedding intelligence into specific workflows and delivering complete solutions to real-world problems.

Developer productivity: the bridge to applications

New AI-driven development environments like Cursor, Windsurf, and GitHub Copilot are transforming engineering workflows. Historically, engineers manually wrote every line of code, akin to manually writing an entire book. Now, these AI tools enable engineers to become 10x more productive.

Tasks that once took months now take weeks. Although questions remain about long-term maintenance, debugging, and code quality, the early evidence shows a dramatic acceleration in development speed. These platforms are empowering the earliest adopters—technical users—to lead the creation of Vertical AI.

The real bottleneck: enterprise data integration

Despite AI’s advances, most enterprises struggle with data silos. McKinsey estimates that resolving this fragmentation could unlock $4.4 trillion in economic value.

A 2025 Writer.com survey revealed that 72% of executives cite internal politics and fragmented ownership as the biggest obstacles to effective AI adoption. Outside of the "Mag 7" tech giants, most companies simply lack the technical expertise or budget to manage massive data integration internally. Salesforce, despite its scale, cannot match the combined annual AI spend of Google, Microsoft, Amazon, and others.

As a result, these enterprises must rely on Vertical AI companies to extract, integrate, and apply their data effectively.

Defining Vertical AI

Vertical AI systems are deeply specialized, combining general AI capabilities with domain-specific expertise.

Some examples include:

Harvey (Legal): Leverages the abundance of publicly available legal documents like SEC filings to draft legal memos rapidly.

Hippocratic AI (Healthcare): Trains on HIPAA-compliant datasets, turning documented patient data into predictive care planning.

Qevlar (Cybersecurity): Automates threat detection and investigations in real-time environments.

Many industries are ripe for Vertical AI disruption, including FinTech, B2B SaaS, defense, and logistics. Lower-hanging opportunities exist where public or standardized datasets already exist.

How Vertical AI builds stronger moats

Vertical AI startups enjoy unique, compounding advantages:

Data Gravity: Models continuously improve with specialized data inputs. Unlike traditional SaaS—which was often retroactive—Vertical AI becomes proactive, surfacing scenarios and opportunities that a human might miss.

Distribution Lock-in: Deep integration into core systems (CRMs, ERPs) makes replacing Vertical AI extremely painful.

Regulatory Compliance: Encoding regulatory standards into workflows (HIPAA, FINRA, SOX) increases switching costs.

Outcome-Based Pricing: Aligning billing with business results—like claims processed, hours saved, or revenue generated—strengthens loyalty.

Vertical AI doesn’t just passively report on data. It proactively analyzes, predicts, and surfaces strategic insights, dynamically adapting to new information like conferences, earnings, and news events.

The disruption of traditional SaaS

Legacy SaaS models are breaking. Companies like Klarna have shown that AI agents can replace entire CRM workflows, autonomously handling millions of customer interactions.

Simply "sprinkling AI" on a legacy SaaS stack will not be enough. True AI-native companies must rethink their architecture from the ground up, rebuilding their data pipelines, infrastructure, and internal agent communication systems to operate autonomously and efficiently.

The future isn't about adding AI—it’s about being AI-first at every layer.

A new playbook for founders

Founders building Vertical AI companies need to ask:

What is my unfair advantage? Do I have insider knowledge, access to proprietary data, or an existing industry network?

Can I find a sharp, urgent entry point? Focus first on a painkiller problem.

How do I own the data pipes? Securing ingestion channels is critical.

Can I treat foundation models as swappable? The real moat lies in data and workflows, not model parameters.

Have I budgeted properly for compute costs? Fine-tuning and scaling production environments still carry real expenses.

The fastest-moving, most expert-driven teams will dominate.

A new mindset for VCs

By early 2025, AI already absorbed 20% of global venture deal flow and over 53% of VC capital.

For venture investors:

Prioritize proprietary data access: Who owns the rarest and most valuable datasets?

Focus on integration difficulty: How easily does the startup fit into existing enterprise systems?

Look for operational expertise: Can this team navigate complex industries, not just build demos?

Expect early exits: Many Vertical AI startups will be acquired by larger companies desperate for domain-specific AI capabilities.

The future winners are not just "building AI"—they are becoming infrastructure for entire industries.

The future is specialization

With general-purpose AI models commoditized and development platforms reducing friction, the frontier is now verticalized intelligence.

The most successful companies will master both AI and industry expertise, building solutions that understand underwriting, radiology, freight logistics, or any domain far better than generalist systems.

Vertical AI is not a side story. It’s the natural maturation of the AI revolution—where broad intelligence gives way to deep, applied mastery.

The pyramid is built. Now the skyscrapers rise.

Looking for Stability in a Volatile Market?

Private infrastructure has outperformed public market equivalents by 86% on a 10-year annualized basis*—it’s no wonder why wealthy investors choose private markets.

With its highly selective, data-driven investment approach, Hamilton Lane’s Private Infrastructure Fund offers real ownership in the assets that are powering our future:

artificial intelligence

clean energy

logistics + trade

Hamilton Lane provides access to deals from the very best private markets funds in the world, and Class R of this offering has delivered 31.67% annualized performance since inception.*

Add these elite institutional-grade investments to your portfolio today for as little as $500. Learn more about Hamilton Lane Private Infrastructure Fund here.

*Source: Hamilton Lane data, Bloomberg as of January 2024. Past performance is not a guarantee of future returns.

All securities come with specific risks not limited to a total loss of your investment. Past performance is not indicative of future results. Please review the risks specific to this investment on the HLPIF deal page hosted on Republic.com/hlpif