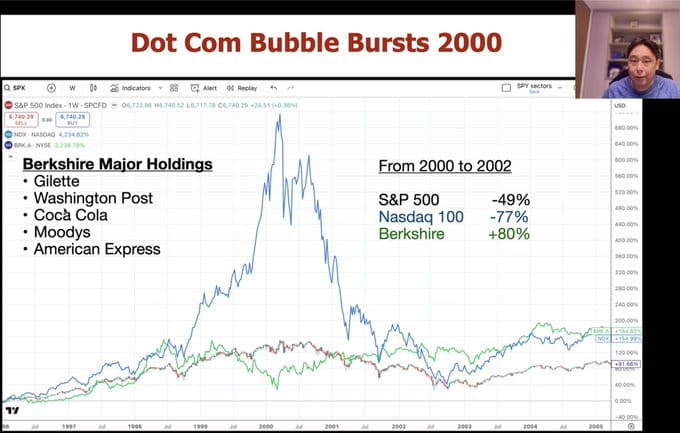

Every day people are declaring that “AI is just another dot-com bubble.” The comparison is tempting: both periods feature rapid technological change, new platforms, and surging valuations. But if you look closely at the numbers, the infrastructure, and the underlying demand, the parallel breaks down completely.

The late 1990s were about connecting for the first time. Valuations ran ahead of reality because the internet felt inevitable, even if the businesses weren’t. Today’s AI wave is about intelligence being layered on top of a fully connected world. The companies leading this buildout are already enormous, profitable, and funding the next stage from operating cash flow — not speculative capital.

1️⃣ Revenue and Scale: Tiny Then, Industrial Now

At the height of the dot-com boom, the numbers were breathtakingly lopsided. Internet stocks were worth around $450 billion, yet they generated just $21 billion in revenue and over $6 billion in losses. Many of the “top” internet companies at the time — Webvan, Pets.com, Commerce One — posted $25 million to $400 million in annual sales, while burning multiples of that.

Fast forward to today, and the contrast is staggering:

Amazon: $638B revenue, $68B operating income

Apple: $391B revenue, $114B+ operating income

Microsoft: $282B revenue, $100B+ operating income

Alphabet: $318B revenue, $96B operating income

Meta: $164B revenue, 43% operating margin

NVIDIA: $130B revenue, 70%+ gross margin, 114% YoY growth

Collectively, the top platforms generate over $1.7 trillion in annual revenue, with multiple lines of business (cloud, ads, services, devices) at or above $100 billion each. Cloud alone is a $100B+ line per platform. Ads exceed $100B at multiple companies. And these businesses are still growing at double-digit rates from enormous bases.

In 1999, stories were big and P&Ls were small. Today, the P&Ls are already massive — before the AI wave fully plays out.

2️⃣ Profitability, Margins, and Free Cash Flow

The dot-com era normalized losses as a “land grab” strategy. Very few companies generated real earnings. Most monetization lagged user growth, and fixed costs often outpaced revenue. Many of the best-known internet companies in 1999–2000 had little to no operating leverage, razor-thin or negative gross margins, and were entirely dependent on capital markets to sustain operations.

Today, it’s the opposite. Profitability is broad, deep, and diversified across multiple revenue lines:

Amazon generated $68.6B in operating income in 2024, with AWS and advertising as core profit engines. AWS alone produced $108B in revenue and high-teens operating margins.

Apple produced over $114B in operating income on $391B in revenue, maintaining industry-leading margins in hardware and services.

Microsoft generated $101.8B in operating income, driven by cloud, Office, and its developer ecosystem, with margins expanding as AI services scale.

Alphabet reported $96B in operating income, with ads still dominant but Cloud and YouTube together exceeding a $110B run rate.

Meta achieved a 43% operating margin on $164B in revenue, even while investing billions annually in AI infrastructure and Reality Labs.

NVIDIA posted a 70%+ gross margin and 114% YoY revenue growth, translating into tens of billions in quarterly operating profit as demand for GPUs surges.

Collectively, these companies are now producing well over $500B in annual operating income and tens of billions in free cash flow every quarter. High-margin software, advertising, and usage-based cloud pricing models create powerful operating leverage at scale.

3️⃣ Capex and Infrastructure: From Marketing Spend to Steel and Transformers

In 1999, capital mostly went into marketing and customer acquisition. The physical internet infrastructure lagged behind adoption. Bandwidth was scarce, compute expensive, and enterprises weren’t ready to deploy at scale.

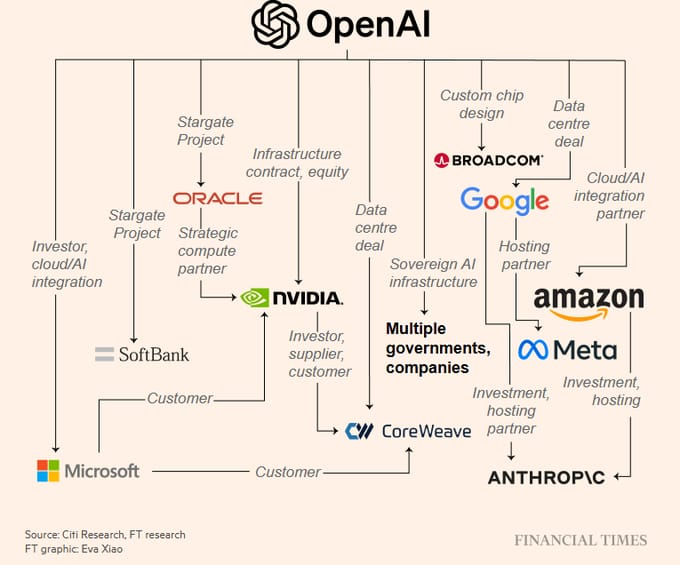

The largest technology companies are committing unprecedented levels of capital to build the data center, compute, and power backbone required for the AI era — and they’re doing it out of their own cash flow:

Alphabet raised its 2025 capex guidance to $75–85B, driven by AI data centers, networking, and custom silicon.

Microsoft is on pace for roughly $80B+ in annual capex, with recent quarterly spends approaching $30B, focused on data center expansion, GPU procurement, and network interconnect.

Amazon has indicated its capex will return to $100B+ annually, with a significant portion allocated to AWS infrastructure and AI acceleration.

Meta projects $66–72B in 2025 capex to support AI workloads, including next-generation data center architectures and power upgrades.

This is an order of magnitude larger than anything seen during the dot-com era. It’s not speculative marketing spend — it’s steel, concrete, substations, cooling systems, power distribution, racks, and chips.

4️⃣ Supply Chain and Physical Constraints: The Tell You Can’t Fake

During the dot-com period, there were no meaningful physical bottlenecks. Orders were shallow and supplier ramps fizzled when financing dried up.

Today, supply chains are stretched to their limits. Accelerators are booked quarters in advance. Server shipments are at record levels. Advanced packaging and HBM memory capacity are expanding to meet committed demand. Power and land have become gating constraints — the kind you only encounter when real workloads are scaling.

5️⃣ Valuation vs. Fundamentals: Multiples With a Floor

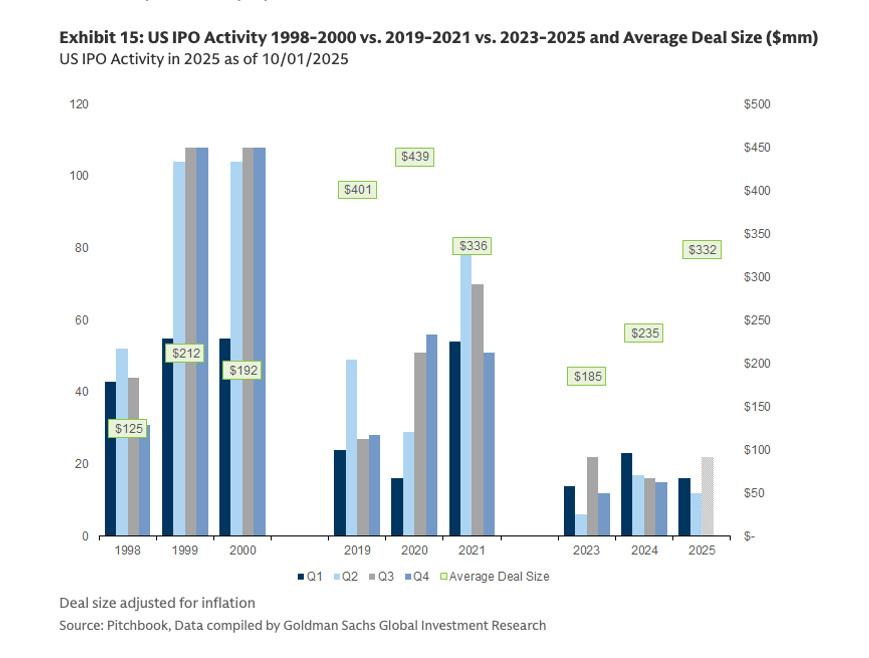

The current environment is structurally different. IPO volume from 2023 to 2025 has remained modest compared to the dot-com frenzy—roughly a third of the deal flow, with average deal sizes between $185M and $332M, reflecting fewer but larger, more mature businesses coming to market. Even during the 2020–2021 cycle, when IPO activity spiked, the average deal size reached $401M–$439M, far exceeding the dot-com era, and many of those companies had real revenue and operating models, even if some were over-valued.

On the public markets, the largest AI beneficiaries trade at 6×–12× revenue multiples, not 20×+. These valuations are supported by:

Operating margins in the 30–40%+ range for companies like Meta, Microsoft, and Apple

Hundreds of billions in annual operating income across the top five platforms

Free cash flow generation in the tens of billions per quarter

Massive buyback programs that provide valuation support and capital return

Multi-year, contract-backed capex programs that reflect real demand

Even in premium sectors like semiconductors, valuations rest on explosive, cash-rich growth curves with booked capacity stretching multiple quarters ahead. Multiples can compress, but the underlying cash flows persist—which gives valuations a structural floor that didn’t exist in 1999.

In short, the dot-com boom was characterized by many small, unprofitable IPOs with extreme multiples, while today’s AI buildout is led by a small number of hyper-profitable incumbents, with IPO markets that are both smaller and more selective.

6️⃣ Demand and Monetization: From Eyeballs to Enterprise Contracts

Dot-com monetization was built on banner ads, eyeballs, and untested consumer funnels. Today’s demand is enterprise-led and contract-backed:

Cloud consumption with usage-based pricing

Subscription software with multi-year commitments

Performance-based advertising with measurable lift

AI features are being embedded across productivity tools, developer infrastructure, cybersecurity, commerce, advertising, and vertical SaaS. Procurement is standardized. Contracts are durable.

This isn’t Pets.com. It’s invoices and cash flow.

7️⃣ Where We Are: Early, Not Late

We are still early. The constraint isn’t hype. It’s physics, permitting, and grid capacity. We can’t even power the AI we want to build. Data centers need more land, more transformers, and more high-voltage infrastructure. That’s not late-cycle euphoria. That’s early-cycle reality.

Yes, there’s froth at the edges. Retail investors don’t want to miss out. Small caps will swing wildly. But that noise doesn’t change the core signal: this is the largest infrastructure buildout since the rise of the internet, and it’s being driven by profitable platforms with real customers.

Trusted by millions. Actually enjoyed by them too.

Most business news feels like homework. Morning Brew feels like a cheat sheet. Quick hits on business, tech, and finance—sharp enough to make sense, snappy enough to make you smile.

Try the newsletter for free and see why it’s the go-to for over 4 million professionals every morning.