Hey everyone - it’s been a while… so less words, more charts and links.

I’m back in NY (Long Island) and will be in the city twice a week - lets hang / invite me to stuff 🙂

TL;DR

What’s going on in the tech world?

Investment updates / links etc

Started a podcast with my brother (so fun!)

I wrote some blog posts with my thoughts

Who plays pickleball? Yes, I’m obsessed and just won my first tournament!

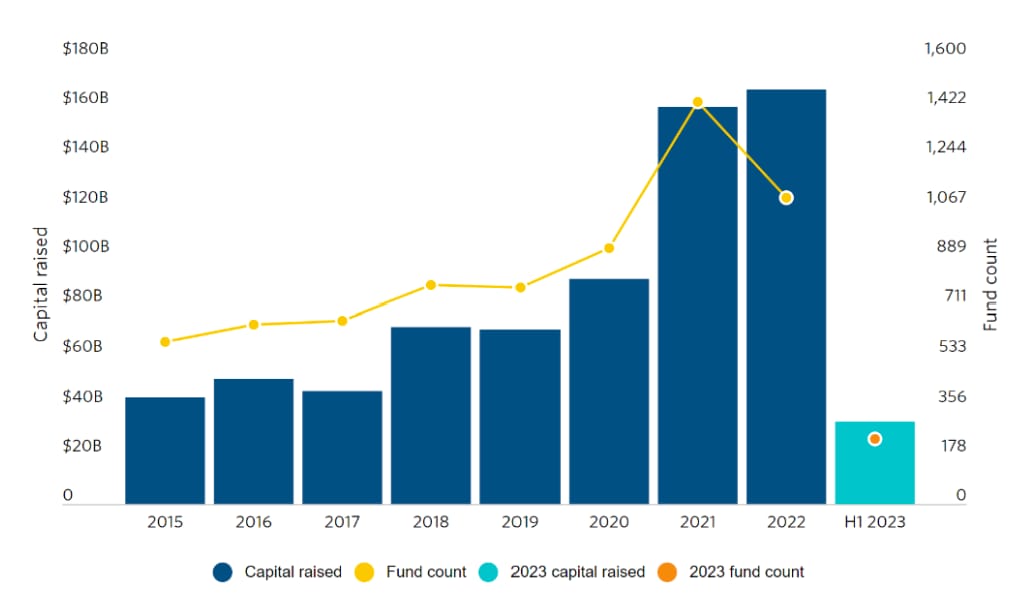

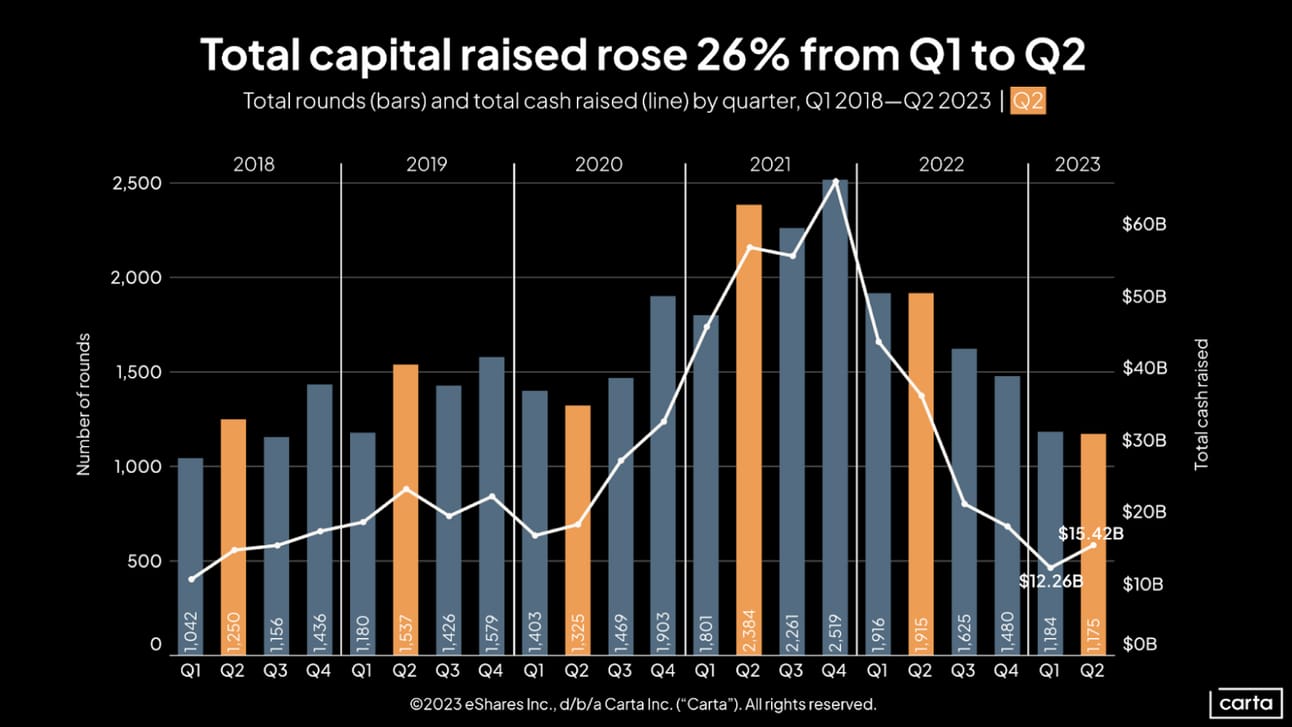

The VC/startup world still seems to be hungover from 2021 which was basically 2 to 3 standard deviations from the mean in almost every way. Will a strong (weird) economy etc be the boost we need to get us through it and feeling better… Tech stocks are booming to all time highs, while private markets are still pretty dry.

Hopefully the funds raised in 2021/2022 didnt invest too fast. Some multi stage, multi billion funds are raising less than their intended targets, which sounds ominous but they will be fine in the long run. I unfortunately believe emering manager funds (<$100M) will be hit the hardest as bigger LPs “flee” to safetey and smaller LPs continue to pull back. Basically a handful of tourist investors made it a lot harder for some of us.

Hopefully we hit the bottom? Only up slowly from here but it wont be easy

We invest at pre/seed (<$10M vals / NO fintech/bio/health/education) and are still seeing a lot of activity/deal flow but the expectations have increased. Unfortunately, later stage/ growth rounds seem to be non-existent which is leaving a lot of big unprofitable startups that already raised significant capital without a lifeline. And for us at the early stages, it keeps us in the dark with regard to how our investments can continue to grow and raise more capital.

My investments that are raising more seed to Series A - let me know if interested in these industries and I’ll share more: restaurant tech, food tech, hospitality, sports betting, DIY CPG

Questions:

How are you dealing with mark downs? Waiting until the founders/something public happens or doing it proactively based on what you know and feel?

Everyone is saying to get profitable and control your own destiny but that’s not entirely how our industry works… what do you think?

Is Ai overhyped? I think most is / BIG tech will be the winner here as they continue to invest billions, though it will be hard to monetize… thoughts?

We’ve still been active though with new investments and helping our portfolio:

My brother Maxwell (Peel Aways founder / link above) and I also started a podcast - these are actually really fun to do! Check out the latest episode:

I also have been writing a little more as well

Thanks for making it this far - I plan to send out more over time but no more than once a month. Feel free to reply back, share and/or unsub.