Happy 2024 - it’s been a long year so far :)

Hey new friends - who am I? Trace Cohen is an Angel investor in 60+ (NYVP.com) pre/seed with background expertise in marketing, PR, startups and family offices. I tweet as lot too https://twitter.com/Trace_Cohen

Growing up with a name inspired by a supercomputer definitely fueled my passion for the tech and startup world. This passion has been a constant throughout my career, starting from my college days where I founded my first company from my dorm room in 2007, while I was also studying Entrepreneurship at Syracuse.

Back then, the industry standards were quite different. I remember how our first business plan competition in college required us to write a detailed 45-page business plan. Contrast that with today, where getting a comprehensive slide deck from a startup can be challenging, and it’s almost taboo to ask for financial projections from a pre-product startup seeking to raise $2M.

The landscape of the industry has transformed significantly since the days before the Facebook IPO, when a typical seed round was $500,000 at a $2M valuation of priced preferred equity. It's exhilarating to see an increasing number of people eager to launch their own companies—it truly keeps the venture capital industry thriving. However, my biggest concern arises from recent trends, notably around 2021, when the startup scene felt overly easy, and seemingly everyone was succeeding. This created a misleading perception of the industry, especially when the reality is that over 90% of startups fail. In the venture capital world, the critical edge is that money (VC) cheats time, but there's no magic formula for guaranteed success in startups.

So here are my thoughts on the current times in the mean time TL;DR:

What’s going on in the tech world? Ai + Series A crunch

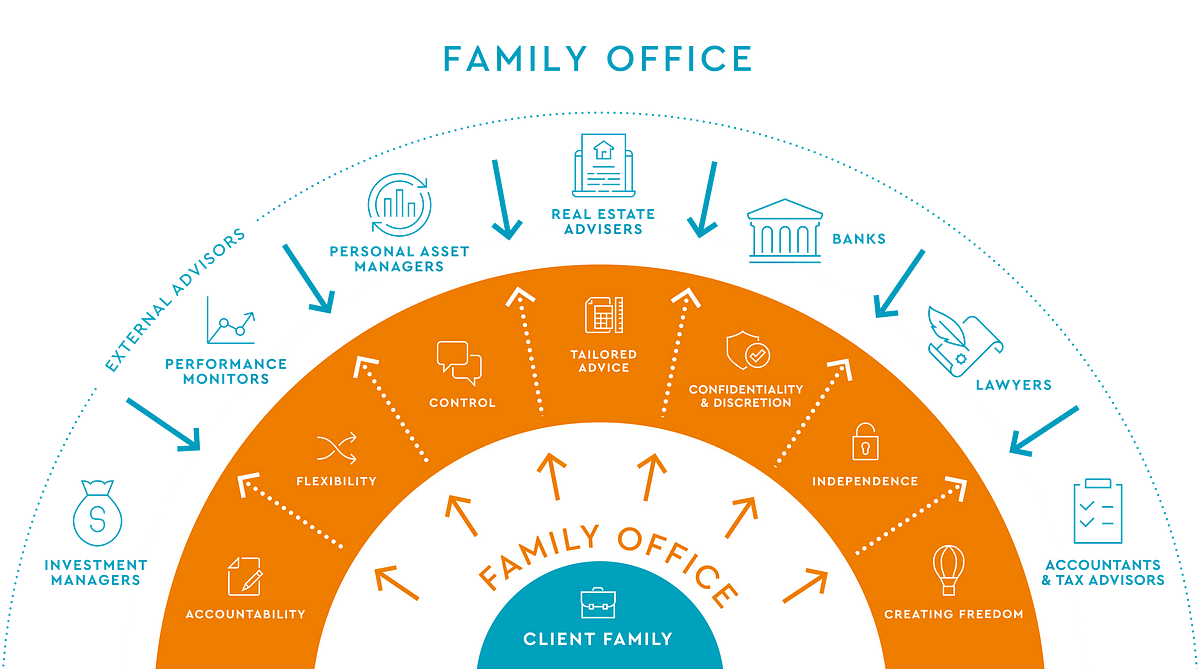

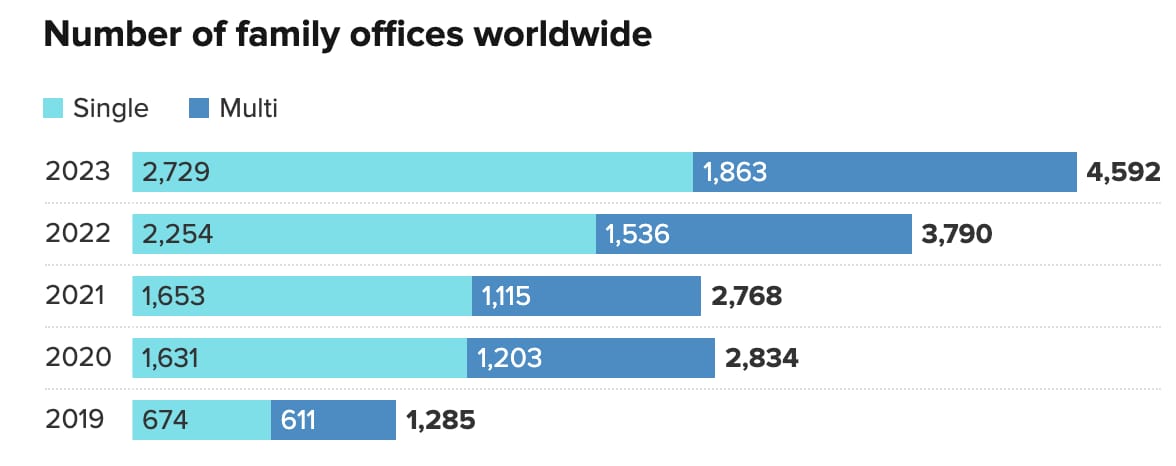

Family offices are growing and investing more

What does it take to IPO? Now that M&A keeps getting blocked

Startup Brothers Podcast with my actual brother (so fun!)

I wrote a lot of blog posts over the last few months

New investments/updates etc

The 2024 VC Scene: AI Startups Boom While Series A Faces a Crunch

The venture capital world in 2024 is a study in contrasts. On one side, there’s a big rush to fund artificial intelligence (AI) startups, thanks to their potential to change everything from how we work to how we live. On the other side, many tech startups are hitting a wall when trying to move from initial funding to the more significant Series A round. Let's dive into these trends, backed by the latest stats and figures, to get a clearer picture of what's happening.

The AI Funding Wave

Ai is all the rage, and for good reason. It’s not just about cool new gadgets; it’s about using LLMs etc that can hopefully solve big problems and improve lives. Investors are pouring money into this space like never before. Almost at ZIRP level alarming rates…

Sky-High Funding: In the first half of 2024 alone, Ai startups pulled in about $9.8 billion from venture capitalists, marking a 25% jump from last year. It’s clear that the buzz around AI's potential is translating into real dollars as every major VC and growth investor tries to pick their winners.

The Series A Crunch

While Ai startups are thriving, the broader tech startup landscape is still in rough shape that I believe will cause a Series A crunch by end of year. Getting that crucial next round of funding after your seed round is proving to be tougher than we’ve seen in almost a decade, especially with thousands of startups that have raised over the last few years.

Funding Downturn: The total amount of money available in Series A rounds has dropped by 15% compared to last year, down to $5.4 billion. This decrease shows that investors are becoming pickier and more cautious about where they put their money.

The Funding Gap: Alarmingly 60% of startups that got seed funding in the past couple of years are struggling to secure Series A funding. This gap highlights the challenge of moving from a promising idea to a viable, growing business. We’re seeing lots of bridges, Seed II, Seed+ and pre-Series As.

In this split investment environment, startups and investors have to adapt. I keep meeting non technical founders building Ai which is kind of ironic but then most VCs also dont have the expertise or even the understanding to evaluate Ai.

Ai Startups: The current boom is great, but it’s not just about grabbing the cash. Ai companies need to think long-term and make sure they’re building something that will stand the test of time and not just ride the hype wave. Just saying that your XYZ but with Ai, wont work anymore.

Other Tech Startups: For startups outside the Ai craze facing the Series A crunch, the focus should be on proving your business can make money and grow. And by grow, I mean like 500%, increasing margins and signing big deals. Expectations are sky high right now.

Looking Ahead

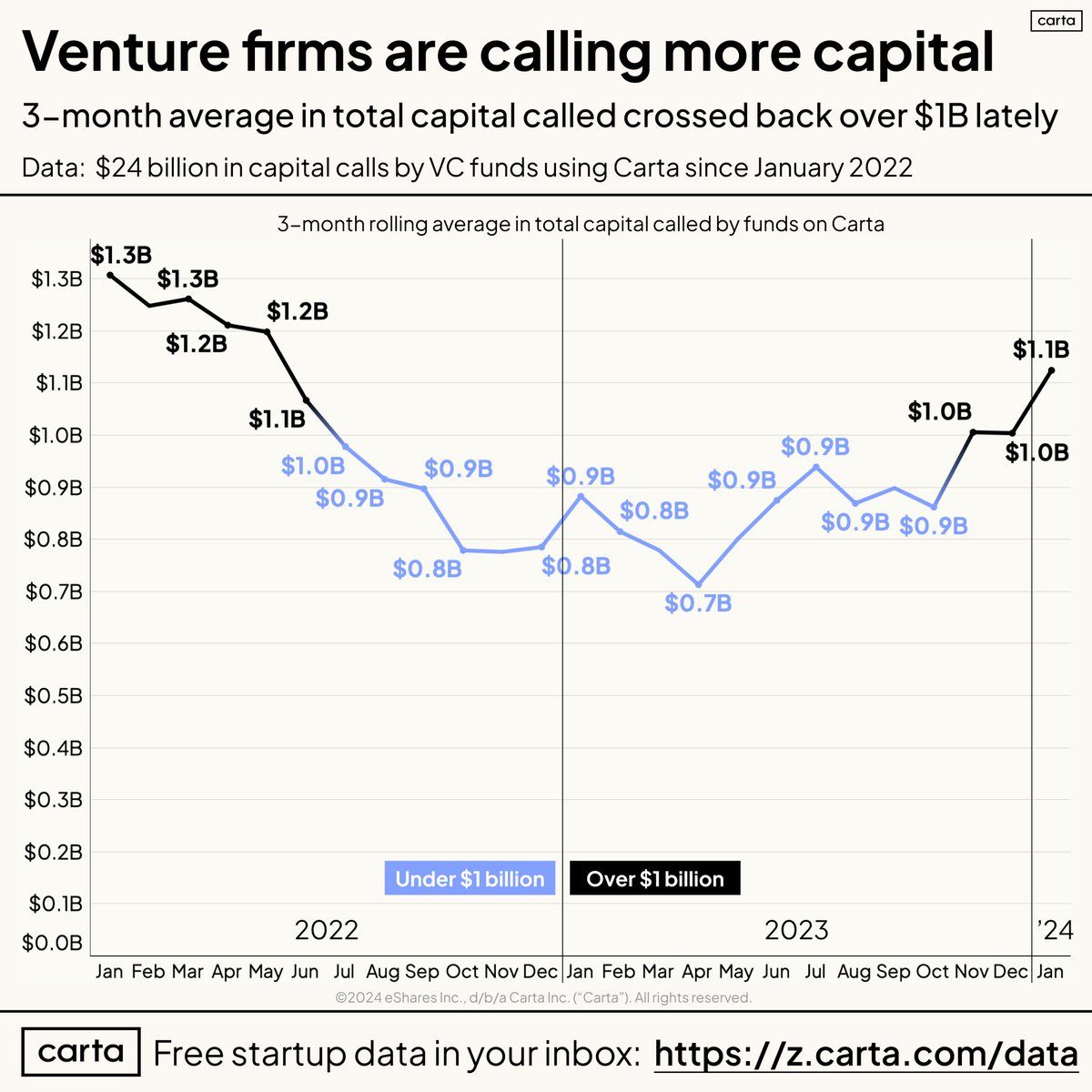

The VC landscape in 2024, with its AI funding boom and Series A crunch, shows the highs and lows of startup funding. While the below chart shows an uptick in called capital (VCs tell their LP investors to wire them money), most basically stopped investing the last year or so and mostly is going into late stage, already well funded Ai startups.

Family offices are stepping up to fund new Emerging Managers!

The job of an early stage angel / emerging manager pre seed funds is to invest in startups that can raise more money. Great team, product etc are really helpful but if the metrics you need don't meet what the next round investors want/need, then we cant invest. Generally this was going really well until 2021 when everyone raised a fund, every startup was awesome and markups were plentiful

Unfortunately now that we’re coming back to reality (in some ways), many of these first and second time fund managers will be unable to raise another fund. Emerging managers are going to have to get even more niche outside of Ai and hyped industries that requires millions to just start and/or higher valuations which kind of break the return model. Still lots of alpha / upside for new LPs to learn and get in early.

This is where I have found numerous family offices starting to build up their portfolio of impressive smaller GPs, who are the true scouts of the venture world. While it will continue to be a difficult, this will be the beachhead that establishes FOs are a solid foundation of the startup VC world.

My family has been attending and joining numerous family office chats, groups and events to learn more about the asset class. For smaller emerging fund raising their first or even second funds that are <$100M in size, it’s usually a mix of strategic operator/angels, net-worth who want exposure and Family Offices trying to diversify their holdings

This has been a very informative endeavor over the last year just meeting with countless other next generation professionals who come from multi generational family business. Our investments are 99% in highly risky, very early stage startups that are generally sub $10M in valuations - so it’s nice to meet other operators who actually run/own businesses that are cash flow positive and profitable. I’ve been advising numerous Family Offices on how our VC world works, the mentality it takes to diligence startup ideas and their founders, while trying to set expectations that this is a highly illiquid asset that wont see returns sometimes for a decade.

What does it take to go public?

99% of VC backed startup exits are via M&A which keeps getting blocked unfortunately… Figma, Plaid, Harrys and maybe more. The only other option is going public which is a long process, often several years. Companies need the following (via https://secfi.com/)

Financial performance: the right combination of scale, growth, a clear path to profitability, and in this market, if you have credible AI story to tell, that’s clearly a bonus

Top management team: a strong C-suite as well as a CFO that runs a tight ship, and who ideally has gone through this rodeo before

Proper reporting and controls: Companies need to have audited financials and robust internal controls to pass through the underwriting process and convince investors to buy stock

Underwriters and advisors: a company will pick several investment banks to help in the IPO process as well as Legal and financial advisors to help navigate all the complexities of an IPO

And now expectations are even higher - the startup must be doing $250-$500M in ARR and growing at least 30-50% YoY with a clear path to $1B in revenue. There are currently 1000 startups valued at $1B+.

Startup CEO pay: The average pay of startup CEOs has held steady over the past year to about $141,000.

Seed and Series A chiefs saw small increases (2.3% to $132,000 and 6.5% to $179,000, respectively), while Series B CEOs saw a 10% cut to $227,000, per new Kruze Consulting data.

My brother Maxwell (Peel Aways founder) and I also started a podcast - these are actually really fun to do! Check out the latest episode:

I also have been writing more blog posts as well, which I really enjoy!

New investments and updates

We’re still active writing $25-$50k checks into sub $15M valuations startups (60+ so far) and just wired our last investment two weeks ago into an amazing team that will significantly improve the writing process.

NO fintech, bio, education, insurance, crypto etc. Send me anything else :)

Upcoming event: Hamptons Tech Week

This summer will be the 3nd Annual Hamptons Tech Week June 4th-6th! We’re so excited to be involved in this amazing event and will be hosting the VIP opening party on the first night at our house.

Also some personal news because you made it this far that most people dont know… I’ve actually been working at American Express for the last year and a half. Yes the Fortune 100 financial credit card company as a B2B product manager for internal products. It has has been a truly unique and eye opening experience to go from the startup/VC world to corporate America but it has taught me a lot. Life is all about learning new things and gaining as much wisdom and experience as possible - I’ll write a much more longer post on this at some point but have 100% still kept my pulse on the tech world which I love!

Feel free to reply back with any questions and thoughts or unsub, whatever you want! Either way expect to get monthly/weekly moving forwards on timely topics like Ai, acq/M&A and other industry news as it happens.