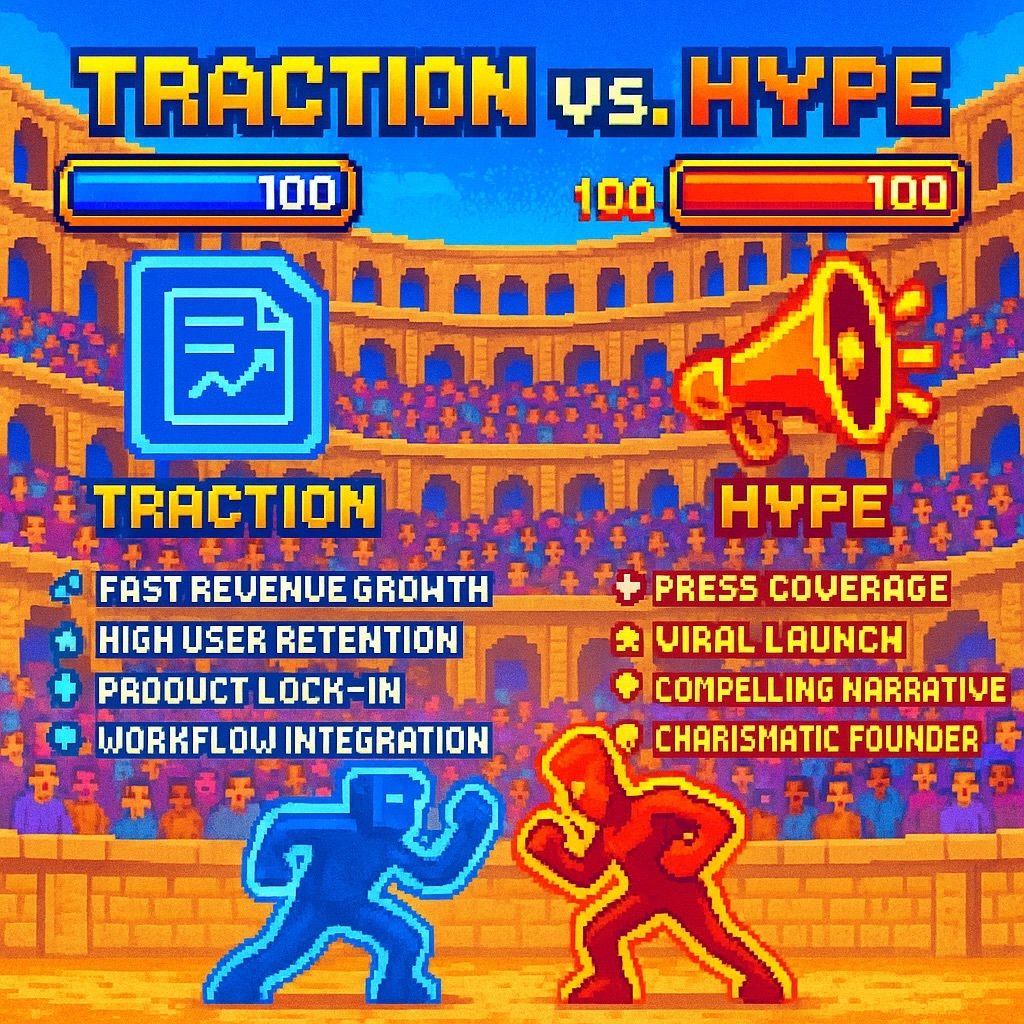

Since 2020, especially in the AI sector, venture capital fundraising has increasingly bifurcated into two contrasting approaches. On one side are startups that methodically build robust products, accumulate a loyal user base, and allow their traction to speak louder than their pitch decks. These companies emphasize sustainable growth, retention, and predictable revenue as the basis for scaling. On the opposite end are startups that prioritize awareness and excitement, leaning heavily on attention-grabbing narratives, public persona, and virality to raise capital before the core product is fully formed or validated by the market.

Both approaches can lead to significant capital injections, but the long-term sustainability of those companies often depends on how well the initial strategy evolves into substance. The reality is that while hype can earn a seat at the table, only real traction keeps it. As venture capital firms adapt to more rigorous standards post-ZIRP, the pressure on startups to demonstrate revenue and defensibility has never been greater.

Cursor vs Cluely: Two Contrasting Models

Consider Cursor, a developer-centric AI tool built on top of VSCode. In a staggering growth sprint, Cursor went from zero to $100 million in annual recurring revenue (ARR) within approximately a year. This meteoric rise beat out several of the fastest-growing SaaS companies in history, including Deel and Ramp. Cursor’s product offered immediate and tangible value to developers, seamlessly embedding into existing workflows while enhancing efficiency. With a low price point of $20 to $40 per month and exceptionally high usage frequency, Cursor achieved deep product integration and strong user loyalty. These dynamics translated into high switching costs, which established a natural moat and made the business highly defensible.

Cursor focused on product first. They didn’t seek to manufacture excitement or generate unnecessary hype. Instead, they relied on cold, hard numbers. Their impressive metrics and sticky usage pattern led to a $2.5B valuation with strong interest from top-tier investors after the press of $100M+ revenue which kept snowballing to a $9.9B valuation in their last round.

Now contrast that with Cluely, an AI startup that took a dramatically different approach. Cluely’s 21-year-old founder generated massive public attention through viral videos and a provocative narrative around an AI product that purportedly helped users manipulate everyday interactions and systems. With little product maturity and minimal user traction at the time, Cluely raised a $5 million seed round, quickly followed by a $15 million Series A, all on the back of distribution and visibility. It was a masterclass in raising capital through attention, not product adoption.

Cluely’s strategy delivered results in the short term, but now the company faces the real test: can it turn millions of eyeballs into long-term users and paying customers? Future rounds will depend less on sizzle and more on steak. Investors will want usage metrics, revenue growth, and engagement data, not just trending videos.

Why the Traction-First Model Works

Startups that follow a traction-first path often experience more sustainable growth. They demonstrate clear, quantifiable proof that customers find value in their solution. When investors see real adoption, they see reduced risk. The strongest indicators of traction include:

📈 Monthly recurring revenue (MRR) that is growing steadily and predictably

🔁 High user engagement and deep integration into customer workflows

📉 Low churn and high retention rates

💰 Meaningful customer lifetime value

🔄 Positive feedback loops that improve user acquisition efficiency

Well-known traction-led examples include:

Harvey AI, which serves legal firms with tailored AI capabilities. In just two years, Harvey scaled to $75 million in ARR and secured enterprise contracts that helped justify its $5 billion valuation. Their traction was rooted in real B2B usage.

ElevenLabs, a voice generation platform, capitalized on the rise of synthetic media to grow from $25 million to $90 million in ARR in a year. Their traction came from serving creators and developers with an easy-to-integrate, API-first product.

Ramp and Deel, though not strictly AI, demonstrate how product-led growth can scale quickly in fintech. Deel hit $100 million ARR in 20 months, while Ramp did so in 24 months. Both achieved remarkable growth by focusing on solving specific pain points with superior UX.

Traction not only validates product-market fit, it also gives founders leverage. With the right metrics, you’re not chasing money. Investors come to you.

The Hype-Driven Approach

While more volatile, the hype-driven strategy can unlock capital and awareness quickly, especially for consumer or platform startups. These companies capitalize on:

🎤 Founders with strong online personas or viral content

🧠 Engaging brand stories or provocative messaging

🌱 Early community growth, even before a monetized product exists

Some illustrative examples:

Cluely, as mentioned, turned massive social engagement into a $15M Series A despite lacking fully functional product-market fit.

Character.AI raised $150 million at a $1 billion valuation while still pre-revenue. Their appeal stemmed from over 20 million monthly users and a growing cultural relevance, even though monetization was just beginning.

Stability AI saw early success by open-sourcing Stable Diffusion, leading to widespread visibility and usage. However, it struggled to turn that into revenue, ultimately leading to internal restructuring and financial instability.

The downside of a hype-first approach is simple: if the momentum doesn’t translate into metrics, capital dries up quickly. Series B and beyond is a metrics game, and hype without numbers almost always leads to a down round, recap, or worse.

Why Moats Make the Difference

Regardless of your fundraising strategy, having a defensible moat is what makes startups investable at scale. Without a moat, even the most exciting startups are vulnerable to competition. Moats can take many forms:

🧩 Integration into core workflows that make switching costs high (Cursor, Harvey)

🧬 Access to proprietary data that improves model performance (vertical AI)

🌐 Network effects that improve product value with every new user (Character.AI)

💎 Strong brand equity and developer loyalty (ElevenLabs)

Building a moat isn’t optional. It’s what separates startups from features and long-term companies from flashes in the pan.

Strategic Tradeoffs for Founders

Founders must be intentional. Early-stage capital is still attainable with a strong story, but to move from vision to enduring business, substance is required. Startups need to balance short-term exposure with long-term strategy. A founder must ask:

🎯 Does my current audience represent long-term customers?

📊 Am I optimizing for user acquisition or user retention?

⚙️ Are my resources going to product development or brand visibility?

By the time you reach Series B, the questions become more specific:

📈 What is our net dollar retention?

🚀 How efficiently are we acquiring users?

💡 What’s our LTV to CAC ratio?

Hype will never answer these. Only traction can.

HR is lonely. It doesn’t have to be.

The best HR advice comes from people who’ve been in the trenches.

That’s what this newsletter delivers.

I Hate it Here is your insider’s guide to surviving and thriving in HR, from someone who’s been there. It’s not about theory or buzzwords — it’s about practical, real-world advice for navigating everything from tricky managers to messy policies.

Every newsletter is written by Hebba Youssef — a Chief People Officer who’s seen it all and is here to share what actually works (and what doesn’t). We’re talking real talk, real strategies, and real support — all with a side of humor to keep you sane.

Because HR shouldn’t feel like a thankless job. And you shouldn’t feel alone in it.