Family Offices (FOs) and Ultra/High Net Worths (HNW) are the key source of capital for small, early stage venture capital managers. Generally they will write at least $100k to multiple millions into 1st, 2nd and 3rd funds usually $5-$50M in size before the institutions, endowments, pensions etc will consider it. So you can thank countless of them for kind of fueling the early stage venture capital and startup ecosystem, because without them, there almost wouldn’t be one.

But who are they, where do you find them and what do they actually know about the tech, startup and VC world? I meet with a lot of them to talk tech, startups and VC via the groups, events and whatsapp chats I’m in - like investors, they’re in search for deal flow as well.

What is a Family Office?

A family office is a private firm (sometimes just the immediate family members) that generally employs people outside the family, that manages the financial affairs, typically with a net worth of over $100M. There are two primary types:

Single-family offices (SFOs): Manage the wealth of a single family like the name says but can still be very large.

Multi-family offices (MFOs): Manage the wealth of multiple families, often acting as more institutional investors and combining forces for better deals.

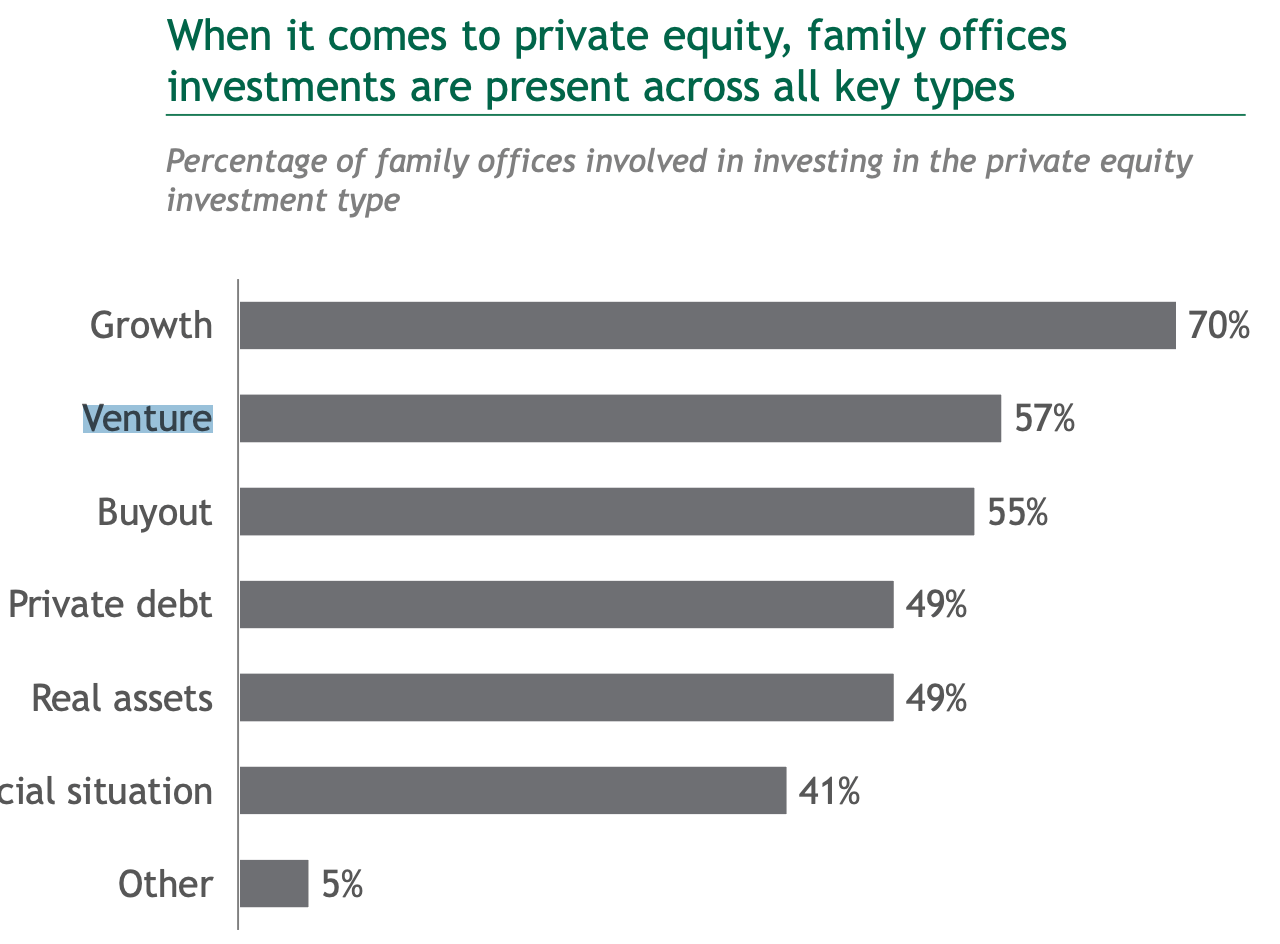

Family offices often manage investments, estate planning, tax optimization, and philanthropy. These entities can differ vastly in their understanding of tech investment, especially since many come from traditional industries like real estate or legacy wealth.

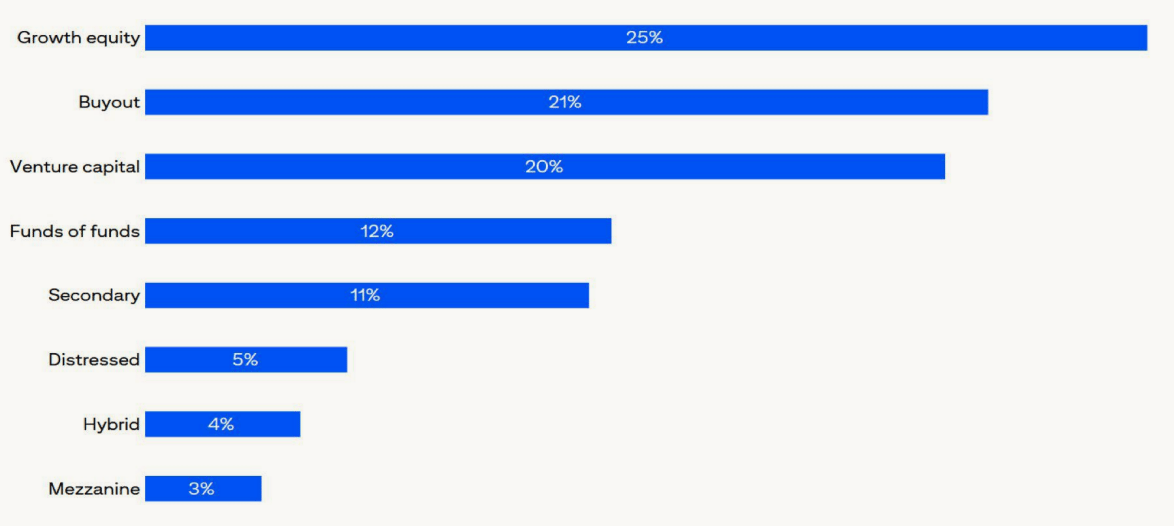

Together, growth equity, venture, and buyout allocations accounted for two thirds of respondents’ capital inflows into private equity funds

Common Wealth Sources for Family Offices

Family offices often derive their wealth from a wide variety of sectors mostly outside of our very visible tech world so they can be very hard to find. If they want to be found at all…

As of 2023 there were 10,000+ families worth $100M+ in the US, with over 700 in NYC alone - report here

Entrepreneurship (25-35%)

A significant portion of family offices originates from entrepreneurs, particularly in sectors like consumer goods, manufacturing, and technology. Over the last decade, tech entrepreneurs have notably joined the ranks, driven by large exits through IPOs or acquisitions. These family offices often only span one or two generations, given the recent nature of their wealth creation.Finance and Investments (15-25%)

Family offices with roots in hedge funds, private equity, and broader financial services are common. Banking dynasties and hedge fund managers frequently create family offices to manage and grow their wealth, often using sophisticated investment strategies and remaining actively involved in financial markets. Hard to explain not being profitable to them…Real Estate (10-20%)

Real estate remains a cornerstone of multi-generational family wealth. Many family offices are built on wealth generated from commercial and residential developments, particularly in high-demand urban areas. This category often spans several generations.Legacy Wealth/Old Money (10-15%)

Family offices rooted in legacy industries like oil, agriculture, or mining tend to be conservative, with a strong focus on wealth preservation. These families typically span multiple generations and are cautious investors, often focusing on traditional asset classes.Pharmaceuticals and Healthcare (5-10%)

Families who have built wealth from pharmaceuticals, healthcare services, or medical device companies form a notable subset of family offices. Many of these families have benefitted from the creation of blockbuster drugs or innovations in healthcare technology.Technology (5-10%)

You think you know all the successful tech exits and their founders but you would be surprised by some random ones you never heard of. Unlike the other groups, this really only goes back really 1-2 generations so they’re relatively up to date and in our world.

Entertainment and Media (5-8%)

Hollywood actors, media moguls, and sports figures who have accumulated wealth in entertainment often turn to family offices to diversify their portfolios. They typically focus on preserving their fortunes through investments in sectors like real estate and private equity but dabbling in tech startups is cool and fun.Luxury and Fashion (3-5%)

Families that built wealth in the fashion or luxury industries, including beauty brands, tend to diversify through their family offices, often investing in real estate or high-end consumer sectors, so more CPG, DTC usually.Energy (Traditional & Renewable) (3-5%)

Wealth created through traditional energy sectors like oil and gas remains significant. However, family offices are increasingly being formed by families involved in renewable energy, where they often invest in sustainable ventures or real estate.Retail and E-Commerce (3-5%)

Retail chain founders, especially those who pioneered online retail and e-commerce platforms, are rapidly forming family offices. This trend has accelerated due to the recent growth in online shopping and digital marketplaces.Industrial Conglomerates (2-4%)

Families with wealth rooted in heavy industry, including steel, automotive, and chemicals, often operate highly diversified family offices that maintain a relatively conservative, risk-averse approach to investing.Natural Resources (1-3%)

Timber, mining, and other extractive industries have also produced family offices, many of which take a cautious approach to investing, often focusing on tangible, real asset investments like land and natural resources.Transportation and Logistics (1-3%)

Wealth generated through shipping, logistics, and transportation, particularly in global trade hubs, forms another category of family offices. These family offices often have close ties to infrastructure and international trade sectors.

Categorizing All These Family Offices into Three Buckets

Family offices come in varying degrees of sophistication, particularly in their approach to venture capital. Based on their backgrounds and level of experience, they can be categorized into three broad groups:

1. Strategic Investors (Experienced and Active in Tech)

These family offices are heavily involved in tech, having made strategic investments and maintaining strong in-house expertise. They:

Actively seek venture capital opportunities and often co-invest with VCs.

Have dedicated teams or advisors focusing on innovation and tech.

Are typically involved in direct startup investments and partnerships.

VC managers should approach these investors with strong deal flow and an opportunity to partner strategically on ventures that align with their long-term objectives.

2. Semi-Strategic Investors (Moderate Experience, Some Tech Exposure)

These offices have dabbled in tech investments but don't have significant internal expertise. They:

Have made a few venture investments but remain passive.

Often follow peer recommendations and broader investment trends.

Are more likely to invest through VC funds rather than directly.

VC managers can educate this group, offering structured opportunities and highlighting how their fund can mitigate risk while providing exposure to innovation.

3. Non-Strategic Investors (Little to No Tech Knowledge)

These offices are largely unfamiliar with venture capital, investing mostly in traditional assets like real estate or finance. They:

May invest in venture capital only based on media hype or peer pressure.

Tend to be risk-averse and require extensive education on the benefits of tech investments.

To engage these investors, VC managers must build trust over time, offering transparency and focusing on wealth preservation along with growth potential. Tailoring the pitch to their conservative nature is key.

😂 MEME of The Week 😂

Always have an ask!

How has your experience with Family Offices been?

What’s your favorite FO conference?

Have a dog? You need a Fi smart collar tryfi.com

FIND ME: 𝕏 @Trace_Cohen / in LinkedIn

Where tier-one VCs get their news 📰

Get smarter about venture capital.

5x / week

<5 minutes / day

15,000 investors already subscribed

100% free forever

Sign up here 👇