A little Mario Cart Rainbow Road like…

The venture capital and startup world has been one hell of a rollercoaster ride since 2020 because of Covid/ZIRP. You can think of 2020-2021 as the heart pounding ride up to the top in the pitch black as you prepare for the big drop and rush. 2022-2023 is the crazy drop, hands in the air screaming hoping for it to end/bottom and 2024 so far are those tight turns around corners, spinning and being thrown in every direction holding on for dear life, not being able to really see what’s coming next…

Unfortunately that volatility doesn’t bode well for large and well funded startups trying to go public or get acquired because uncertainty doesn’t breed confidence. So what do VCs do when exits are difficult to come by and LPs are kind of over allocated with illiquid assets? The only thing you can do, buy more time.

What Are VC Secondaries and Continuation Funds?

VC secondaries involve the purchase of existing stakes in venture capital funds or their portfolio companies. This can occur through LP-led transactions, where limited partners (LPs) sell their stakes, or GP-led transactions, where general partners (GPs) facilitate the sale or restructuring of the stakes within their portfolios. Continuation funds, on the other hand, are specific types of GP-led secondaries where a GP transfers high-quality assets (startup equity) from an existing fund into a new vehicle (which they can own as well), allowing for an extended holding period and potentially new investment capital. Basically taking your best investments (you know which) and separating them out into a new fund because you think they have the best chance to exit in the next few years.

Continuation funds have seen a significant rise, primarily driven by the need for liquidity and the desire to maximize the value of VCs better investments. Yes they choose favorites! In 2023, GPs (PE + VC) closed on $78 billion in secondaries funds, with a substantial portion directed at providing liquidity to buyout funds. This marked a sharp increase from previous years and set the stage for what is expected to be a record number of continuation fund exits in 2024.

“It’s a great fund, performing really well, but it’s 13 years old… Imagine you put your money in 13 years ago. It’s a 10-year fund; you should have your money back in 10 years—and you don’t.”

We kind of bottomed out a year ago but it’s a slow rise back to “normal”

Valuation discounts have decreased from 46% in December 2023 to 31% in June 2024, indicating a more favorable transaction environment, per secondaries platform Zanbato.

Major players are increasing their focus on secondaries with dedicated billion-dollar funds, including a $1.45B 10th secondaries fund raised by Industry Ventures and a $3.3B fund closed by StepStone Group.

VC firm Lightspeed is looking to become a registered investment advisor, allowing the firm to deploy more than 20% of its funds into secondaries.

The lack of traditional exit opportunities, with only $49B in exit value generated in the first half of 2024, has also contributed to the growing importance of the secondaries market.

Buyers are selectively choosing the best assets rather than purchasing entire portfolios. Better than mortgage backed securities 😅

For VCs, this evolving secondaries market presents both opportunities for liquidity and potential investments in a challenging exit environment.

Via Pitchbook / Launch newsletter

Factors Driving the Growth

“Show me the money!” - Jerry Maguire

Liquidity Needs: The non existent exit environment has pushed venture funds towards secondary markets to deal with liquidity issues. With extended fund lifespans and high valuations, the pressure to return capital has increased, making secondary markets a vital tool to keep LPs happy.

Pick Your Favorite/Best: Continuation funds allow GPs to retain and manage high-performing assets by transferring them into new vehicles. This not only provides continuity but also attracts new investors looking for stable, high-return opportunities without the extended commitment of the initial fund / hopefully just a few years.

Discounted Prices: Secondary transactions often occur at significant discounts, sometimes averaging 60-65% of the reference date NAV for venture and growth interests. This provides an attractive entry point for investors, allowing them to acquire well known startups at lower prices.

Cant Stop, Wont Stop!

The tech startup VC world wont stop… that’s kind of our thing.

Fundraising Resilience: Despite macroeconomic challenges, secondary fundraising has remained robust. Global secondary volume reached $112 billion in 2023, with a notable increase in deal activity towards the end of the year. This trend is expected to continue into 2024, driven by record levels of dry powder.

Deal Volume: The GP-led secondary market is anticipated to drive significant deal volume in 2024. The momentum from the second half of 2023 has carried into the new year, with expectations of a strong performance across the sector.

Market Dynamics: The secondary market has demonstrated resilience, even as other areas of private equity and venture capital face slowdowns. This resilience is attributed to the growing demand for liquidity solutions and the strategic use of continuation funds by top-tier GPs.

Conflicts of Interest: The GP’s dual role in continuation fund transactions can lead to perceived conflicts of interest, especially regarding the pricing and terms of the portfolio companies being transferred.

Market Volatility: The secondary market, while resilient, is not immune to broader economic volatility. Changes in interest rates, market sentiment, and global economic conditions can impact deal flows and valuations.

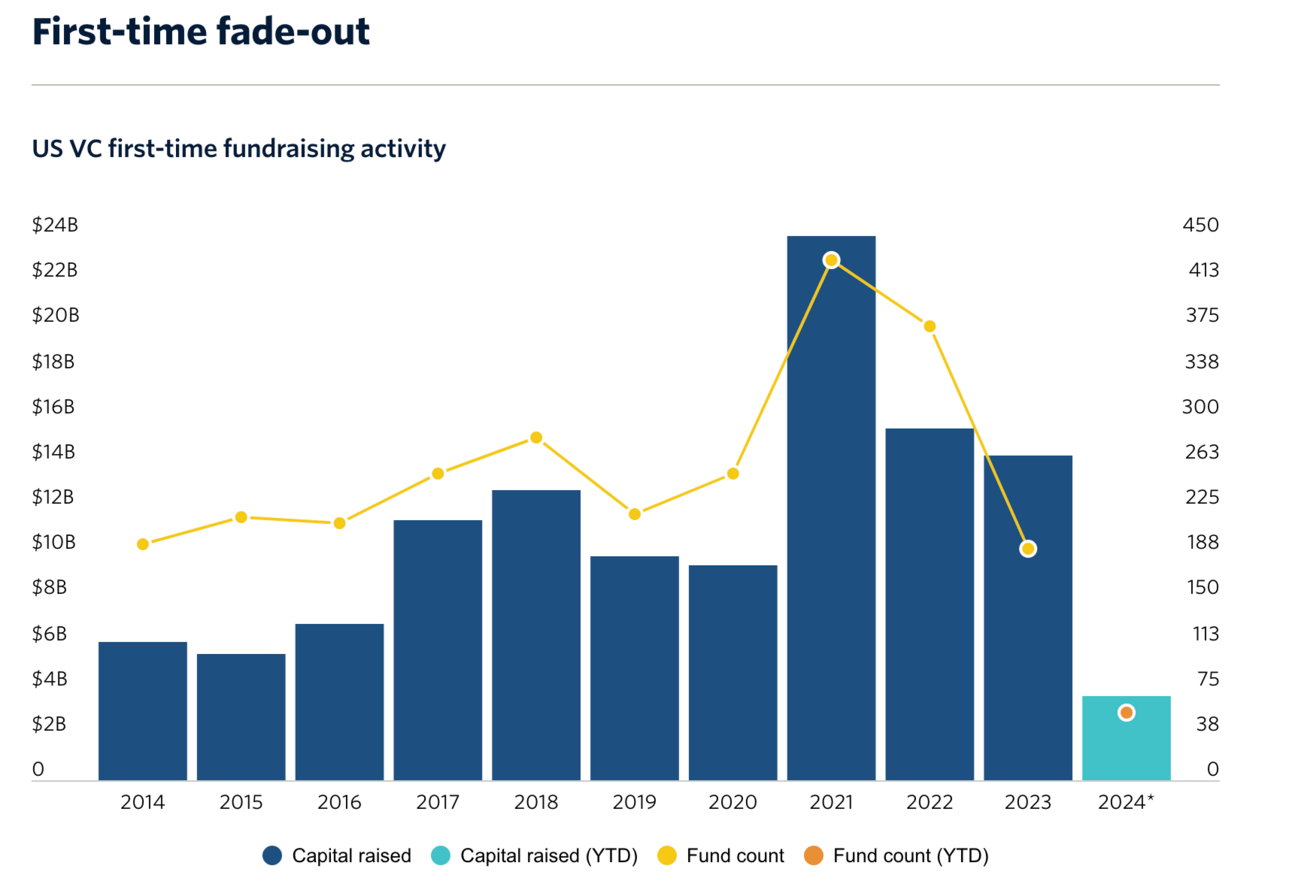

Current VC LP Fundraising in 2024 is Still Really Tough For Emerging Managers…

Not good.

For the BIG, well known and established venture capital firms it’s been a particularly good 2024. Top-tier VCs like Andreessen Horowitz, Sequoia Capital, and Lightspeed Venture Partners have been able to secure billions from LPs. For example, Andreessen Horowitz recently announced raising over $9 billion across multiple funds, while Sequoia Capital closed on $8.5 billion for its latest global growth fund. Lightspeed Venture Partners also successfully raised $1 billion through a continuation fund featuring high-quality assets from its portfolio.

This trend indicates strong investor confidence in established venture capital firms, driven by their track record and the quality of their portfolio companies. The ability to raise large funds also positions these VCs to capitalize on secondary market opportunities, further fueling the growth of secondaries and continuation funds.

Emerging Fund Managers on the other hand generally dont have any DPI and large LPs cant write smaller checks into them. Hence my last newsletter on Family Offices coming to save the day - so go help, hug and support your early stage friends!

😂 MEME of The Week 😂

Always have an ask!

When do you think the startup market will recover? I think 2025 to 2026 will be so much better - what do you think?

Israeli startup Wiz walked away from a $23B acq offer by Google!?

I’m looking to meet with some pre/seed Israeli startups and investors if you know any.

Hospitality operators? Check out marqii.com

FIND ME: 𝕏 @Trace_Cohen / in LinkedIn / [email protected]