Better business banking, from idea to IPO

Rho is the business banking platform with everything you need to manage your company cash and scale your business. Apply in minutes and enjoy 24/7 customer support plus enterprise-grade spend management – all with zero monthly, wire, or ACH fees.

Two business bank account options, one powerful platform.

Operate with stress-free banking, $0 ACH and wire fees.

Getup to $75M in FDIC deposit insurance to secure non-operating cash while earning yield.

Banking services provided and cards issued by Webster Bank, N.A., Member FDIC. International and foreign currency payments services provided by Wise US, Inc. Treasury Management services provided by American Deposit Management, LLC. All Rights reserved. © 2019-2024 Under Technologies, Inc. DBA Rho Technologies. Rho is a trademark of Under Technologies, Inc. Rho is a fintech company, not a bank. Rho partners with FDIC-insured banks to offer banking products and services.

Thanks to everyone for sharing and providing a lot of feedback on Part 1 of this series a few weeks ago that was really helpful. I’m going to keep emphasizing it though to make sure everyone understands how difficult it is for Emerging Managers to raise a fund right now. It’s really hard!

There will be huge repercussions if the earliest and riskiest investors don't have the money to seed the startup environment - less founders will be able to start companies. Yes yes I know “Trace you don’t have to raise money to start a company!” To which I say you’re right BUT some do; while it’s not for everyone, we the angels and VCs, are only in business because they need to raise capital. The proverbial pendulum has swung back towards investors being in control for everything that isn’t Ai hype.

We also have to consider all the orphaned and zombie startups that have raised a few million to even hundreds of millions that can’t raise anymore and/or exit (there are 1000+ unicorns worth $1B+). It’s really heart wrenching to meet some of these founders who know they’re between a rock and a hard place - they’ve worked years and will never see any liquidity. While the odds were always against them, the reality is starting to set in and they wont just shut down their company because of employees, a sense of failure to themselves, friends/family and their investors. They are their startup.

I wanted to share two more charts before we jump into the Q&A to get to know some Emerging Managers and support them. Statistically, smaller funds have a better chance of returning more money. Yes, it’s a bit skewed as smaller funds and earlier, lower valuations make it more likely that an investment will have bigger multiples. However, as I mentioned in the last post, while they have a higher ceiling, they also have a lower floor. Hence, bigger LPs tend to play it a bit safer since those alpha returns are still outliers. This is where numerous Family Offices and high net-worth individual are really starting to step up - I’ll dive into that in a future newsletter.

This is an interesting chart that that basically everyone agrees with - if you want a higher probability of returning more capital, you invest in smaller funds. This data is from 1976-2014 so take it with a grain of salt but no one will really refute it. The major issue is bigger LPs just cant really write smaller checks and smaller funds are more risky, so is it really worth it in the long run / 10ish years later?

And the chances of success are extremely low… Every VC fund deck targets 3x DPI, though only 1 in 20 historically have actually achieved that. So lets be clear that you dont invest in a VC fund to get rich - you dont even start one to get rich either - you invest to learn, get exposure, potential follow on opportunities and be in the game. It’s as much about skill, expertise and network as it is about luck and timing.

3X your investment back after 10yrs is an IRR of 12% and 4x is 15%, while QQQ has averaged 18% over the last 10yrs (yes you can do capital calls over time to increase IRR). This is why the VC world is an irrational and impractical industry because it’s all about outliers - we know the odds are always against us but we’re builders and chase dreams and visions that are sometimes a little crazy and/or delusional. As a startup founder you’re betting everything on one idea, while Emerging Managers are founders as well but get to bet on multiple startups, the risk is still just as high because it also really just takes one hit.

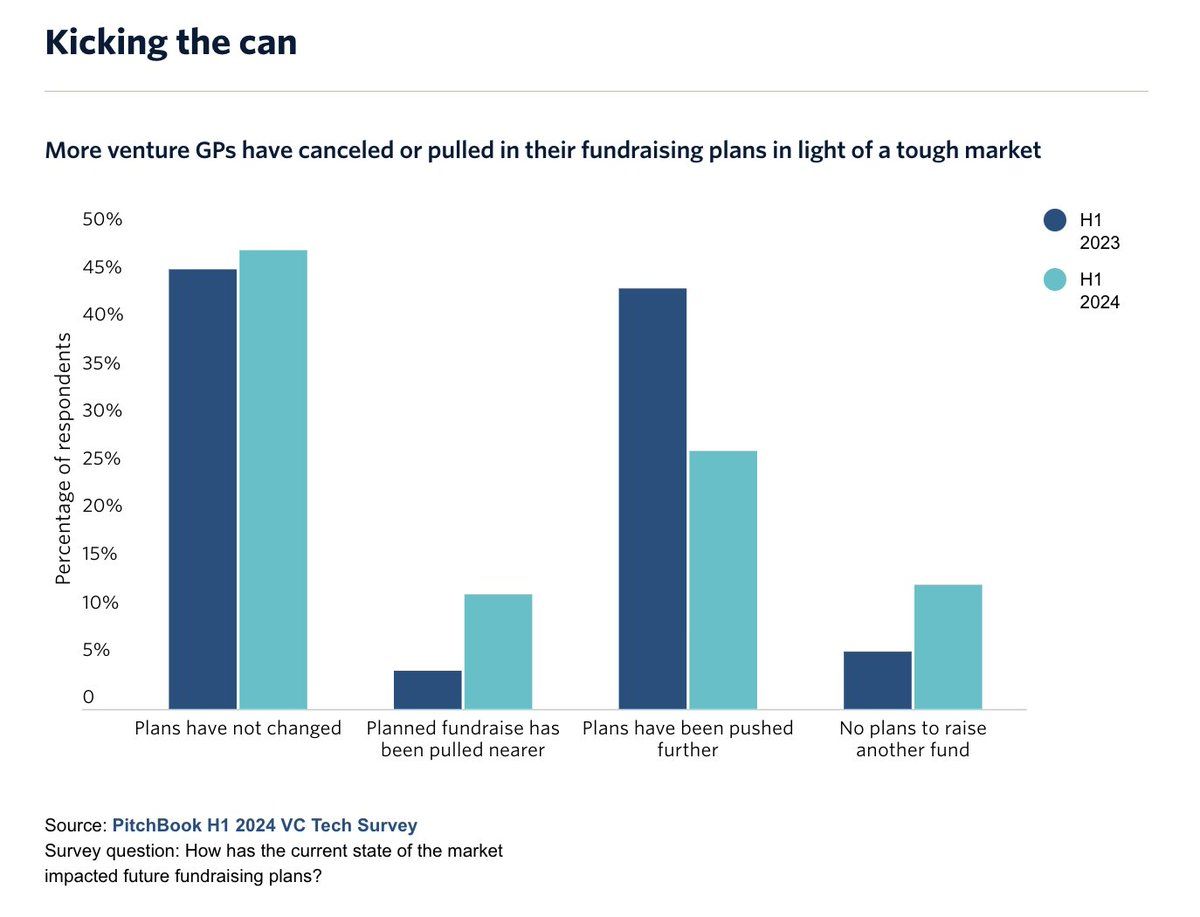

Unfortunately because of that risk and the fact that many people forgot how hard it’s supposed to be, we’re dealing with the repercussions. The graph above paints an interesting picture - many fund managers are trying to stay the course, others are trying to raise now while they can, while a small but growing few sadly are not going to continue. But as I mentioned a few weeks ago, roughly 40-50% of those trying to raise now wont be able to close a new fund, which will have serious repercussions as hundreds of investors will leave the industry.

Liquidity next year in 2025 will help alleviate a lot of issues. Hopefully when the IPO market opens back up - probably 20-30 startups are ready to go - plus some M&A that doesn’t get blocked by the government will really help. LPs need money back, which will then hopefully get reinvested, though not right away, back into the markets that will spur the beginning of the next tech startup market run.

Lets meet 3 Emerging Managers!

FYI I have no idea if any are raising a fund right now / this isn’t a solicitation for investment and this is not an endorsement of any of them

The Aligned Fund | Ariel Winton-Jones

What differentiates your fund from others in the market?

I started The Aligned Fund because I believe the path to maximizing value creation is to make a low volume of high conviction, well-researched bets - a practice that’s somewhat contradictory to the venture industry’s reliance on the ‘law of large numbers.’

To do this successfully, I believe it’s important to...

Focus on one stage and sector (in my case, B2B SaaS at the early stages of PMF), such that it's possible to go from the 100k ft view to the 5k ft view, ultimately driving a higher hit rate on investments through deeper diligence; and

Invest late enough that there’s qualitative (and quantitative) data to evaluate, but early enough that there’s still significant alpha to be captured.

That’s what I’m doing with the Aligned Fund - leading rounds into ~2 truly exceptional SaaS companies at the early stages of PMF per year, and pouring outsized time and resources into understanding and supporting those companies both pre- and post-investment.

What is your vision for the future of your fund, and how do you plan to achieve it?

I’m setting out to build a venture fund that has fully aligned incentives internally, with founders, and with its LPs. The path to this, in my view, is practicing venture that doesn't scale by maintaining a small, trusted team of full-stack partners that rows in the same direction and wins and loses together.

As a team, we’ll foster a close-knit, trusted community that gives founders a safe place to work through personal, strategic, and tactical challenges they’re facing without fear of judgment or repercussion. The founder journey is a rollercoaster ride, and The Aligned Fund provides the most exceptional early stage SaaS founders a support system to ground them through that journey.

Lorimer Ventures | Zach Magdovitz

What value do you bring to portfolio companies beyond capital?

Lorimer Ventures is a $10M operator fund led by partners who've scaled Product, Strategy, and Finance teams from 0 through IPO. Our goal is to be, dollar-for-dollar, the most valuable investor on your cap table. This manifests through design partner introductions, helping founders find, close, and retain top talent and helping founding teams build an enterprise grade FP&A stack. Our hero metric is we've placed over 50 hires in the first 20 employees across our portfolio companies. We know these areas can have an outsized impact at the crucible moments in the early stages of company building and we look to help derisk them across our portfolio.

What characteristics do you look for in founders before investing?

The 3 main characteristics we look for in every founder we back are:

Are they a talent magnet? From the first call, we utilize our talent network of experienced operators to help us assess whether or not the team has the necessary charisma, intellect, or skillset to close the best candidates in the market. In our experience, this is one of the best early indicators of success.

Do they have a unique insight? What do they believe to be true that nobody else understands or sees yet? Are they convincing, rigorous, and thoughtful about the validation process to prove that out?

Is there founder market fit? We do a lot of references to understand what drives the founding team to solve this problem and why. Do they have the requisite chip on their shoulder/drive to change the market in a meaningful way?

Space VC | Jonathan Lacoste

Tell me about how the typical startup in the industry starts / raises capital:

One of the reasons for the VC interest in space and defense tech is due to the substantial scale of non-dilutive capital increasingly available to venture-backed startups from the U.S. Government. Whether from the annual Department of Defense budget or the generational investments made from the CHIPS Act, IRA, Bi-Bipartisan Infrastructure Bill — building hardware-oriented, capital intensive companies no longer requires as many equity dollars (and therefore, dilution).

We frequently see teams close several million dollars in the first few months of operations, unheard of for typical B2B software companies. One of our defense tech startups closed nearly $20M in non-dilutive funding in their first 12 months. This shift has enabled entrepreneurs to build hardware companies in space & defense tech more quickly and more capital efficiently than before.

😂 MEME of The Week 😂

Always have an ask!

Are you an Emerging Manager or know of one I should highlight in the next part? Reply back.

What are your thoughts on the Series A crunch right now? What metrics are working / not working?

Want to protect your kids online while playing games? Check out https://getkidas.com/

Please share this with your friends/network! twitter.com/Trace_Cohen