The period from 2020 to 2021 was an extreme anomaly, where rational thinking and sound decision-making took a backseat. We were intoxicated by easy money and reckless behavior, which inevitably hit a wall when the first interest rate hike arrived.

Personally, I stopped angel investing in February 2022 because all my friends at the Series A and beyond seemed to vanish, leaving me in a position where any new investment wouldn’t be able to secure follow-on funding. While it’s crucial to back great founders, it’s equally important to invest in startups that can continue raising capital—no new investors means a higher risk of failure. And, unfortunately, that’s been the case for many companies over the past couple of years.

That said, we’ve made six angel investments over the last two years, four of which were repeat founders we know well, all of whom had prior exits and returned to their original investor base. Remember to love those that love you first 🙂

That doesn’t mean venture capital is dead or dying, just badly wounded right now — it’s simply shifting back to “normal.” Unfortunately, this also means that many investors who entered the space driven by FOMO and hype are exiting. As a result, there’s less funding available for both new and existing startups, contributing to the current “startup apocalypse” we’re seeing, with VC fund formation shrinking by over 50%.

You need to remember a few things though:

Investors are in the business of exits, not investing (more on that later)

We invest for where we believe the future will be in the coming years. Our startups need to keep raising capital to grow

It takes 8-12yrs to get a significant exit, so while we live in the now, it shouldn’t entirely affect our expected outcomes.

Our liquidity engine has definitely stalled, and there's no denying it—exits are the lifeblood of our industry, essential for providing returns to LPs and keeping the capital flowing. It’s understandable that this creates a lot of doom and gloom. But if that’s your mindset, feel free to step away—no one’s holding you back. Just know that if you keep complaining and being pessimistic, we’re all quietly taking note of who the real startup players are and who’s losing their edge.

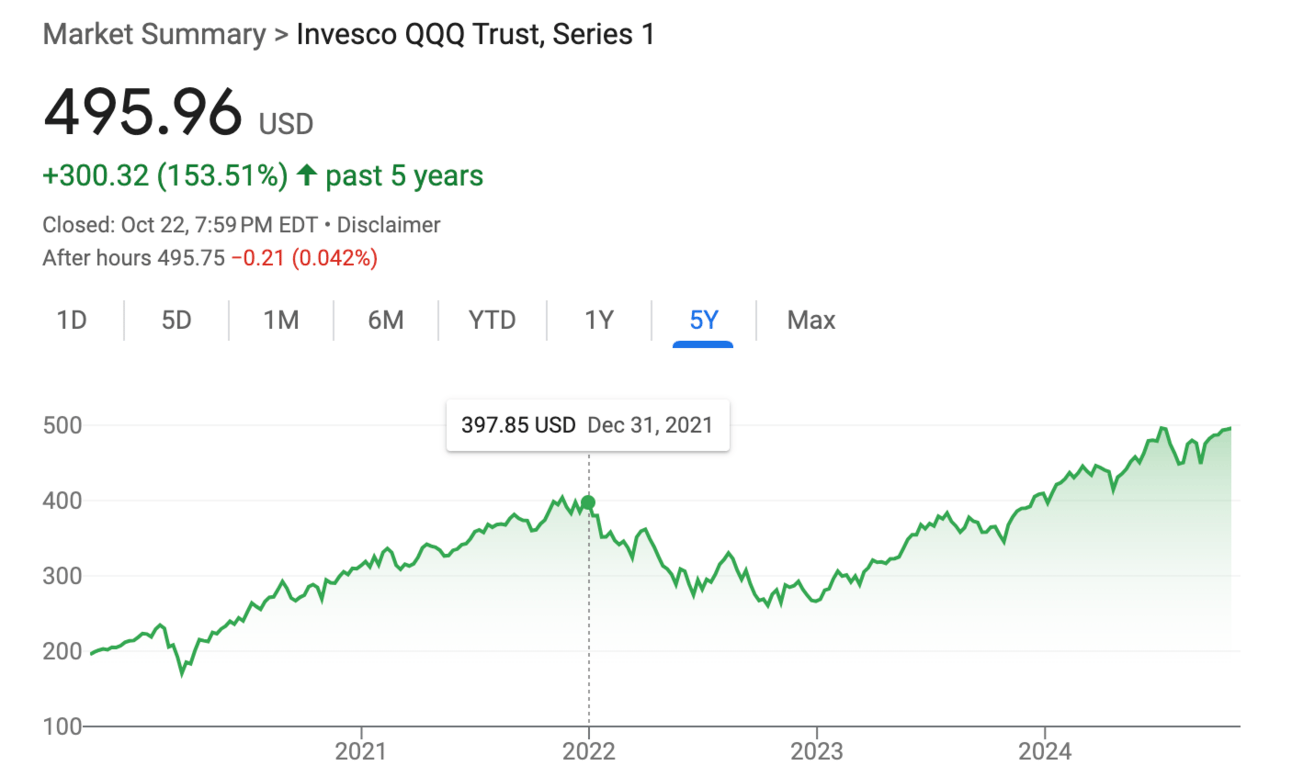

“The S&P 500 has advanced 23% year to date, roaring through 47 record highs in the process”

The stonk market is at all time highs!

And yet US LPs have pulled back significantly on investing in VC funds - mostly international LPs buying up all the legacy funds. At the early stages it’s all high net worth and FOs that keep Emerging Managers going and they are starting to lean in again but it’s still not easy. Expectations are higher than ever and track records are really setting funds/GPs apart right now.

We all know once a few IPOs and some major M&A happen though mid 2025 and the flood gates open, everyone will come back rushing in like nothing ever happened. So make sure you’re prepared and ready to rumble again!

Some of our most iconic companies started during the Great Financial Crisis - constraint breeds creativity!

😂 MEME of The Week 😂

Always have an ask!

How many startups/funds have you invested over the last year?

When do you think IPOs and M&A will come back?

Have a dog? You need a Fi collar tryfi.com

FIND ME: 𝕏 @Trace_Cohen / in LinkedIn

10x Your Outbound With Our AI BDR

Imagine your calendar filling with qualified sales meetings, on autopilot. That's Ava's job. She's an AI BDR who automates your entire outbound demand generation.

Ava operates within the Artisan platform, which consolidates every tool you need for outbound:

300M+ High-Quality B2B Prospects

Automated Lead Enrichment With 10+ Data Sources Included

Full Email Deliverability Management

Personalization Waterfall using LinkedIn, Twitter, Web Scraping & More