I. Introduction & Evolution

Over the past decade, enterprise technology has moved through several layers of transformation. The transition from legacy on-premise systems to cloud-based SaaS reshaped procurement, revenue models, and organizational structure. Firms adopted subscription models, multi-tenant architectures, and continuous delivery. Vertical SaaS emerged as founders realized that generic tools often failed to address domain-specific needs—compliance, regulation, workflow, data structure—for industries like healthcare, finance, legal, manufacturing, and property.

Now we are in the early innings of what may become the Vertical AI wave: intelligent systems tuned to specific industries, capable of prediction, generative content, automation, and domain adaptation. The arguments for this wave are strong:

Industry workflows are inefficient. Data is often siloed, manual processes remain extensive. AI models tuned for vertical contexts promise step-change improvements.

Enterprises, particularly in regulated domains (healthcare, finance, government), require trust, interpretability, safety—vertical AI must build those in from the ground up.

Innovation currently is iterative. Rather than revolutionary leaps, the progress looks like successive model improvements, new tools for safety and alignment, better infrastructure, more optimized compute, more efficient data handling. Domain-fine tuning, latency reduction, cost of inference, and specialized models are becoming differentiators.

A good analogy: imagine building a transcontinental railway. The locomotives are already powerful (big tech, foundation model firms). Still, countless rails, bridges, stops, service lines (data pipelines, domain-specific models, enterprise integrations, regulatory approval processes) must be laid. Many early stage startups are laying those rails. Some will be on the train’s front in a few years; many will haul the line from behind, but without them, the train cannot run at scale through difficult terrain.

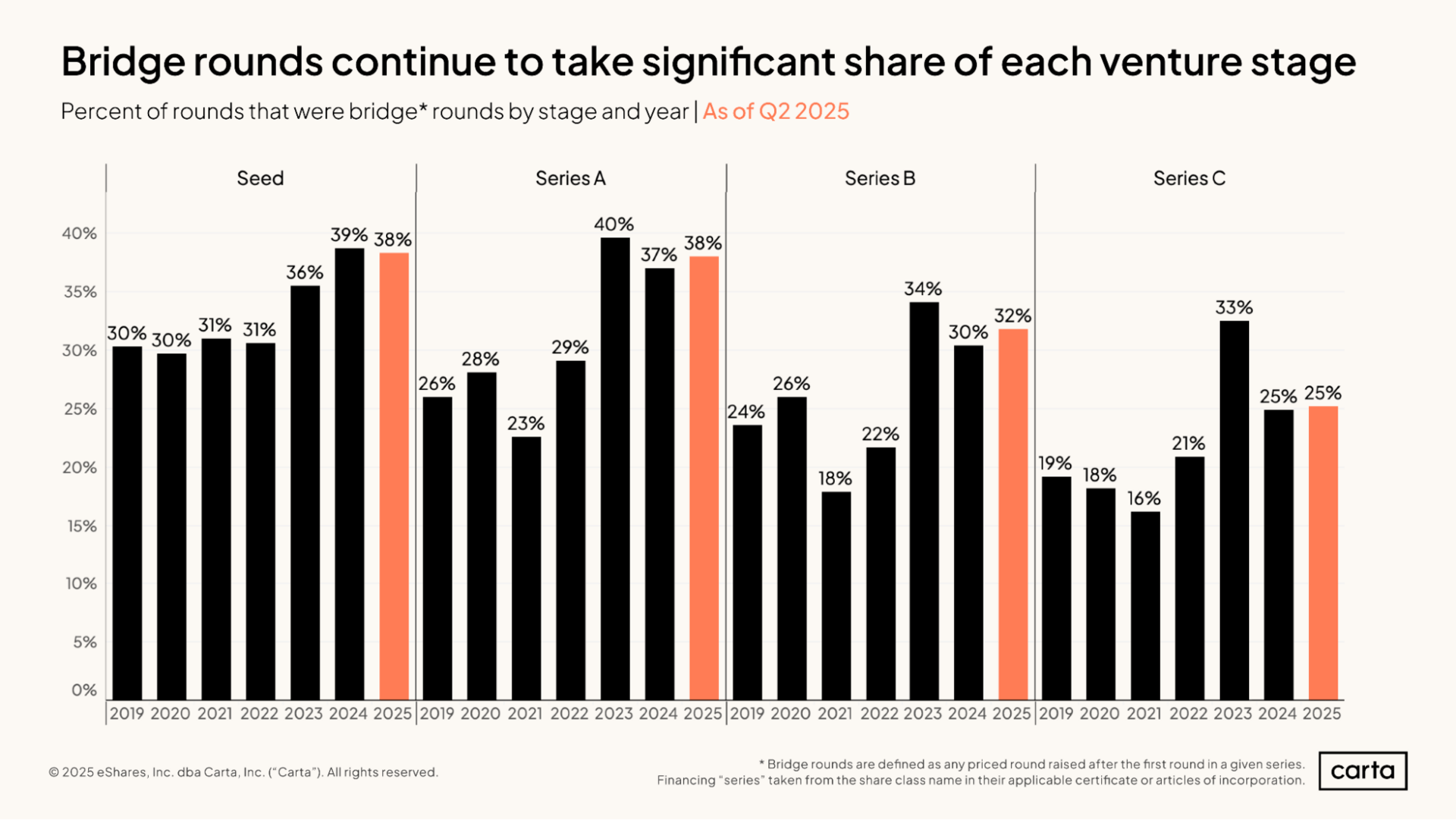

The thesis of this report: we are still very early in vertical AI. Venture capital is frothy, valuations high, and many use-cases remain proofs of concept. But the investments of today are building the foundations—compute infrastructure, domain-adapted models, regulatory compliance, safety/interpretability, and vertical deployment paths. For investors focused on pre-seed, seed, Series A/B in vertical AI, there remains considerable opportunity, especially in underexposed verticals.

II. Current Market Dynamics

In 2025, the Vertical AI market reflects massive investment, rapid valuation growth, active mergers & acquisitions, but also clear gaps in enterprise deployment and risk.

Investment Scale & Trends

As of mid-August 2025, AI-related funding globally had reached approximately US$118 billion, surpassing full-year 2024 totals in many regions, particularly for early-growth and infrastructure plays.

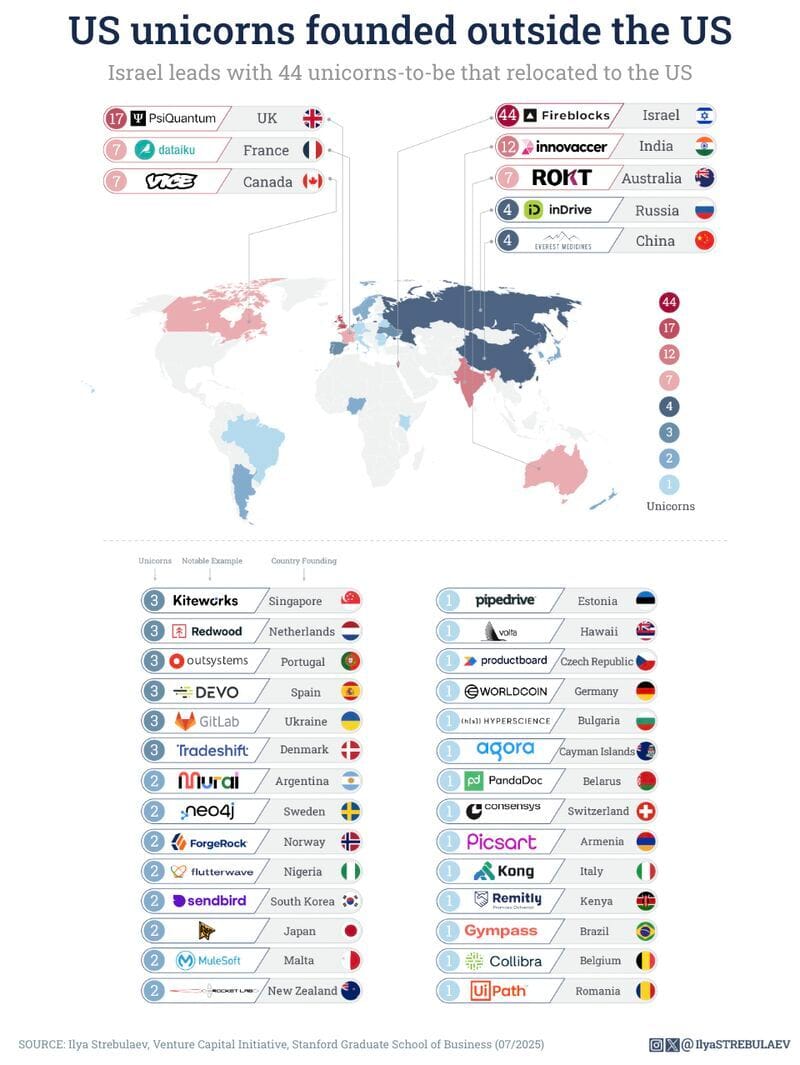

U.S. AI startup funding remains the largest single pool. Israel has also been a standout: generative AI startups alone have raised over US$20 billion to date, with 342 Israeli generative AI startups that have raised at least US$1 million in disclosed funding.

Among U.S. AI startups, 33 had raised $100 million+ by late August 2025. These include enterprise search, vertical infrastructure, foundation model firms, and specialists in domain-specific AI tools.

Deals, M&A, and Exits

M&A activity in AI has surged. In H1 2025, AI M&A deal volume increased by ~35% year-over-year in many markets.

Notable enterprise tech deals: Google’s proposed acquisition of cloud security company Wiz for approximately US$32 billion is among the largest vertical AI-adjacent deals this year.

Recent strategic acquisitions by publicly traded enterprise software firms include Atlassian buying DX (developer productivity / engineering workflow insights) for about US$1 billion. This underscores how large SaaS players are buying upward into vertical AI-adjacent intelligence tools.

CrowdStrike acquired Pangea Cyber (~US$260 million) to improve AI security lifecycle capabilities, particularly given rising concerns about AI exploitation vectors

Workday acquired Sana, an AI-native learning and knowledge management platform, for ~US$1.1 billion. This reflects corporate moves to embed AI in HR / knowledge workflows

Adoption Gap & Hype vs. Reality

Despite widespread funding, many enterprises remain in experimentation mode. Use cases often remain “non-core”: marketing personalization, customer support automation, administrative assistance rather than mission critical operations.

Regulatory, safety, interpretability, liability issues slow adoption in sensitive verticals.

Enterprise procurement cycles are long; integration with legacy systems takes time.

III. Geographic Focus

While the forces of Vertical AI are global, two geographies—United States and Israel—stand out in magnitude, innovation, and dynamics.

United States

The U.S. remains the primary center for capital, talent, infrastructure, and large enterprise customers. Most of the late-stage valuations, mega-rounds, and foundation model labs are here.

Some major recent activities include: CoreWeave’s IPO (raising US$1.5 billion), its contract with OpenAI worth ~US$12 billion over five years; Databricks paying ~$1 billion to acquire Neon, a serverless database startup, signaling investment in vertical AI infrastructure.

Applied Intuition (autonomy / AV software tools) in mid-2025 achieved a valuation of about US$15 billion after a US$600 million Series F (plus secondary transactions), showing investor confidence in simulation, testing, software tools for autonomy and ADAS use cases.

Israel

Israel now has ~180 AI startups (2025) with aggregate funding totaling roughly US$8.5 billion, roughly US$124 million average funding per company in that group.

In generative AI specifically, Israeli startups have raised over US$20 billion to date, and in the past year ~31 acquisitions have occurred in this space; 17 disclosed terms total ~US$6.1 billion in exit value.

Israel’s government has a National AI Program that is investing in infrastructure, research, regulation, and talent pipelines to support vertical AI.

IV. Vertical Deep Dives

1. AI Platforms & Infrastructure

CoreWeave has been one of the breakout performers of 2025. After its IPO in March raised US$1.5B, the company’s stock has surged more than 200%, giving it a current market cap of US$60–70B. It signed a US$6.3B deal with Nvidia to guarantee cloud computing capacity through 2032 and acquired OpenPipe, an agent-training startup, strengthening its developer stack.

Anthropic completed a US$13B Series F in September 2025 at a valuation of US$183B, up nearly threefold from its March 2025 valuation of US$61.5B. This puts it in the same valuation tier as some of the largest publicly traded software companies, underscoring demand for enterprise-safe models.

AI21 Labs in Israel has raised US$636M total to date, including US$300M in 2025, with backing from Nvidia, Google, Intel Capital, Pitango, and Samsung Next. Its valuation sits around US$1.4B, making it one of the strongest foundation model challengers outside the U.S.

Overall, infrastructure funding is sharply up year-over-year, with both deal size and valuations expanding as investors double down on compute, orchestration, and safety tooling.

2. Financial Services & Fintech

AI adoption in fintech remains steady but heavily regulated. Capital inflows are increasing modestly, with some later-stage rounds in 2025 at higher valuations.

Glean raised an additional round in 2025, lifting its total funding above US$300M and pushing its valuation above US$3B, up from US$2.2B earlier this year. Its enterprise search tools, which extend into compliance and fintech workflows, are seeing accelerating adoption.

Alta, an Israeli startup, raised US$7M in seed funding in 2025 to build AI revenue operations agents. While small, the round illustrates how Israel’s early-stage ecosystem continues to produce fintech-adjacent AI companies.

Compared to 2024, deal sizes are larger and valuations have expanded, though activity remains more concentrated in compliance, fraud, and infrastructure layers rather than consumer-facing fintech.

3. Healthcare & Life Sciences

Funding momentum in healthcare AI has stayed strong, with major players maintaining billion-dollar valuations while early-stage companies continue to attract attention.

AION Labs in Israel, backed by Pfizer, Teva, AstraZeneca, and Merck, has raised about US$40M to date. It stands out as a model for consortium-based AI drug discovery.

Tempus raised US$200M+ in 2024 at a valuation of US$8.1B and has continued to expand its clinical partnerships into 2025. Its valuation remains steady, reflecting both the promise and the challenges of scaling healthcare AI.

Insilico Medicine raised a US$95M Series D in 2024 at a US$1.5B valuation and continues to grow its pipeline of AI-discovered molecules.

Compared to 2024, capital inflows remain high, but growth in valuations has been slower, reflecting regulatory timelines and the need for clinical validation before broader adoption.

4. Manufacturing & Industry 4.0

Industrial AI continues to attract capital, though the sector remains smaller in deal volume compared to infrastructure and security.

Applied Intuition raised US$600M in mid-2025, reaching a valuation of US$15B. This is a significant step up from its prior valuations and underscores investor conviction in simulation and ADAS/robotics software.

Vayyar Imaging in Israel raised US$108M in 2024, reaching a valuation of US$1.5B, leveraging its AI sensors across automotive and industrial applications.

Bright Machines raised US$100M in 2024 at a valuation of US$1.1B, focused on AI-powered robotics and manufacturing automation.

Relative to 2024, deal sizes are larger but concentrated. Growth continues in simulation and robotics, though early-stage activity has cooled somewhat, especially in Israel.

5. Retail & Consumer

Retail and consumer AI remain active, with incumbents continuing to buy startups and private capital flowing into generative tools.

Wix acquired Base44 for US$80M in 2025, bringing conversational app-building capabilities into its SME-focused platform.

Runway raised US$141M at a valuation of US$1.5B in 2023 and continues to grow, cementing its role as one of the leading AI creative platforms.

Character AI has raised US$190M total (including its US$150M Series A in 2023) at a valuation of about US$1B. In 2025, it is exploring either a new round or a sale as it grapples with rising infrastructure costs. Revenue has climbed toward US$30–50M annualized, showing early traction but not yet on the scale of other unicorns.

Compared to 2024, deal activity is slightly down, but average valuations remain high for the leading players.

6. Cybersecurity & Defense

This vertical has had some of the most significant deals of 2025, with valuations climbing sharply.

Scale AI saw Meta acquire a 49% stake for about US$14.8–15B, valuing the company at ~US$29B. While not a full acquisition, the transaction makes Scale one of the most strategically important AI companies for defense and infrastructure.

CrowdStrike acquired Pangea Cyber for US$260M in 2025 to add AI-enhanced detection and response.

Wiz’s US$32B acquisition by Google officially closed in 2025, making it the largest cybersecurity transaction in AI history to date.

Compared to 2024, capital and M&A values are both significantly higher, reflecting the urgency of AI-driven security.

7. Transportation & Mobility

AI in transportation has seen fewer but larger deals, with capital clustering around autonomy and logistics.

Wayve in the UK is negotiating a US$500M raise in 2025, with Nvidia among potential backers. This represents a large step up from its prior Series B.

Aurora raised US$800M in 2025 as a public company, helping stabilize its financial position amid ongoing uncertainty in the AV sector.

Nuro raised US$600M in its Series D at an US$8.6B valuation, continuing to push forward in autonomous delivery.

Compared to 2024, overall deal volume is lower, but the size of transactions is larger, with investors focusing capital on a small group of autonomy leaders.

V. Underpenetrated Sectors & White Space

While many verticals are crowded or well capitalized, several sectors remain underinvested relative to their size and potential. These are opportunities for early-stage ventures.

Construction & Real Estate: Project risk modeling, AI for site safety, materials supply chain optimization, building performance analytics. Many firms remain manual; a few startups exist but few large exits and limited capital density.

Agriculture & Food Systems: Precision farming, disease detection, yield optimization using drone/satellite imagery; post-harvest sorting automation. Adoption is constrained by small farm scale, distribution, climate variability.

Energy & Utilities: Grid optimization, renewable energy forecasting, predictive maintenance of infrastructure, demand response AI. Regulatory and technical inertia slow growth.

Hospitality & Tourism: Guest experience automation, dynamic pricing, review analytics, operational scheduling; human service remains central and sensitive to brand risk.

Government & Education: Budget constraints, procurement risk, equity / regulatory concerns; digital infrastructure and policy make or break adoption; still mostly pilots rather than scale.

These sectors are risky (long time to scale, unclear regulatory or revenue models) but for investors willing to accept slower growth, they may deliver outsized returns as vertical AI matures.

VI. Strategic Investors & Corporate Adoption

Key players are not just startups—they include large corporations, venture funds, and government entities making strategic bets, and acquiring capabilities, competing on infrastructure, or embedding AI.

Corporate Acquisitions and Bets

Atlassian acquired DX (developer workflow & engineering productivity) for ~US$1 billion, enhancing enterprise tools to measure AI tool adoption ROI

Workday acquired Sana (learning & knowledge management AI) for ~US$1.1 billion.

CrowdStrike acquired Pangea Cyber (~US$260 million) to strengthen AI security lifecycle

Meta initiated content licensing talks with major media outlets, illustrating awareness that AI’s content base needs licensing structures.

Investor Landscape

Firms like Sequoia, Andreessen Horowitz (a16z), Lightspeed, Index Ventures remain central—often leading rounds in infrastructure, AI agents, vertical AI startups.

Israel’s funds (e.g. OurCrowd) note that 2025 has been “breakthrough” in AI, especially where it converges with cybersecurity, defense, deep tech.

There is a trend of funds shifting from broad tech bets toward more specific, vertical domain expertise, compliance, and safety-aware models.

Corporate Adoption Patterns

Large SaaS / enterprise software companies are increasingly integrating AI by acquisition (as above) or strategic internal investment.

“Non-core” functions—HR, support, marketing, knowledge management—are often the first to get AI investments. Once the tools prove reliable, deeper vertical integration follows.

Defense and government contracts are rising; for example Scale AI’s deal with U.S. DoD for AI-ready data pipelines.

VII. Future Outlook & Thesis

Drawing together the data, deal flow, barriers, and vertical dynamics, the following points form the forecast and investment thesis for Vertical AI over the next 3-7 years.

Foundational Infrastructure Will Cement Leadership

Compute, data pipelines, domain-adapted models, safe/aligned AI will separate winners. Firms that invest early in interpretability, safety, compliance, edge deployment will likely capture premium.Acceleration from Pilot to Production

Though many current uses are pilots or internal tools, the pressure (competitive, regulatory, cost) will force enterprises to scale. Vertical AI becoming core to operations in regulated industries will drive growth.Valuations Remain High (Frothy), But Metrics Will Matter More

Investors are paying up for growth, scale, perceived future dominance. However, future rounds and exits will reward those with strong unit economics, retention, domain like safety/regulatory evidence, deployed customers, real revenue traction—not just hype.Acquisition & Partnerships will Increase

Many large SaaS players, industrial firms, defense contractors, and incumbents lack AI native capabilities. Acquiring startups that provide vertical-specific intelligence or infrastructure will be a common strategy. Partnerships (e.g. embedding startup models into enterprise platforms) will also become more frequent.White-Space Verticals Will Emerge as Key Sources of Innovation

As frontrunners saturate certain verticals, underpenetrated sectors like construction, agriculture, utilities, gov/education will become increasingly attractive, especially for investors with domain knowledge and regulatory understanding.Regulation, Ethics, Data Governance will be Determinants

As AI proliferates, regulatory scrutiny will increase. Privacy laws, model bias, explainability, safety, licensing of training data / content all will matter. Startups and investors who build governance early will have competitive advantage.

Returns Delayed, Risk Elevated

Many current startups will struggle or fail. Infrastructure heavy companies may burn cash waiting for enterprise contracts; those in difficult verticals may find market resistance. But for those reaching scale, vertical AI may generate multi-billion or (in aggregate) trillion dollar value flows, with AI becoming as pervasive as cloud or the internet.