Hey readers just a reminder that I’m a GP of Six Point Ventures, a VC fund investing in Vertical AI B2B Enterprise SaaS across the U.S. and Israel.

We back early-stage founders (pre-seed to seed) with $500K–$1M checks, often before a product or revenue. If you’re building something really cool in fintech, defense, cyber, logistics or automation etc — I want to hear from you!

The Magnificent Seven and the Great Compute Expansion

The Magnificent Seven—Meta, Apple, Alphabet (Google), Amazon, Microsoft, Nvidia, and Tesla—are reshaping industrial economics through historic levels of investment. Artificial intelligence has evolved from a software capability into a capital-intensive infrastructure business. These companies, fortified by vast cash reserves, strong balance sheets, and access to inexpensive capital markets, are uniquely positioned to build the future. Their Q3 2025 results reveal that CapEx isn’t a risk—it’s a renewal of dominance.

Up and to the right

Meta: Scaling Compute and AI Integration

Meta reported $51.2 billion in Q3 revenue (+26% YoY) and $18.6 billion in net income, excluding a one-time tax event. The company continues to leverage AI to optimize advertising efficiency while extending its infrastructure advantage.

CapEx: $19.4 billion in Q3, tripling YoY; full-year guidance at $70–72 billion, with 2026 increases anticipated.

Focus Areas: Proprietary silicon, hyperscale AI infrastructure, and a consolidated Superintelligence division to unify model development.

AI Expansion: Generative ad tools, video personalization, and recommendation algorithms are already integrated into every core product line.

Meta’s spending trajectory mirrors the early 2010s cloud buildout, when scale created enduring margins. The company’s cash generation remains enormous, ensuring its ability to fund this new AI infrastructure without strain.

Apple: Precision and Privacy in AI Deployment

Apple reported $102.5 billion in revenue (+8% YoY) and $27.5 billion in net income. Its disciplined CapEx reflects a strategic preference for precision engineering rather than brute-force expansion.

CapEx: $12.7 billion in FY2025—modest but focused.

AI Strategy: On-device processing via the Neural Engine and selective private cloud compute.

Product Integration: The Apple Intelligence suite enhances iOS and macOS functionality while preserving privacy.

Apple’s AI approach is deliberately incremental, aligning innovation with user trust. With over $160 billion in cash on hand and world-class supply chain control, it remains capable of scaling hardware and AI capabilities quickly if the opportunity demands.

Alphabet (Google): AI Everywhere, Scaling Cloud and Chips

Alphabet recorded $102.3 billion in quarterly revenue (+16% YoY) and $34.98 billion in net income (+33%), underscoring its operational leverage as AI adoption accelerates.

CapEx: $24 billion in Q3, directed toward new AI data centers and TPU chip manufacturing.

Guidance: 2025 CapEx projected between $91–93 billion, with further growth planned in 2026.

Cloud Growth: Google Cloud up 34% YoY; nine of the top ten AI labs now run on its infrastructure.

AI Products: Gemini’s enterprise adoption is accelerating, generating triple-digit growth in generative AI revenue.

Google has executed this level of investment before—during the global internet expansion of the 2000s—and proved its ability to monetize infrastructure over time. Its scale in data, search, and compute ensures it remains an indispensable platform for AI workloads.

Amazon: The Anthropic Effect Accelerates AWS

Amazon’s Q3 revenue reached $180.2 billion (+13%), with net income climbing 39% to $21.2 billion. Its latest results show AWS regaining momentum as enterprise AI demand expands.

AWS Growth: +20% YoY (vs. +17.5% in Q2), with further acceleration expected in Q4.

Margins: AWS operating margin rose to 34.5%.

CapEx: $34.2 billion in Q3; 2025 forecast raised to $125 billion, with increases planned for 2026.

Infrastructure: Added 3.8 GW of power capacity in 12 months; plans to double global compute by 2027.

Restructuring: Reduction of 30,000 roles to streamline operations and improve deployment speed.

Amazon has always played the long game with infrastructure. Its CapEx intensity mirrors early AWS expansion in 2012–2016, when upfront investment paved the way for a trillion-dollar business. With debt capacity, strong cash flow, and recurring cloud margins, Amazon can sustain this growth phase indefinitely.

Microsoft: Planet-Scale AI Cloud Expansion

Microsoft reported $77.7 billion in revenue (+18%) and $27.7 billion in profit (+12%), as Azure continues to define the enterprise AI landscape.

CapEx: $34.9 billion in Q3 (+74% YoY), funding one of the largest data center buildouts in history.

Capacity Growth: AI compute set to grow 80%+ in FY2026; global data center footprint will double by 2027.

Partnerships: Deeper collaboration with OpenAI, exclusive Azure integration, and 150M+ Copilot users.

Efficiency Gains: GPU optimization improving throughput per watt and cost per token.

Microsoft’s balance sheet strength allows it to outspend nearly any competitor. Its recurring software revenue base and AAA credit rating give it flexibility to scale CapEx far beyond $100B without material risk.

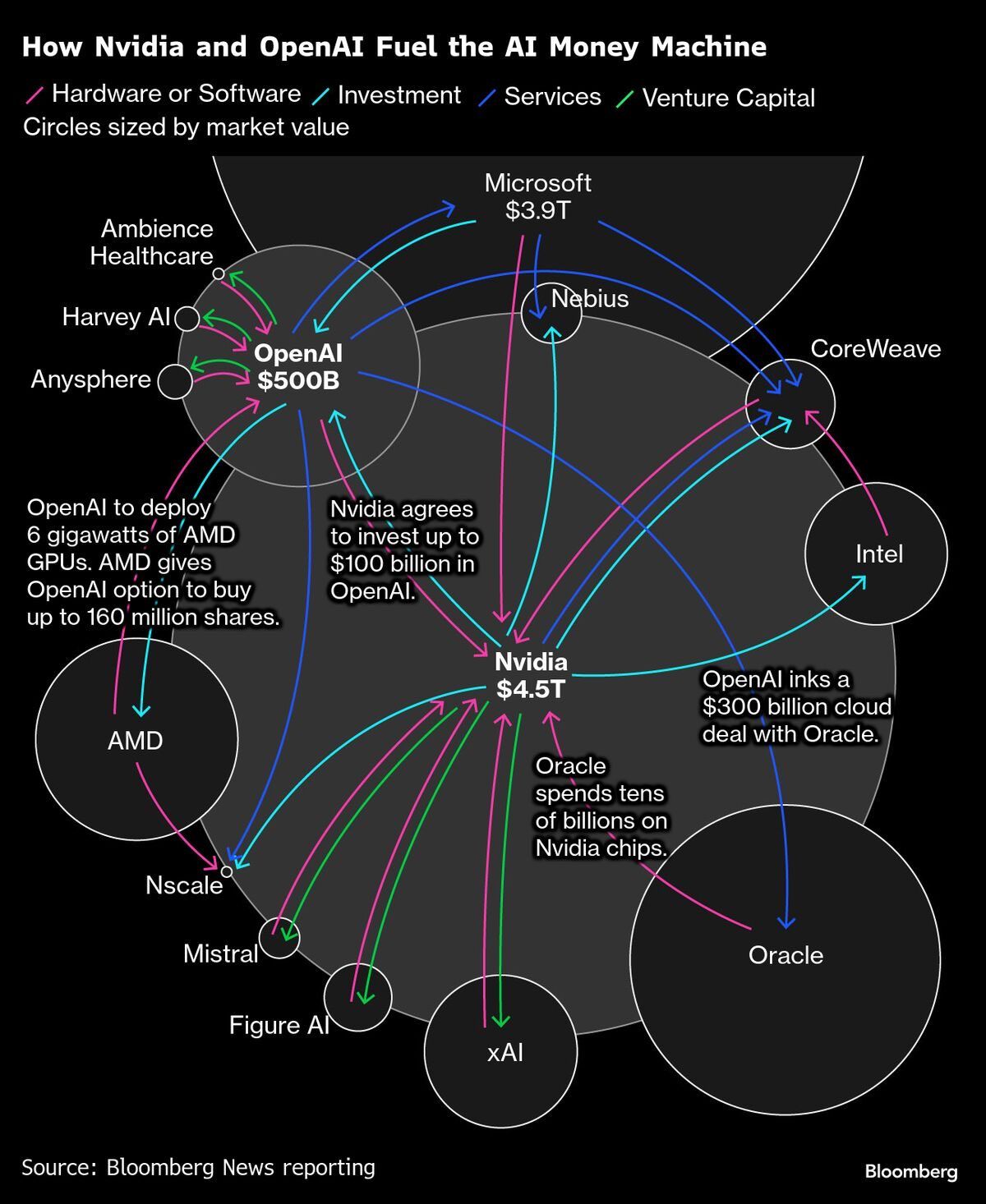

Nvidia: The Core Supplier of the AI Economy

Nvidia projects Q3 revenue of ~$54 billion (+54% YoY), powered by relentless AI infrastructure demand. The company’s expansion now underpins nearly every major cloud provider’s growth.

Backlog: Over $500 billion in GPU and system orders.

Product Cycle: Blackwell GPUs entering full production amid tight global supply.

Vertical Integration: Delivering turnkey AI supercomputers to hyperscalers, defense clients, and governments.

Nvidia’s ability to scale production, manage shortages, and extract premium pricing makes it the primary beneficiary of global AI spending. Its gross margins remain world-leading, providing ample capital for R&D and next-generation architectures.

Tesla: Real-World AI at Scale

Tesla reported $28.0 billion in revenue (+12%) and $1.37 billion in profit, highlighting growth across both automotive and energy segments.

CapEx: $2.25 billion in Q3, concentrated on the Dojo AI supercomputer and robotics.

AI Initiatives: Expansion of FSD beta, enhanced sensor fusion, and continued Optimus robot testing.

Energy Segment: Grid-scale storage and solar deployment are contributing meaningful profit growth.

Tesla’s advantage lies in its ability to merge physical production with AI systems. Its investments in compute and robotics parallel early factory automation cycles that later transformed industrial manufacturing.

Compute as Capital, CapEx as Destiny

We’re all friends!

Quarterly capital expenditures by Meta, Alphabet, Amazon, and Microsoft have surged from under $25 billion in 2018 to over $110 billion in 2025, reflecting the acceleration of AI infrastructure and data center investment across the global technology sector.

In Q3 2025, Amazon, Meta, Alphabet, and Microsoft invested $112 billion combined—twice their spending in Q1 2024 and triple Q2 2023. CapEx growth is not speculative; it is strategic. Each of these firms has the liquidity, operating cash flow, and credit access to fund long-term infrastructure cycles measured in decades, not quarters.

Amazon: Forecasting $125B in 2025 CapEx, rising again in 2026.

Alphabet: Expects $91–93B this year.

Meta: $70–72B in 2025, with significant 2026 expansion planned.

Microsoft: +45% CapEx YoY; trajectory toward ~$94B.

The industrialization of AI is underway. Compute, energy, and data storage are the essential inputs of a new global economy. This is not overextension—it’s foundation building. The infrastructure being erected today will define productivity, innovation, and economic growth for decades.

Compute is the new capital. Power is the new frontier.

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.