Israel’s reputation as the “Startup Nation” is stronger than ever. In 2024, the Israeli tech ecosystem demonstrated resilience, innovation, and growth, solidifying its position as one of the most compelling places to invest globally.

Despite concerns over the impact of the prolonged war with the terrorist organization Hamas and global backlash, Israeli tech startups saw a surprising 28% growth in investments in 2024, totaling $10.6 billion. This marked a rebound from 2023’s $8.3 billion but remained far below the 2021 peak of $30 billion.

The increase, led by cybersecurity firms capturing 40% of funding, helped stabilize Israel's economy, contributing 2.2% to GDP growth despite challenges such as mobilized tech workers, reduced foreign travel, and lowered credit ratings. Defense-tech companies also saw significant growth, fueled by battlefield-tested innovations and rising global demand. While the sector showed resilience, industry experts noted growth was limited by the ongoing conflict and global sentiment.

Here’s why now is the time to double down on Israel’s tech sector

Key Highlights of Israel’s Tech Ecosystem

Global Leader in Startups: With over 7,200 active startups, Israel has the highest number of startups per capita worldwide—a staggering 1 startup for every ~1,500 citizens.

Tech’s Dominance in the Economy:

20% of Israel’s GDP comes from high-tech, compared to 10% in the U.S. and 9% in Germany.

54% of exports from Israel are tech products and services, far outpacing the global average.

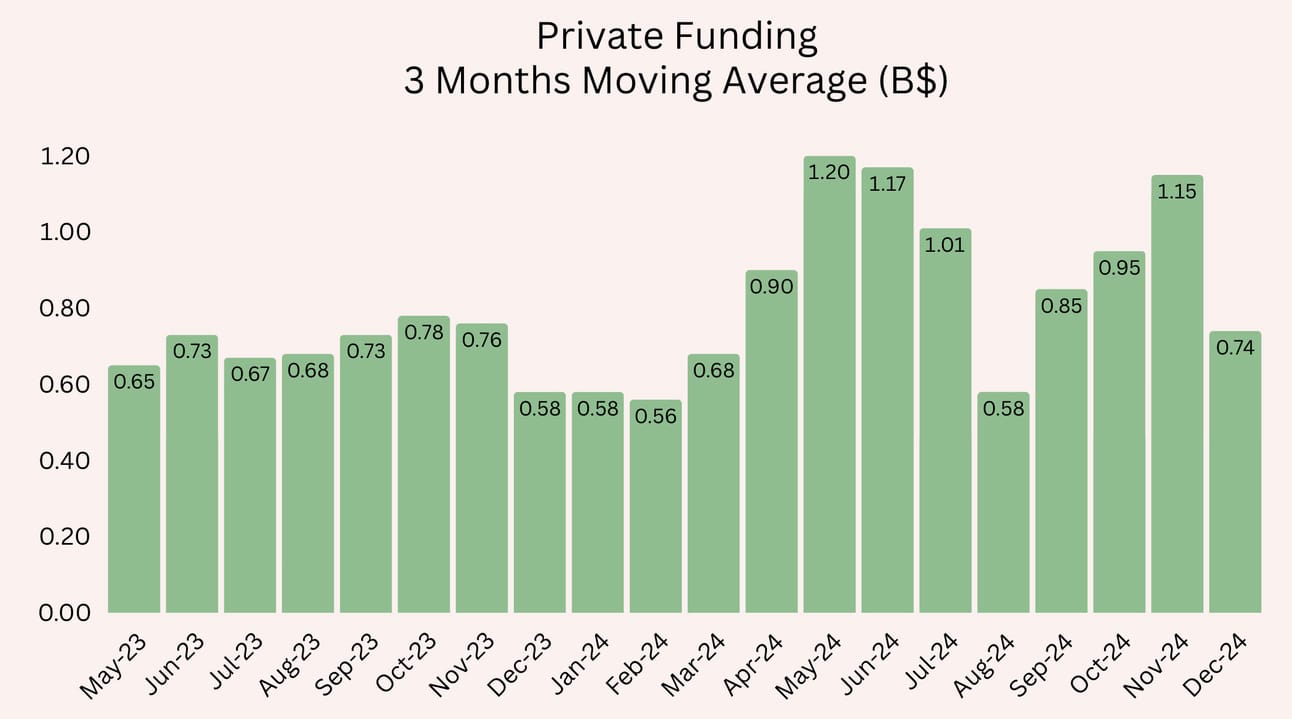

Private Funding in 2024:

$5.1 billion raised in H1 2024 across 322 rounds (+31% vs. H2 2023).

Israel consistently outperforms Silicon Valley and Europe on a per capita funding basis, with nearly $550 raised per capita in H1 2024, compared to ~$350 in Silicon Valley and ~$200 in Europe.

Here’s a list of the top 10 most important Israeli technology inventions:

Iron Dome – Revolutionary missile defense system.

Mobileye – AI and computer vision for autonomous vehicles.

USB Flash Drive – Co-invented by M-Systems, revolutionized portable storage.

Drip Irrigation – Pioneered water-efficient agriculture worldwide.

Waze – GPS navigation app acquired by Google.

PillCam – Swallowable camera for gastrointestinal diagnostics.

Firewall Technology – Invented in Israel, forming the basis of modern cybersecurity.

Watergen – Atmospheric water generators creating potable water from air.

ReWalk Robotics – Robotic exoskeletons for paraplegics.

SolarEdge – Innovative solar energy optimization technology.

Notable Startups and Recent Fundraising Successes

Wiz: Raised a total of $900M, valued at $10B, becoming one of the fastest-growing cybersecurity companies globally.

Redis: Secured $110M in a late-stage funding round, achieving a valuation of $2B.

Pliops: Raised $200M to develop groundbreaking storage and data acceleration solutions.

OrCam: A leader in AI-powered vision devices, raised $200M and reached a valuation exceeding $1B.

Lightricks: Developer of photo and video editing apps, raised $130M and achieved unicorn status.

Fireblocks: A blockchain security company, raised $550M over multiple rounds, now valued at $8B.

Celsius: A crypto-lending platform raised over $860M before its acquisition.

Major Exits in Recent Years

Mergers & Acquisitions (M&A)

Mobileye: Acquired by Intel for $15.3B (2017), followed by its IPO at a valuation of $17B (2022).

Checkmarx: Acquired by Hellman & Friedman for $1.15B (2020).

Paragon: Acquired by AE Industrial Partners for $900M (2024).

Vdoo: Acquired by JFrog for $300M (2021).

CyberX: Acquired by Microsoft for $165M (2020).

Initial Public Offerings (IPOs)

Monday: IPO in 2021, valued at $7.5B at listing.

SentinelOne: IPO in 2021, valued at $10B.

WalkMe: IPO in 2021, valued at $2.5B.

Jfrog: IPO in 2020, valued at $4B.

Comparative Per Capita Data (2024)

Region | Population (M) | Tech Startups | Funding Per Capita | Startups Per Capita |

|---|---|---|---|---|

Israel | 9.4 | 7,200 | $550 | 1 per 1,500 |

Silicon Valley | 7.7 | 15,000 | $350 | 1 per 500 |

Europe | 741 | 112,000 | $200 | 1 per 6,600 |

Singapore | 5.6 | 3,800 | $300 | 1 per 1,470 |

Sector Leadership

AI: 47% of all investments in 2024 went to AI startups, which now make up 30% of Israel's startup ecosystem.

Cybersecurity: Israeli cybersecurity firms raised $4 billion in 2024—accounting for 20% of global cybersecurity funding.

Defense Tech: Record exports of defense systems like the Iron Dome, driven by demand from Europe and the U.S.

Why Invest in Israel Now?

Proven Exit Value: Israeli companies deliver some of the highest returns on exits per dollar invested due to their lean, efficient operations and innovative tech.

Global Innovation Leader: Israel leads the world in R&D spending per capita (5.4% of GDP vs. 2.8% in the U.S. and 2.3% in the EU).

Unmatched Resilience: Even amid geopolitical challenges, Israel’s tech sector continues to thrive, showcasing its ability to adapt and innovate under pressure.

Unique Access to Talent: A steady pipeline of world-class talent from IDF units like Unit 8200, coupled with top-tier universities (e.g., Tel Aviv University and Technion), ensures a robust talent pool for deep tech and vertical AI startups.

My fund Six Point Ventures will be spending a significant portion of our time investing in early stage startups across the US and Israel to support the best and brightest founders that will change the world. More to come on this soon 🇺🇸🇮🇱

FIND ME: 𝕏 @Trace_Cohen / in LinkedIn

Seal the Deal and Get Paid. Instantly.

Tired of chasing payments and paying for every e-signature? Meet Agree, the all-in-one platform that combines contracts and payments into a single step. Get paid on time, every time, without the hassle. Choose from sleek templates or upload your own fully editable agreements—no e-signature fees, ever. Whether you’re a founder, entrepreneur, or anyone looking to get ink dry fast, Agree simplifies it all so you can focus on what matters: closing deals and getting paid.