Ai is coming for every vertical

The Ai world is kind of crazy right now; literally changing everyday from Deepseek seemingly doing the impossible (which they didn’t), to OpenAi releasing Deep Research that can perform many agent like tasks. We’re basically just limited by data and our imaginations right now.

The initial wave of Ai funding went into large, foundational models—massive infrastructure plays requiring billions in capital to fuel the OpenAI, Anthropic, and Google DeepMinds. But for most early-stage investors, especially pre-seed and seed funds, these opportunities are fundamentally out of reach.

Foundational Ai model startups are raising $10M–$50M seed rounds (e.g., Mistral AI and Cohere, which raised substantial early funding to compete in the foundation model space), an order of magnitude larger than what most early-stage investors can (or should) write checks for. These deals don’t fit the financial structure of emerging VC funds, where writing a $250K–$1M checks into a round that is already oversubscribed by deep-pocketed firms means having little influence, no ability to follow on, and being diluted into irrelevance.

The best opportunities for early-stage AI investing don’t lie in competing with OpenAI or Anthropic. Instead, they lie in Vertical AI—industry-specific AI startups that embed deeply into existing workflows, automate high-value processes, and drive measurable economic impact.

This is where early-stage investors can truly win.

Why Vertical AI is the Best AI Investment for Pre-Seed & Seed Investors

1️⃣ The Market is Moving Toward Industry-Specific AI Solutions

AI isn’t just another software wave—it’s fundamentally changing how businesses operate. While general-purpose AI tools capture headlines, the real value is emerging within industries where AI can be deeply integrated into existing workflows with the right data.

Bessemer Venture Partners has identified this trend in their latest research on AI. The most promising AI startups today are not broad-based generalists but focused, verticalized applications solving high-value, industry-specific problems.

Take legal tech, for example. Harvey, one of the standout Vertical AI startups, is automating legal research and document drafting for top law firms. This isn’t just adding AI to an existing workflow—it’s transforming how lawyers operate, reducing billable hours on tedious tasks and letting firms take on more cases.

In healthcare, Hippocratic AI is focused on patient engagement and administrative automation, solving a real pain point in an industry drowning in paperwork and regulatory burdens.

In logistics, AI robotics company Covariant is automating warehouse operations, helping companies move goods faster and with fewer errors—improving margins in one of the lowest-margin industries on the planet.

These startups don’t need billions in compute costs because they leverage existing AI models via APIs, cloud-based AI infrastructure, and fine-tuned smaller models suited for their specific industries. They use existing AI infrastructure but apply it intelligently to industry-specific problems with clear economic benefits.

2️⃣ Vertical AI Will Captures More Value Than Traditional SaaS Eventually

Vertical AI is not just another layer of SaaS—it’s potentially a fundamentally new business model. Kind of like an affiliate model like those house property tax reducer firms that take X% if they can lower your bill 🙂

Traditional SaaS businesses charge per-seat or per-license fees. This model works well but limits pricing power. Some vertical AI startups, on the other hand are trying to charge based on actual value created.

This means pricing shifts from: 🚫 Flat monthly SaaS fees → ✅ Performance-based, outcome-driven pricing

For example:

AI-powered legal platforms charge based on the number of cases won or documents processed.

AI-driven insurance startups are pricing based on claims approved and fraud detected.

AI-based sales enablement tools are shifting to percentage-of-revenue models instead of flat SaaS fees.

This shift could make some Vertical AI startups far more defensible than traditional SaaS companies.

Scale Venture Partners points out that Vertical AI companies own the entire workflow, allowing them to deeply integrate AI into mission-critical processes, which increases customer dependency and retention., making them far stickier than traditional software tools. Instead of just being an "add-on" to existing software, they become the core operating system for their industry.

I’m still waiting on this to learn more before I believe it’s really viable because I’m not the biggest fan of “performance” based outcomes but there is potential.

3️⃣ Vertical AI Investment is Growing—But Still Underfunded

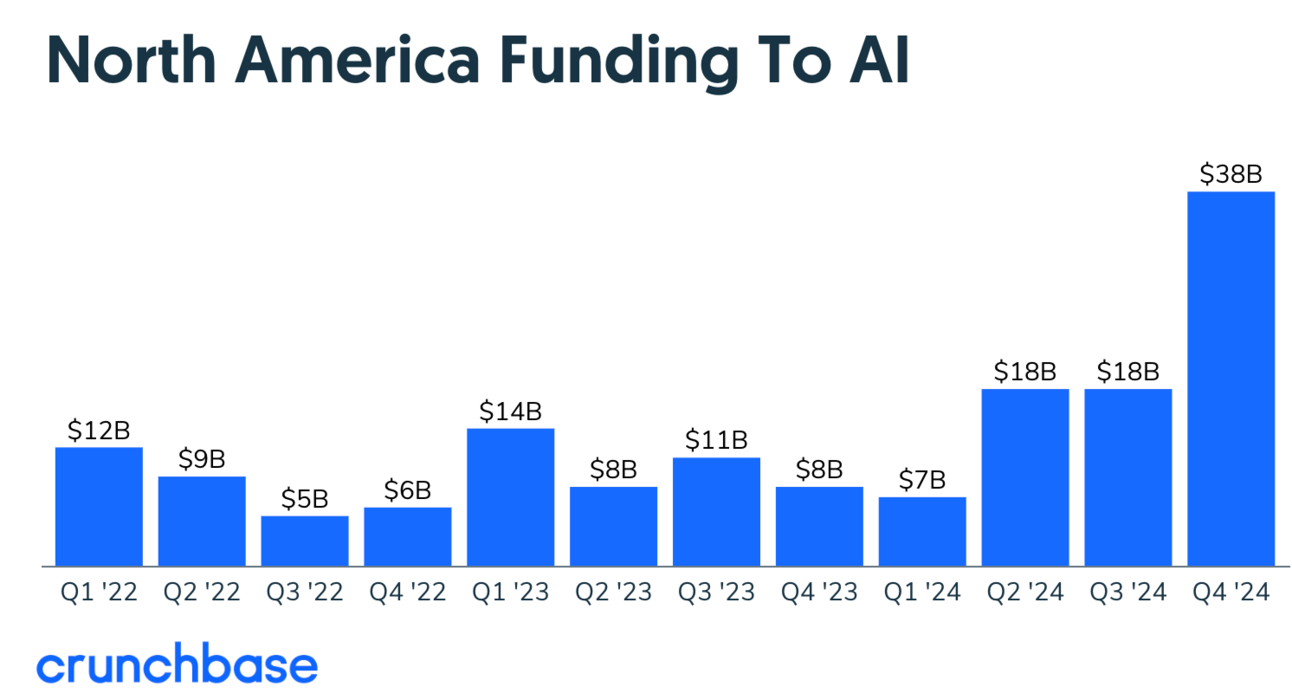

Venture investment into AI is growing at a record pace, but most of the capital is still flowing into large-scale foundational models rather than practical, industry-specific applications.

According to PitchBook, in 2023: ✅ AI startups raised $50B in total funding ✅ $29.1B went into generative AI (a 268% increase over 2022) ✅ A growing percentage is flowing into Vertical AI, though it's still an underinvested category

At the same time, Vertical AI funding rounds are smaller and more manageable for early-stage investors. Unlike foundational models that require $100M+ just to compete, Vertical AI startups typically raise $2M–$8M at pre-seed/seed, with more reasonable valuations and capital efficiency.

Costanoa Ventures, a firm specializing in applied AI, has noted that generative AI has made previously “too small” vertical markets investable—meaning sectors that VCs once ignored due to limited scalability are now viable because AI lowers operational costs and expands the total addressable market (TAM).

This is the sweet spot for early-stage investors:

Smaller rounds that fit traditional pre-seed/seed check sizes

Capital-efficient startups that don’t require massive follow-on rounds

A growing market where large VCs haven’t yet dominated

4️⃣ Vertical AI and the Defensibility Challenge

Andrew Chen’s article, Revenge of the GPT Wrappers: Defensibility, highlights how GPT wrappers struggle to differentiate themselves, leading to pricing pressure and difficulty in maintaining competitive moats: how do AI startups avoid becoming commodity “wrappers” on top of large models?

His answer? Defensibility comes from owning unique workflows, proprietary data, and deep industry integrations—all of which are core strengths of Vertical AI companies.

Chen’s insights align perfectly with the Vertical AI thesis: the best AI companies will be those that go deep into an industry, capture value beyond simple automation, and become indispensable within workflows.

The Takeaway for Early-Stage Investors

For pre-seed and seed funds, the decision is clear: investing in foundational models is structurally impossible, but Vertical AI is a high-growth, high-upside opportunity that aligns perfectly with early-stage capital.

Instead of competing for access to oversubscribed, billion-dollar AI rounds, investors should be focusing on:

✔ AI-native startups that embed deeply into industry workflows

✔ Companies that capture more of the value chain through performance-based pricing

✔ Startups that align with pre-seed and seed check sizes and fund structures

✔ Vertical AI markets that are still underfunded and open for disruption

The future of early stage VC Ai lies in backing companies that develop deeply embedded AI solutions, creating indispensable value through industry-specific automation. It’s in funding the startups that are actually putting AI to work.

The best early-stage AI investments won’t be horizontal. They will be vertical.

FIND ME: 𝕏 @Trace_Cohen / in LinkedIn

Get your news where Silicon Valley gets its news 📰

The best investors need the information that matters, fast.

That’s why a lot of them (including investors from a16z, Bessemer, Founders Fund, and Sequoia) trust this free newsletter.

It’s a five minute-read every morning, and it gives readers the information they need ASAP so they can spend less time scrolling and more time doing.